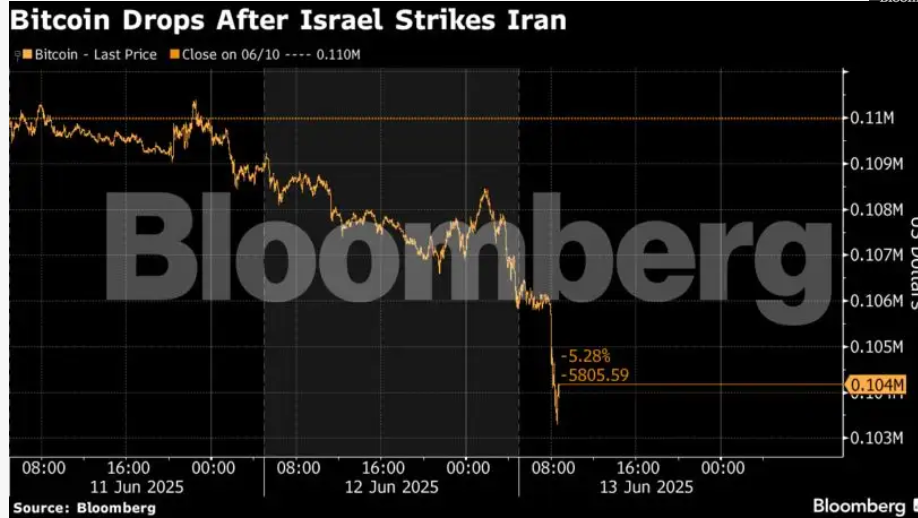

Cryptocurrencies went into a downward spiral following reports of Israeli airstrikes on Iran. Escalating tensions in the Middle East have triggered a broad risk-off sentiment, resulting in a $1 billion liquidation from the cryptocurrency market in 24 hours, according to Coinglass data.. The world’s biggest cryptocurrency, Bitcoin, declined by over 4% to $104,000 in morning trade on June 13, 2025. Other cryptocurrencies like Ethereum plummeted 9.6%, whereas Solana, XRP, and BNB also fell by 9.62%, 5.97%, and 2.63%, respectively.

What is liquidation?

In crypto trading, liquidation happens when the exchange automatically closes a trader’s position because they’ve lost too much money. This usually occurs when the trader doesn’t have enough funds to keep the trade going. It can happen in both margin and futures trading.

High-risk investments, like cryptocurrencies, are prone to extreme price swings. Geopolitical uncertainties add to the volatility, making investors jittery, and turning them away from derivatives products like margin trading, perpetual swaps, and futures.

Uncertainty to persist

The sell-off intensified after explosions were heard in Tehran, according to local media. Israeli Defense Minister Israel Katz said he’s declaring a special state of emergency due to Israel’s “preemptive strike against Iran.” Israel is anticipating a retaliatory drone and missile attack.

Speaking to the Economic Times, Caroline Mauron, co-founder of crypto derivatives liquidity provider Orbit Markets, said that the crypto market is falling in response to reports of Israel’s airstrikes on Iran, mirroring the broader decline in risk assets. She added that while technical support for Bitcoin is likely around $101,000, short-term price movements will largely depend on further geopolitical developments.

In other markets, stocks dived in early Asian trade, led by a selloff in U.S. futures, while investors scurried to safe havens such as gold and the Swiss franc.

Bitcoin has seen some major swings in the last few months, with its value depending on public sentiment and speculation, also causing short-term price changes. At the time of reporting, Bitcoin’s market cap had dropped to $2.06 trillion.