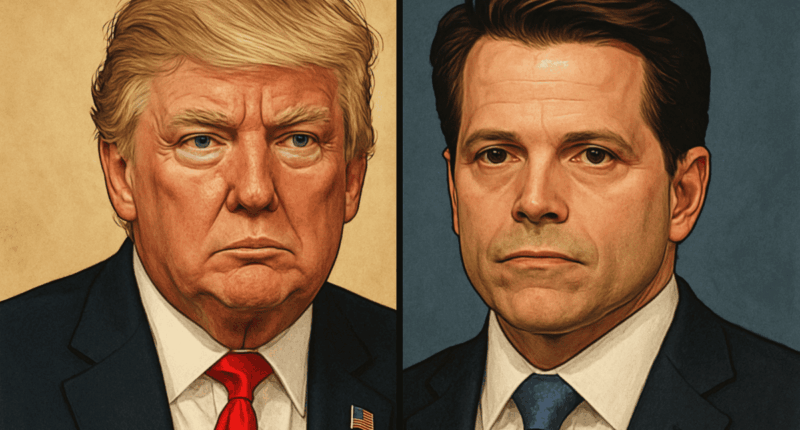

SkyBridge Capital founder and former White House insider Anthony Scaramucci says Trump’s crypto businesses create ‘pathways’ for corruption.

Speaking at the Financial Times Digital Asset Summit, SkyBridge Capital founder and former White House Communications Director Anthony Scaramucci expressed concerns that the Trump family’s growing involvement in cryptocurrency could create opportunities for corruption and hinder bipartisan legislative efforts in the sector.

He pointed to several Trump-linked crypto ventures—including the Solana-based TRUMP meme coin, World Liberty Financial (co-founded by Eric Trump), and a reported collaboration between Trump Media and Crypto.com—as potential “distractions” for lawmakers attempting to regulate the industry.

He said, “Let’s give them all the benefit of the doubt, but I do think there are pathways for some level of corruption, potential bribery, and even what I would call ‘sinistership”.

He emphasized the importance of removing such influences to facilitate a clearer dialogue among skeptical members of Congress.

Scaramucci, who briefly served under President Trump in 2017, gave the administration a generally positive review for its approach to crypto policy, grading it between a B-plus and A-minus.

He went on to acknowledge the work of White House crypto adviser David Sacks, particularly the efforts to engage Democratic lawmakers on the concept of a U.S. strategic Bitcoin reserve.

However, he criticized the decision to establish the reserve through executive order, arguing that it lacks bipartisan permanence and could easily be reversed by a future administration.

His remarks came amid several Democratic lawmakers raising concerns over the Trump family’s crypto initiatives. A recent letter from Senator Elizabeth Warren (D-Mass.) and Representative Adam Schiff (D-Calif.) criticized a planned gala dinner for TRUMP meme coin holders, calling it a potential example of “pay-to-play” access to the presidency.

Warren also highlighted a controversial $2 billion deal between World Liberty Financial and Emirati firm MGX, which includes the use of the newly launched USD1 stablecoin as a settlement currency, warning that such agreement could facilitate financial misconduct and increase regulatory risks.