U.S. President Donald Trump’s overnight post on Truth Social regarding a likely trade deal with the United Kingdom kept global markets upbeat through Thursday. The White House is due to hold a news conference at 10:00 a.m. ET (3 p.m. London time) detailing the contours of the deal, but Trump impatiently announced that “the agreement with the United Kingdom is a full and comprehensive one”

The trade deal between the U.S. and U.K. will be the first significant change after the stiff “reciprocal” tariffs that were announced on April 2 or as President Trump termed it ‘Liberations Day’. Britain, which runs a trade deficit with the U.S., was spared the higher “reciprocal” tariffs, but still had to pay up a baseline 10% levy and a 25% charge on steel, aluminium and cars. European stocks traded in positive territory in anticipation of further good news bolstered by the interest rate cut announced by the Bank of England.

Central banks take action

The Bank of England lowered interest rates from 4.5% to 4.25% even though its U.S. counterpart stayed its ground, keeping interest rates unchanged for the 4th time this year; the last rate cut announced by Chairman Jerome Powell was in December 2024. The Fed doesn’t want to slash rates as a measure to counter the disruption caused by Trump’s tariffs which could end up sparking inflation.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

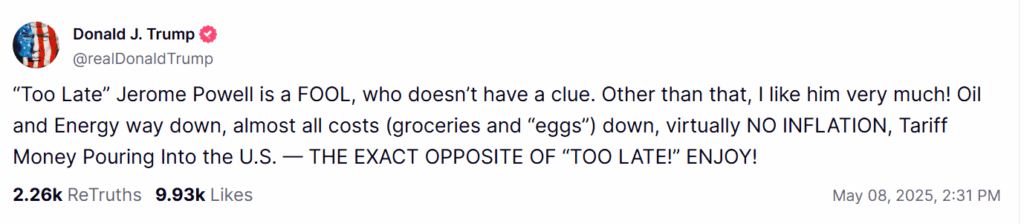

“Jerome Powell is a fool”

Trump didn’t waste time in reacting to the FOMC’s decision. Calling Chairman Powell a fool, who doesn’t have a clue, President Trump said that there was “virtually no inflation”.

There has been fear-mongering on whether Trump would have Powell fired before his term as chair ends in May 2026. The president has rubbished these claims during his Meet the Press interview on NBC saying “why would I do that? I get to replace the person in another short period of time.”

Not so glittery

Meanwhile, Gold prices fell on Thursday, reversing its earlier gains, especially on the back of the U.S.- U.K. deal, which shows signs of easing trade tensions, lowering the precious metals appeal as a safe-haven.

Spot gold prices were down 0.4% to $3,352.63/oz, whereas U.S. gold futures slipped 0.8% to $3,3463.8/oz. Gold is often used as a safe store of value during times of political and financial uncertainty.