-

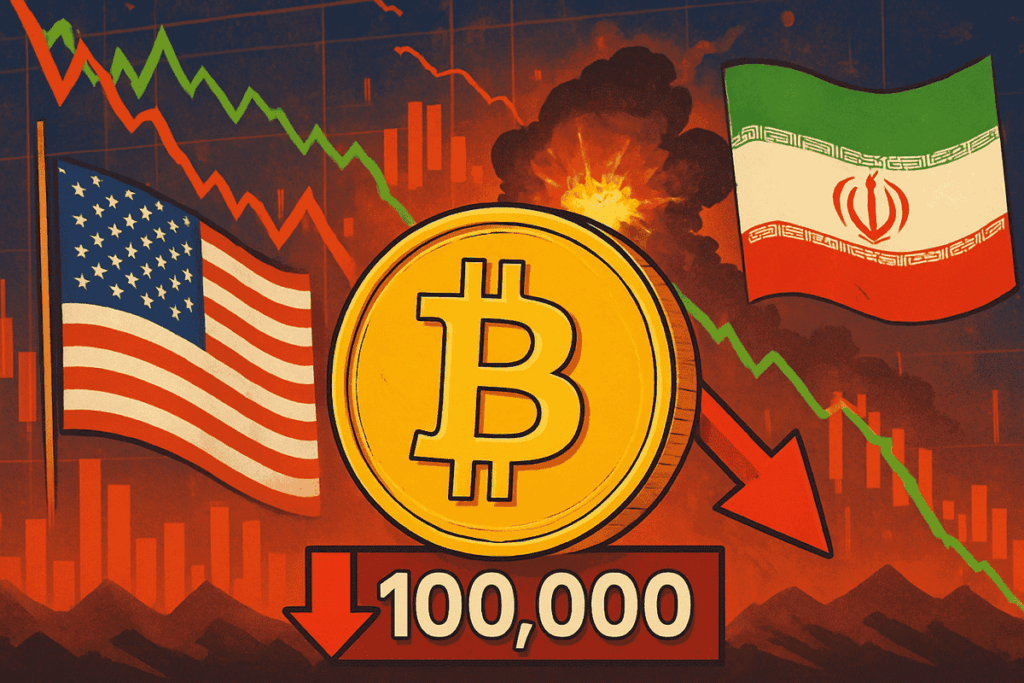

- Over $1 billion in crypto positions were liquidated following U.S. airstrikes on Iranian nuclear facilities, with long positions hardest hit.

-

- Bitcoin dropped below $100,000 for the first time in 45 days, while altcoins and AI tokens suffered double-digit weekly losses.

-

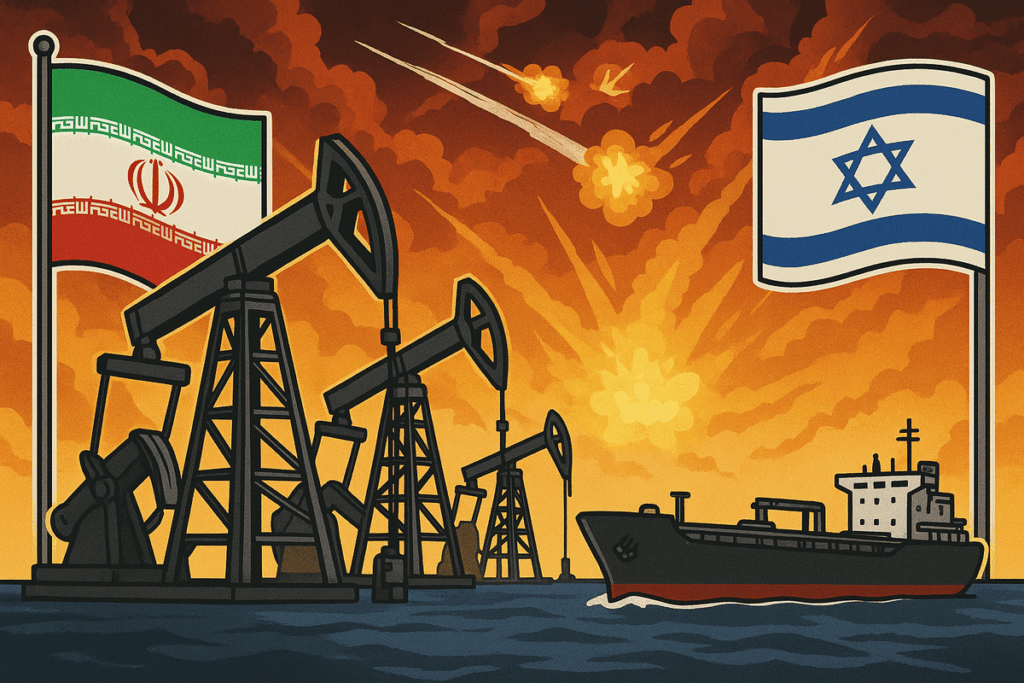

- Iran’s parliament threatened to close the Strait of Hormuz, escalating fears of a spike in oil prices and wider market instability.

The cryptocurrency market faced significant losses over the weekend after the United States confirmed it had launched three military strikes targeting Iranian nuclear infrastructure. The development triggered over $1 billion in crypto liquidations, sending Bitcoin below $100,000 for the first time in 45 days.

The majority of these liquidations were long positions, and publicly available data likely reflects only a portion of the actual liquidation volume. Altcoins experienced the steepest declines, although the largest 30 cryptocurrencies by market capitalization held relatively firm.

Amid mounting tensions, Iran’s parliament stated on Sunday that it may consider closing the Strait of Hormuz, a critical corridor for global oil shipments.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Crypto selloff deepens after military escalation

Cryptocurrencies dropped sharply especially alternative tokens following the U.S. airstrikes on Iranian nuclear sites late Saturday, setting the stage for heightened volatility as international markets reopen on Monday.

President Donald Trump confirmed the strikes via a statement, referring to the targeted attacks as a “great success.” He later posted on Truth Social, expressing possible support for regime change in Iran.

In the 24 hours following the announcement, over $1 billion in crypto positions were liquidated, with long bets making up the bulk, according to Coinglass data. The platform aggregates publicly reported liquidation figures, which may not account for all losses due to limited data access.

Iran’s legislative body responded by urging national leadership to take steps toward potentially shutting down the Strait of Hormuz, a move that would rattle energy markets worldwide. Though Iran has previously issued such threats, it has never succeeded in fully closing the passage, which remains a linchpin in the global oil supply chain.

Bitcoin dips below six-figure mark amid outflows concerns

Bitcoin fell below the $100,000 threshold for the first time in a month and a half, as broader market pressure pushed prices downward. This occurred despite a strong nine-day inflow streak into U.S.-based spot Bitcoin ETFs.

Weaker inflows, combined with Bitcoin’s recent price decline, indicate the current rally may face headwinds when markets reopen. However, Bitcoin rebounded on Sunday, climbing above $101,000 after earlier losses. The recovery was driven by a sharp 75.8% surge in daily trading volume, which spiked to over $48.4 billion.