- US federal agencies warn that crypto custody may expose banks to liability and complex compliance obligations

- New document outlines risks, including Bank Secrecy Act requirements and third-party custodial responsibilities

- Recent regulatory easing may explain why more banks are exploring crypto services

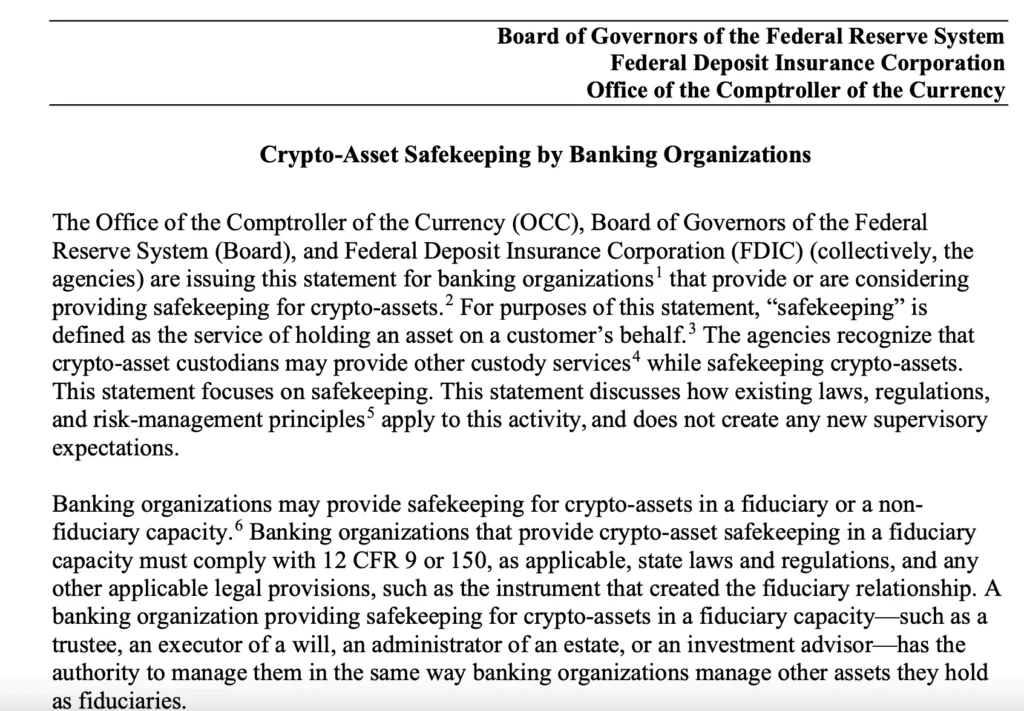

Three major US financial agencies the Federal Deposit Insurance Corporation (FDIC), the Office of the Comptroller of the Currency (OCC), and the Federal Reserve Board have issued a joint document warning banks about the potential risks associated with custodying crypto assets on behalf of clients.

The document, titled “Crypto-Asset Safekeeping by Banking Organizations,” was published Monday and outlines the challenges banks face in safeguarding digital assets. While it does not establish new supervisory rules, it provides a risk assessment framework for institutions considering entry into the crypto custody space.

Among the most prominent concerns is the liability banks may face if crypto assets are lost. The document highlights the need for a deep understanding of the evolving asset class and stresses that banks must comply with Bank Secrecy Act and Anti-Money Laundering (AML) laws.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Providing crypto-asset safekeeping services may entail significant resources and attention, the agencies wrote.

Source: FDIC

Custodial responsibility extends to third parties

Many financial institutions outsource crypto custody to third parties. For example, BlackRock has used Coinbase and Anchorage to hold its Bitcoin, while BNY Mellon, the oldest U.S. bank, also offers digital asset custody.

However, the document stresses that even when custody is outsourced, banks are still responsible “for the activities performed by the sub-custodian.” This warning could become important in the event of a security breach or loss of assets caused by a third-party provider.

The agencies also emphasized the importance of robust audit programs, noting that these should cover crypto-specific concerns such as key generation, asset transfer, and settlement controls. Where internal expertise is lacking, banks are encouraged to hire external professionals to assess their safekeeping practices.

Regulatory shift encourages bank interest in crypto

Several developments in 2025 suggest a more favorable regulatory climate for banks exploring crypto services.

In May, The Wall Street Journal reported that major banks were in early discussions to launch a joint stablecoin. Meanwhile, the Federal Reserve removed the “reputational risk” criterion from its supervisory practices, a move critics say had previously been used to unfairly target crypto firms.

Also in May, Acting Comptroller Rodney Hood issued a letter stating that banks and federal savings associations could buy and sell crypto assets they custody at the direction of clients.

The FDIC has also introduced a “regulatory reset” in 2025, easing prior restrictions that had limited crypto involvement by traditional financial institutions.

On the flip side, some crypto-native companies are attempting to enter the banking space. On July 2, Ripple, the issuer of XRP, applied for a banking license with the OCC. Stablecoin issuer Circle, creator of USDC, has also filed for a banking charter.