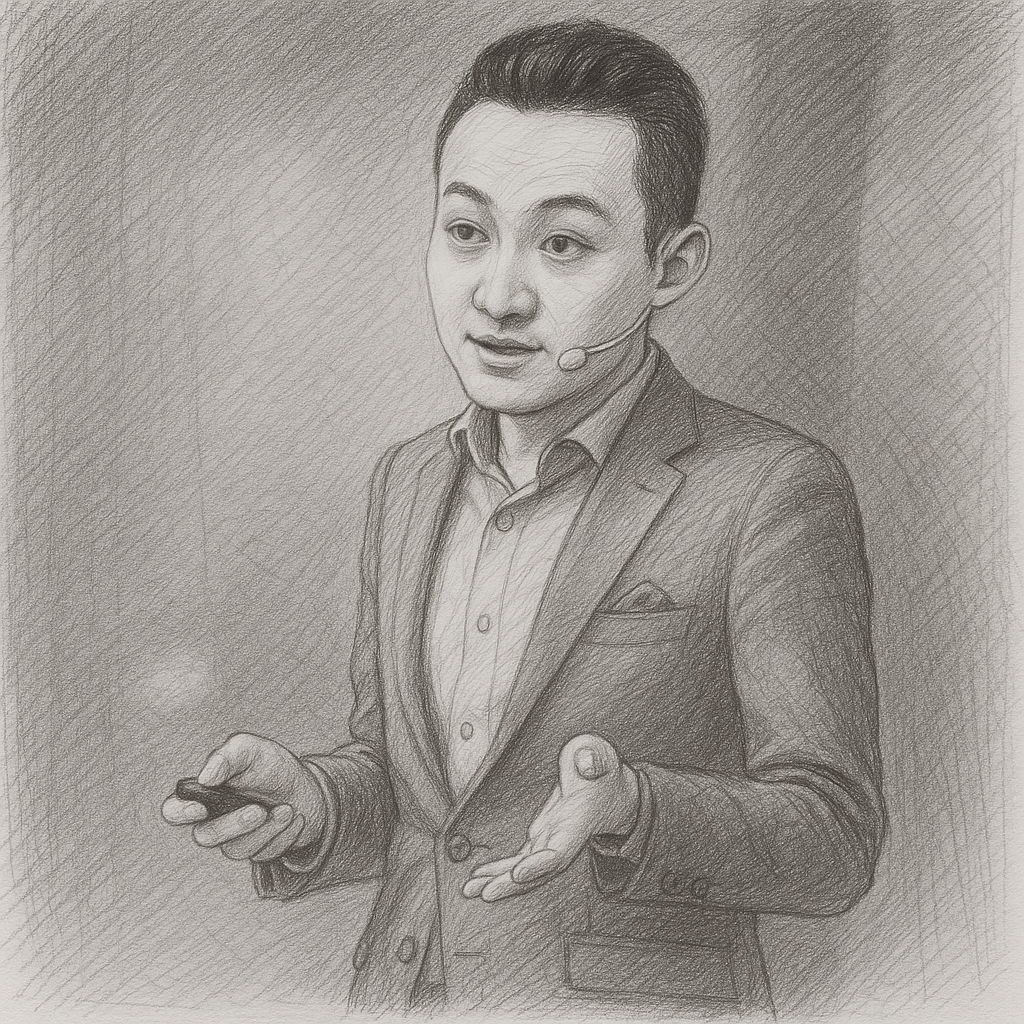

The story of FTX, once a rising star in the cryptocurrency world, serves as a stark reminder of the volatility of digital assets. Founded by the charismatic Sam Bankman-Fried (SBF), FTX promised a sophisticated platform for trading cryptocurrencies and derivatives. Its rapid ascent captivated investors, drew celebrity endorsements, and positioned SBF as an industry leader who advocated for regulation while building a sprawling financial empire. Yet, in November 2022, the exchange collapsed spectacularly, leaving behind bankruptcies, shattered trust, and legal turmoil.

The rise of FTX

FTX, short for ‘Futures Exchange’, launched in 2019 with a focus on cryptocurrency derivatives. Its success stemmed from several factors:

- A user-friendly interface that outpaced competitors.

- A wide range of trading pairs, including altcoins and derivatives like futures and leveraged tokens.

SBF himself played a key role in FTX’s growth. His public image — a brilliant, altruistic entrepreneur — resonated with investors and regulators alike. He engaged in policy discussions, donated to political causes, and cultivated an aura of legitimacy around FTX.

Venture capital firms, including Sequoia Capital and SoftBank, poured billions into FTX, enabling aggressive expansion. The exchange’s branding became ubiquitous, from sports arenas (like Miami’s FTX Arena) to celebrity endorsements. This visibility drew a flood of new users eager to capitalize on the crypto boom.

The hidden risks

Beneath the surface, however, FTX’s ties to Alameda Research — a trading firm also founded by SBF — proved disastrous. While presented as separate, the two entities were deeply intertwined.

The unraveling began in November 2022, when CoinDesk reported that Alameda’s balance sheet was heavily weighted in FTT, FTX’s native token. This raised concerns about solvency, suggesting Alameda’s stability depended on an inflated asset.

Panic ensued when Binance CEO Changpeng Zhao (CZ) announced plans to sell Binance’s FTT holdings, further crashing the token’s price. As users rushed to withdraw funds, FTX faced a liquidity crisis. It soon became clear that customer deposits had been improperly funneled to Alameda, allegedly for risky investments.

Collapse of FTX

FTX halted withdrawals, freezing billions in user funds. Within days, FTX and Alameda filed for Chapter 11 bankruptcy. John J. Ray III, the new CEO overseeing the bankruptcy, described the situation as a “complete failure of corporate controls” with no reliable financial records.

The fallout was immense:

- The crypto market plunged, eroding investor confidence.

- Millions of users lost access to their savings, with recovery uncertain.

- Other crypto firms with FTX exposure faced contagion risks.

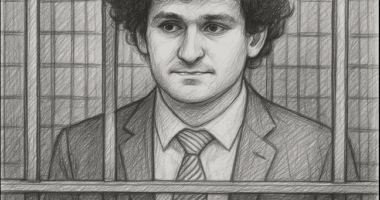

Legal reckoning

SBF was arrested in the Bahamas and extradited to the U.S., where he faces charges including fraud, money laundering, and campaign finance violations. The trial could reveal further details about FTX’s mismanagement.

Weak oversight in crypto

The FTX saga underscores the dangers of weak oversight in crypto. Its collapse highlights the need for:

- Stronger regulation to protect users.

- Transparency in exchange operations.

- Better safeguards against conflicts of interest.

FTX’s meteoric rise and fall will shape the future of cryptocurrency, reminding investors and regulators alike of the risks in this evolving market.