Humble beginnings and immigration to Canada

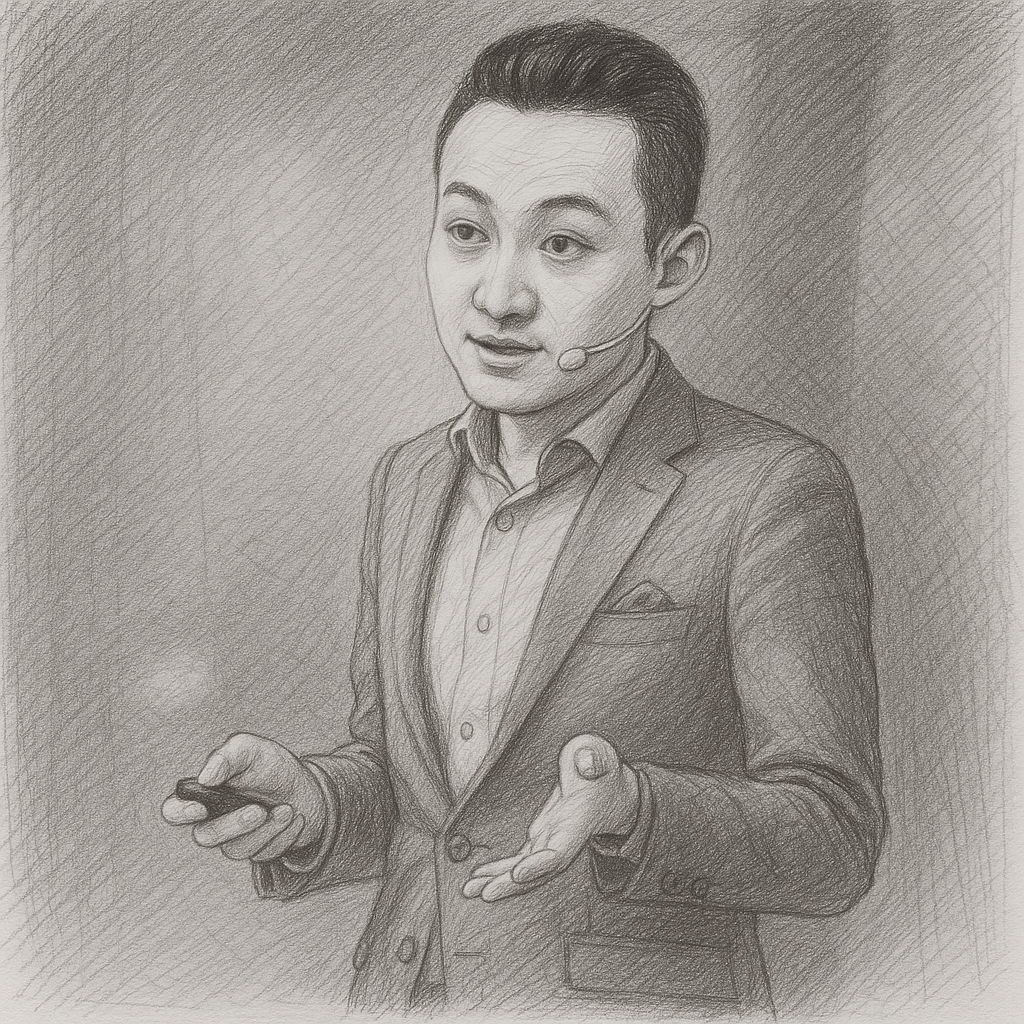

Changpeng Zhao—or, as he is commonly known in the media, CZ—has been at the forefront of the crypto market for close to ten years. His company Binance is the largest crypto exchange in the world. He has accumulated a fair share of notoriety in recent years as well.

Changpeng was born in 1977 in the Jiangsu province of China. He immigrated to Canada at the age of 12. His parents were both teachers, and his father was a university instructor. In his teenage years, he flipped burgers and worked overnight shifts at the gas station to provide for household expenses.

He did his B.Sc at McGill University, majoring in computer science. Changpeng interned for a subcontractor of the Tokyo Stock Exchange after graduating. He went on to build high-frequency trading systems on Wall Street.

Binance’s rise and fall

Changpeng Zhao founded Binance in 2017. He currently owns 90% of all BNB currency—the native tokens backing the exchange. At the height of the crypto crackdown, where multiple firms were either sued by investors or the SEC, Binance was also facing controversy for money laundering.

His net worth spiked to $65 billion in 2022 and dipped massively in 2023 during this period. His wealth slowly recovered to $62.9 billion in 2025. He did not lose his billionaire status during this period of loss and growth.

Road to recovery and pivot to advisory roles

Changpeng pleaded guilty to charges of enabling money laundering in Binance and was sentenced to four months in prison in 2024. He agreed to pay a $50 million fine.

Today, he plays the role of chairman in Binance and is frequently tapped to advise countries on their approach to cryptocurrency as a sector. He is now an official adviser on crypto to Kyrgyzstan and Pakistan. Changpeng currently resides in the United Arab Emirates.

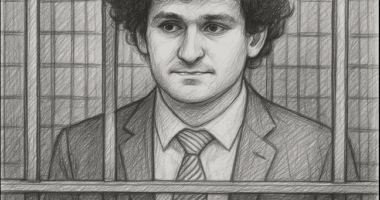

Changpeng’s prison sentence was relatively mild when compared to Sam Bankman-Fried’s. His statements during court rulings were apologetic.

“I believe the first step of taking responsibility is to fully recognize the mistakes,” said Changeng. “Here I failed to implement an adequate anti-money laundering program… I realize now the seriousness of that mistake.”