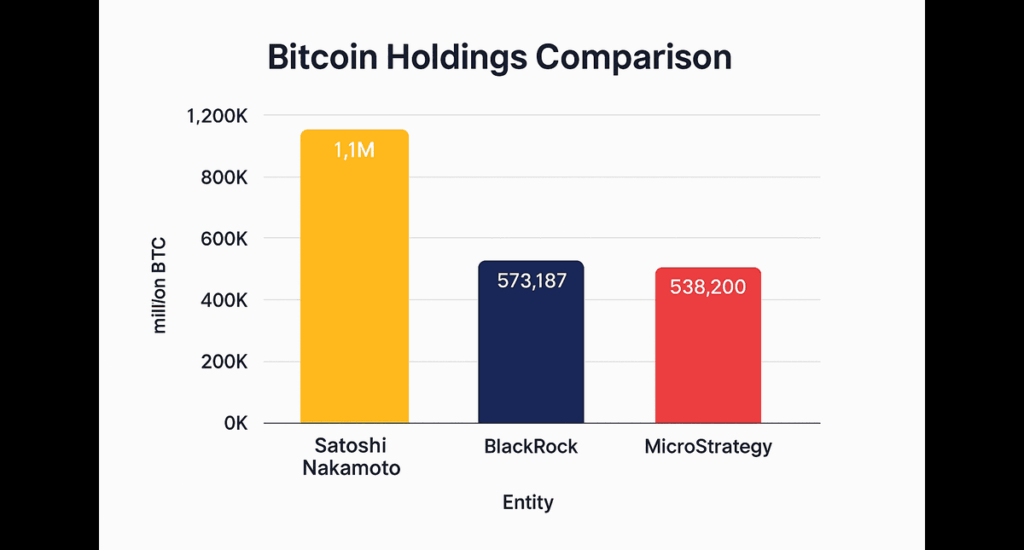

BlackRock and MicroStrategy now collectively hold more Bitcoin than Satoshi Nakamoto, the cryptocurrency’s anonymous creator. The estimated 1.1 million Bitcoin that Satoshi mined in the early days of the cryptocurrency has been formally surpassed by these institutional giants, whose combined holdings now exceed 1.11 million Bitcoin.

BlackRock and MicroStrategy bitcoin holdings surge past 1.1 Million BTC

As of April 23, 2025, BlackRock’s iShares Bitcoin Trust (IBIT) holds approximately 573,187 BTC and about 538,200 BTC is held by MicroStrategy, which is run by veteran Bitcoin supporter Michael Saylor. Although Satoshi’s wallet hasn’t been used since 2010, BlackRock and MicroStrategy have been actively collecting Bitcoin, which has changed the landscape of cryptocurrency ownership.

This change marks a new era in a market that was previously dominated by retail investors and cypherpunks. Today, companies like $MSTR and BlackRock are in charge. Whether it’s a threat to decentralization or a step toward mainstream adoption its who owns the coins shapes the future of the network.

From Satoshi to CEOs

There is now more Bitcoin held by two corporate behemoths than by its anonymous creator, which has generated new discussion in the cryptocurrency community. Critics argue that this concentration of BTC undermines the decentralized ethos of Bitcoin, one of its core principles since inception. However, supporters of institutional growth claim that Institutional titans like BlackRock and MicroStrategy contribute long-term funding, regulatory clarity, and compliance, all of which could eventually aid in stabilizing the price movement of bitcoin.

A new era of Bitcoin has begun, with Wall Street already owning more of the cryptocurrency than its founder ever did. The only thing left to ask is, are you ready for what comes next?