- HBAR surged 30% after breaking out of a double bottom, targeting $0.333.

- Bearish RSI divergence suggests a potential short-term pullback or pause.

- A Hedera ETF and July 23 network upgrade are key catalysts to watch.

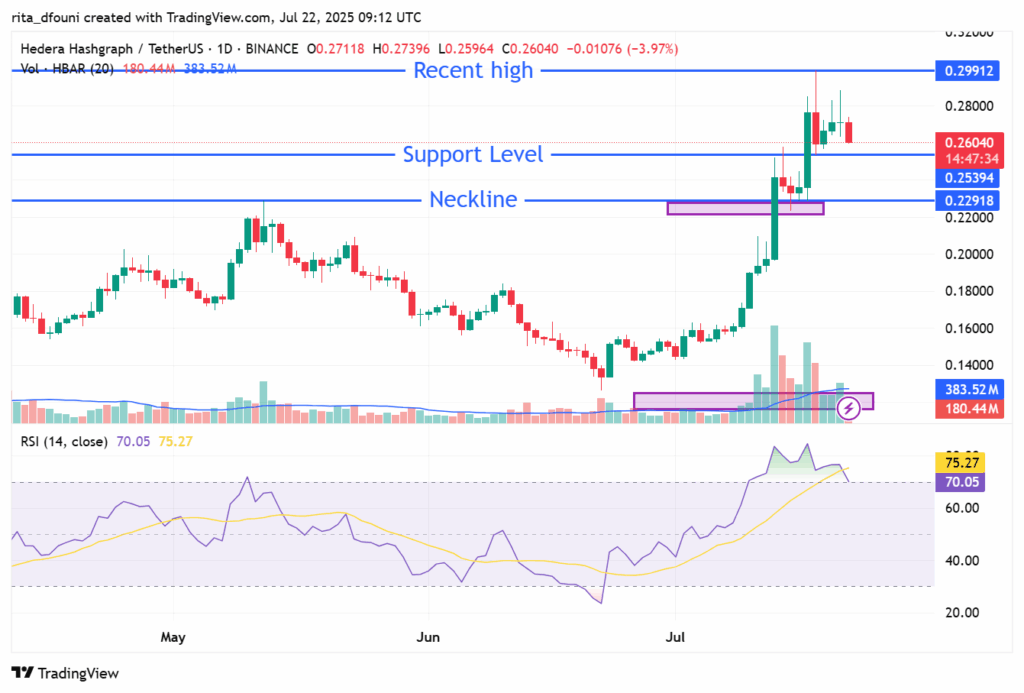

Hedera’s HBAR token surged over 30% after breaking out of a double bottom pattern, rallying from the neckline at $0.229 to a peak of $0.299 on July 18 — a level last tested in early May. Since then, the price has pulled back slightly to around $0.267, consolidating above key support at $0.253.The breakout remains technically valid, with a measured move target of $0.333, calculated by adding the $0.104 depth of the pattern to the neckline. However, momentum indicators suggest that upside may pause in the near term.

The Relative Strength Index (RSI) reached 73, entering overbought territory. A bearish divergence has formed, as price made a higher high while RSI posted a lower high — often a sign of waning bullish momentum. A short-term pullback or extended consolidation may be necessary before HBAR resumes its rally.If HBAR closes below $0.253, attention will shift to $0.229, now acting as a strong support level.

Catalysts driving the move

The recent move was boosted by the launch of the Valour Hedera Physical Staking ETP on the SIX Swiss Exchange, giving institutional investors regulated access to HBAR and its staking rewards.Meanwhile, the SEC is reviewing a proposed Hedera ETF by Canary Capital. Though the decision deadline was extended to September, many analysts remain confident of approval, which could drive new inflows and raise Hedera’s market profile.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Hedera’s mainnet upgrade to v0.63 is scheduled for July 23, bringing performance optimizations and backend enhancements. While it won’t impact tokenomics directly, it may strengthen developer and investor confidence in the protocol.

HBAR chart showing double bottom breakout, support/resistance levels, and bearish RSI divergence.

Source: Trading view