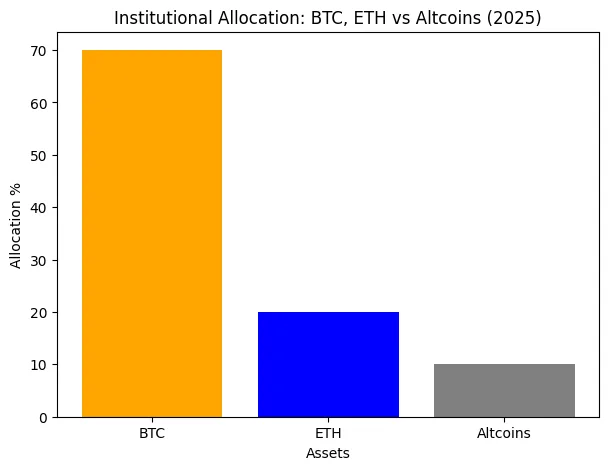

- Organizations strongly prefer Bitcoin (70%), solidifying its position as the most reliable digital asset.

- Ethereum (20%) maintains a robust standing, demonstrating its usefulness in DeFi and smart contracts.

- Altcoins stay specialized at 10%, indicating careful exposure beyond BTC and ETH.

- Portfolio distribution highlights a trend of “flight to quality” in institutional investment.

- The allocation indicates that institutions perceive BTC as digital gold, whereas ETH serves a supplementary growth function.

The question of Altcoin season

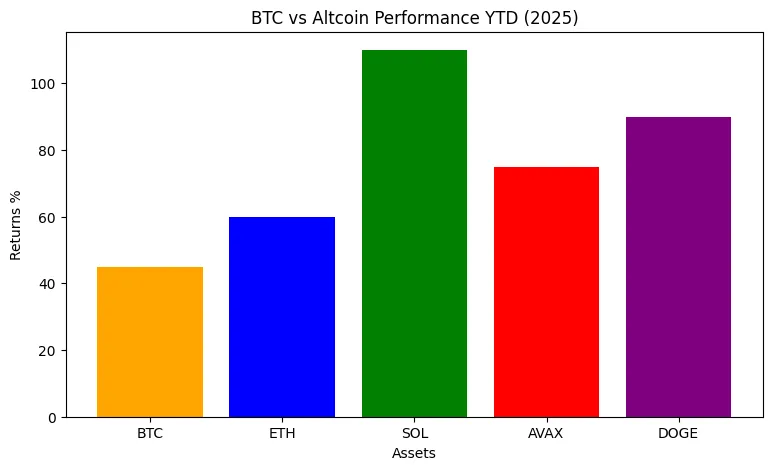

The issue of whether the market is entering an altcoin season or merely going through another phase of speculative chatter arises with each cycle. Both traders and analysts have highlighted the recent surges in tokens beyond Bitcoin and Ethereum as proof of a market rotation. From meme-inspired coins like Dogecoin and Pepe to foundational networks such as Solana, Avalanche, and Cardano, the increase has rekindled discussions within crypto communities. However, the distinction between noise and a genuine altcoin season is essential. The former indicates short-lived surges of speculation, whereas the latter denotes a prolonged change in capital movements and usage.

Bitcoin dominance and capital flows

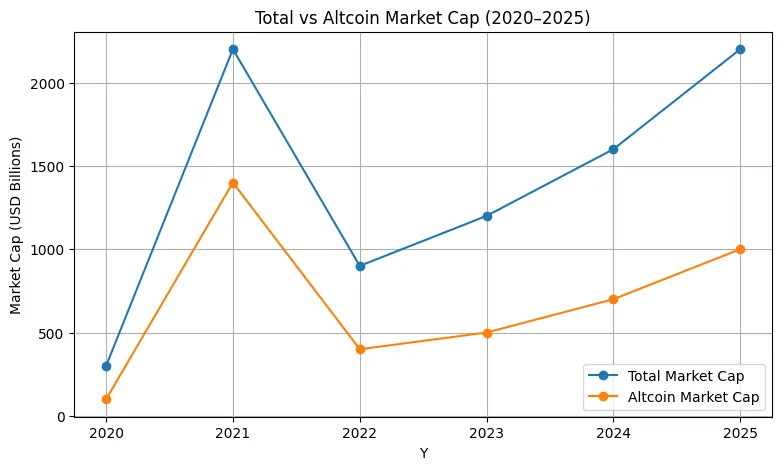

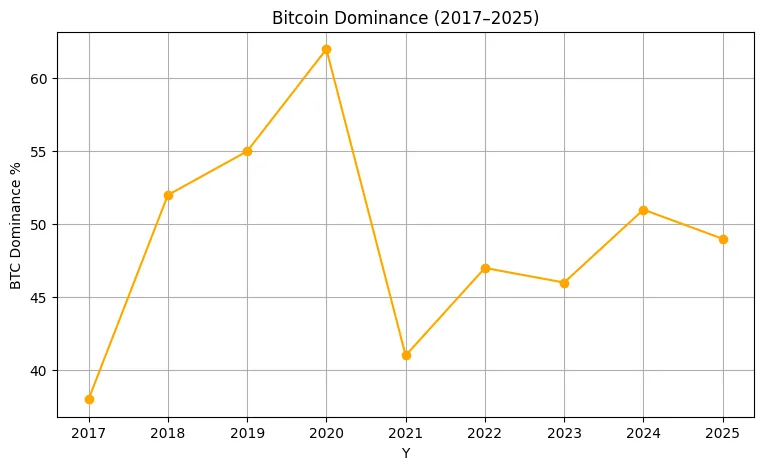

The initial indicator that numerous market players watch is Bitcoin dominance. This metric, which gauges the portion of total crypto market cap represented by Bitcoin, has historically functioned as the heartbeat of altcoin trends. When dominance rises, Bitcoin gathers liquidity and restricts the expansion of other tokens. On the other hand, as dominance decreases, money shifts into smaller coins, leading to widespread rallies. Currently, Bitcoin dominance stays quite high compared to past altcoin surges in 2017 and 2021. This indicates that Bitcoin remains trusted in the market, showing only specific outperformance in certain altcoins. For a true season to develop, consistent withdrawals from Bitcoin to mid-cap and smaller tokens need to be seen over months, not just weeks.

Macroeconomic backdrop and liquidity

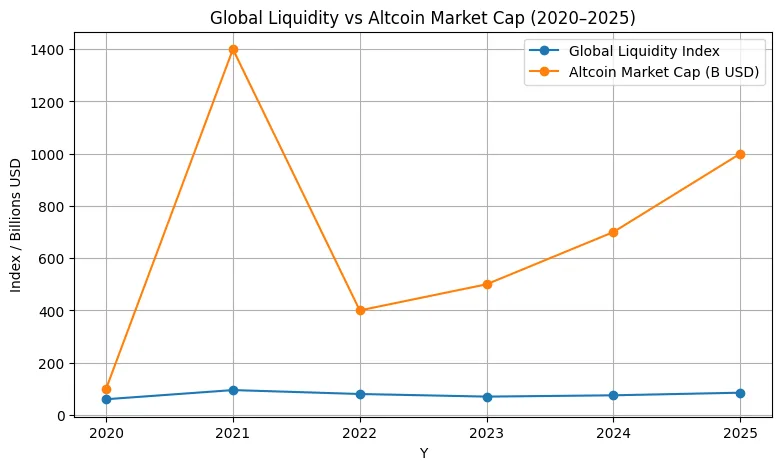

The wider macroeconomic context is important as well. The significant altcoin surges of 2021 occurred amidst a landscape of ample global liquidity, government stimulus payments, and negligible interest rates, creating an ideal setting for high-beta assets to prosper. In contrast, the period from 2023 to 2025 has experienced elevated interest rates and stricter monetary policy, factors that dampen speculative enthusiasm. This has resulted in a contradiction within the cryptocurrency market. Bitcoin has gained from widespread acceptance, such as ETFs and investments from institutions, while altcoins continue to be primarily driven by retail investors. In the absence of a macro tailwind to inject new capital, numerous current increases may be fleeting reflections of previous booms instead of a genuine shift.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

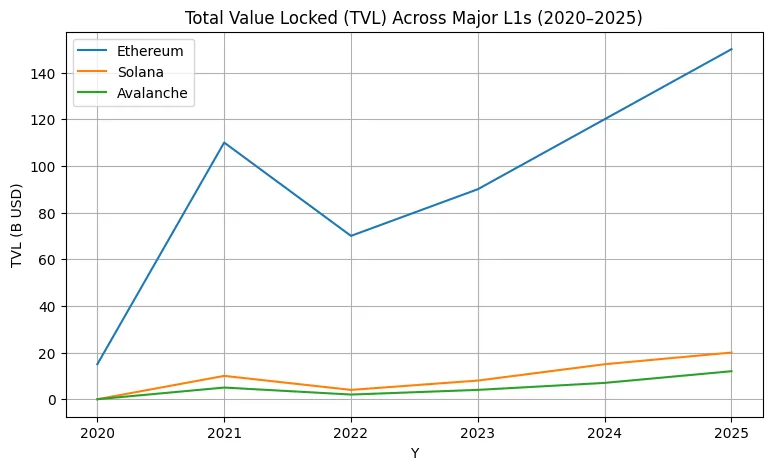

Ethereum and the smart contract ecosystem

The significance of Ethereum in this conversation cannot be ignored. Frequently seen as the cornerstone of the altcoin market, Ethereum holds a leading position in decentralized finance, NFTs, and smart contracts. Nonetheless, it has faced mounting competition from opponents like Solana, Avalanche, and Cardano. The sustainability of altcoin surges relies more on reliable user engagement than on speculative fluctuations. Key indicators like total value locked, daily active users, and on-chain transaction volume serve as the true measures of performance. Should adoption keep growing across various ecosystems, the argument for a true altcoin season becomes more compelling.

Meme coins and retail speculation

No analysis could be thorough without considering the impact of meme coins. Memecoins like Dogecoin, Shiba Inu, and more recently Pepe draw significant retail interest and often provide triple-digit returns in brief periods. However, history demonstrates that these rallies seldom maintain their momentum. Memecoins create enthusiasm, but they also amplify the feeling of a trend. They create sound, but lacking fundamental usefulness or acceptance.

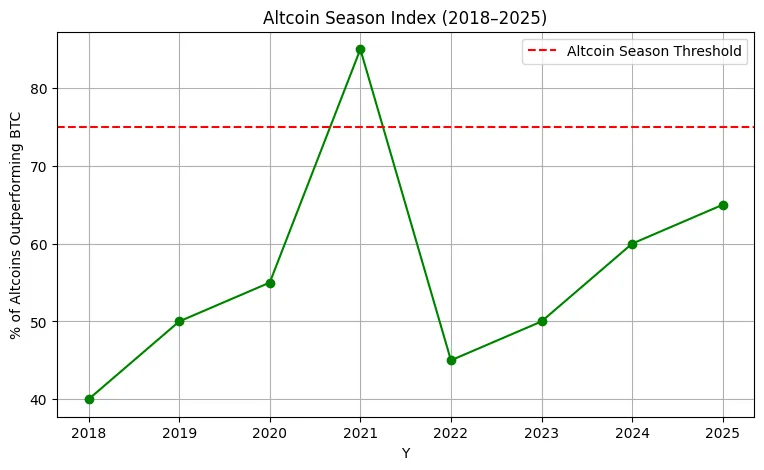

The altcoin season index

Analytical instruments like the Altcoin Season Index offer further insight. This index assesses if most major altcoins are surpassing Bitcoin during a specified period. Traditionally, when over seventy-five percent of the top fifty coins outperform Bitcoin over a period of ninety days, the market is considered to be in altcoin season. Currently, the index shows an initial rotation, with approximately sixty to sixty-five percent of leading altcoins surpassing Bitcoin in performance. This positioning indicates the market is experiencing an altcoin “spring,” rather than a complete summer. Momentum is present, but it hasn’t met the levels of earlier cycles.

Institutions vs retail

From an institutional standpoint, much of the present activity seems to be mere noise. Organizations have adopted Bitcoin and, to a lesser degree, Ethereum via regulated ETFs, custody services, and growing integration into conventional finance. However, the same cannot be stated for the wider altcoin market. Regulatory unpredictability, liquidity challenges, and security issues continue to be major hurdles. Absence of institutional involvement means that altcoin surges are primarily fueled by retail investors and speculation. For professionals overseeing extensive portfolios, spikes in tokens lacking solid fundamentals are seen as short-term anomalies instead of viable trends for investment.

Global adoption and regional drivers

Regional complexities add to the overall situation. In nations experiencing significant inflation or deteriorating currencies like Argentina, Turkey, and Nigeria, the use of crypto has increased not out of speculation but out of necessity. In this context, altcoins and stablecoins offer essential access to dollar-linked savings, remittances, and international payments. In these areas, the role of altcoins is essentially distinct from that in developed markets, where speculation prevails. Although this doesn’t directly correlate with global altcoin seasonality, it emphasizes how actual adoption frequently differs from market excitement.

Noise or season? the verdict

Considering all these factors, the evidence suggests that the ongoing rally is primarily noise rather than a prolonged trend. Bitcoin dominance stays strong, institutional investments are focused on Bitcoin and Ethereum, while numerous altcoins exhibit speculative spikes without sustained growth in usage. The signs indicating a significant capital shift have not yet appeared. With that in mind, the market might be beginning an altcoin spring, an initial stage of rotation that could develop into a more comprehensive season if global liquidity enhances and adoption metrics increase across various chains.

The judgment is prudent. Although rallies in altcoins often draw interest, historical patterns show that genuine altcoin seasons are uncommon and depend on several factors: declining Bitcoin dominance, positive macroeconomic conditions, institutional engagement, and actual usage. In the absence of these elements coming together, what seems like a season might just be noise intensified by meme coins and speculative excitement.

In the interim, investors need to differentiate between temporary rallies and fundamental changes. Altcoins will keep rising in certain areas, providing chances for traders, but it’s unclear if this moment will develop into a significant season. The market might be lively, yet the indicators seem to suggest more noise than a significant change.

Rita Dfouni

Rita Dfouni