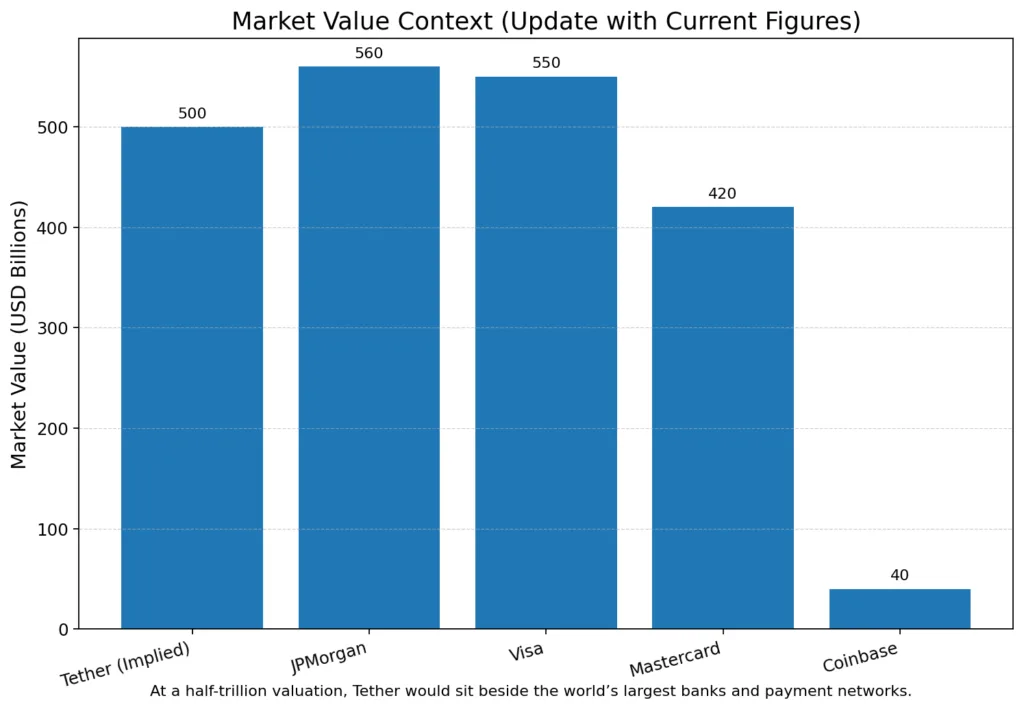

- Tether aiming for a $500B valuation would align it with Wall Street powerhouses such as JPMorgan and Visa.

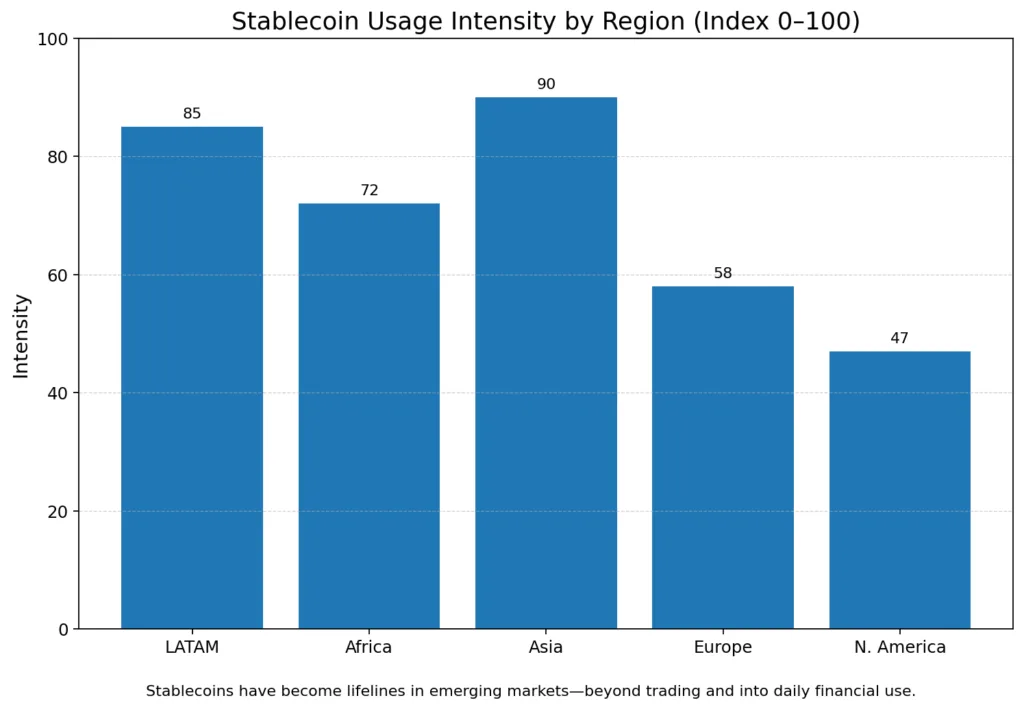

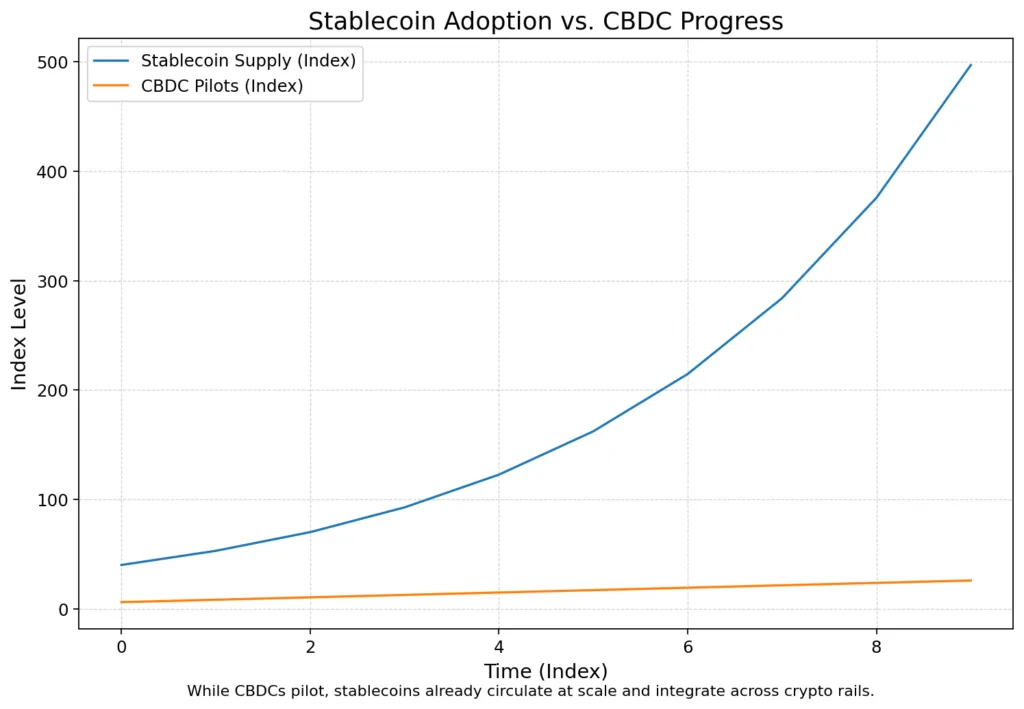

- Stablecoins have transformed from tools for trading into integral financial instruments.

- Tether’s earnings compete with those of the biggest asset management firms globally.

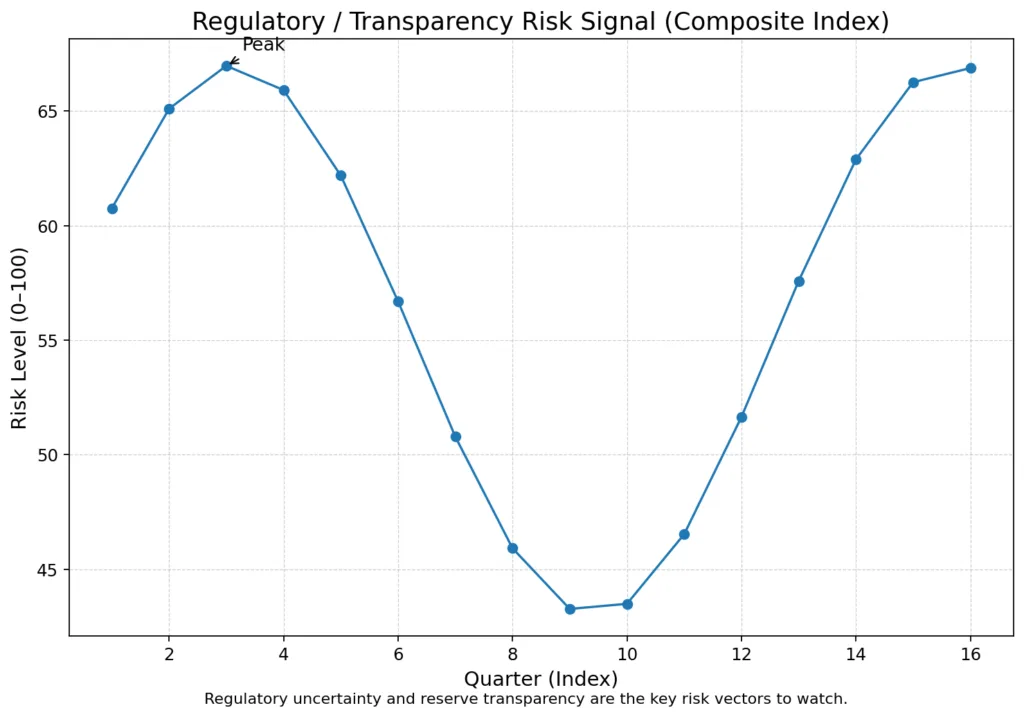

- Risks continue to be considerable, particularly concerning regulation and reserve clarity.

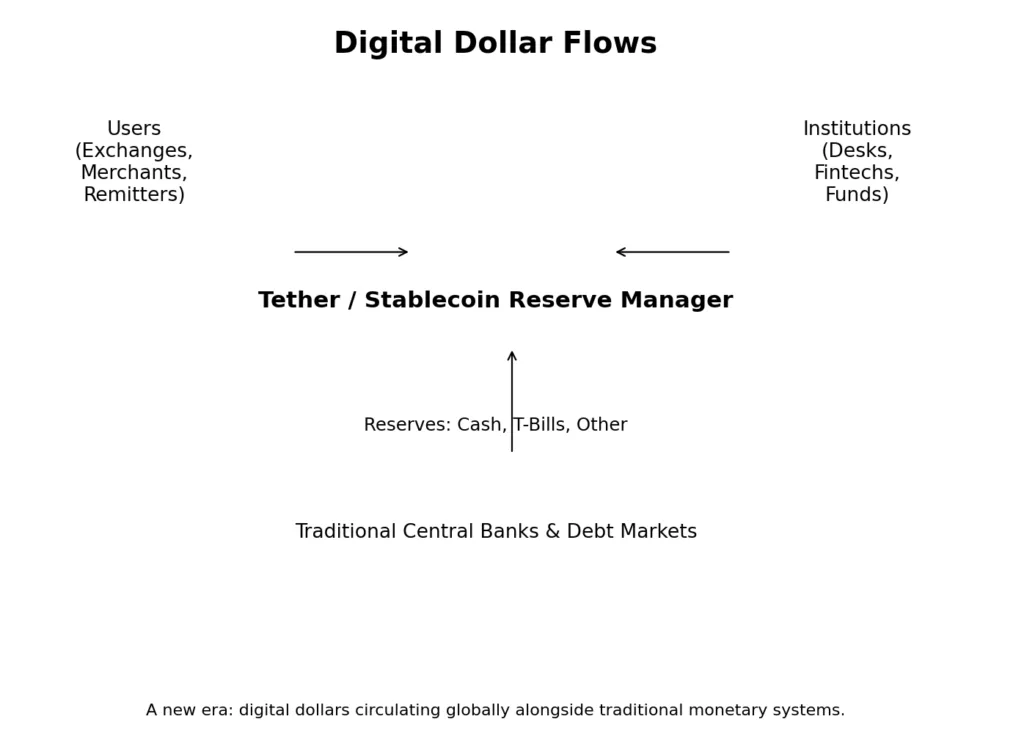

- The era of stablecoins might hint at a model resembling a “shadow central bank.”

The half-trillion dollar question

The realm of digital assets is no stranger to audacious assertions, yet Tether’s alleged aim for a $500 billion valuation has drawn interest well beyond typical cryptocurrency communities. This isn’t just another report about the largest stablecoin; it’s a significant moment that compels the financial sector to acknowledge the progress stablecoins have made, their deep integration into global markets, and what their path indicates about the future of currency itself.

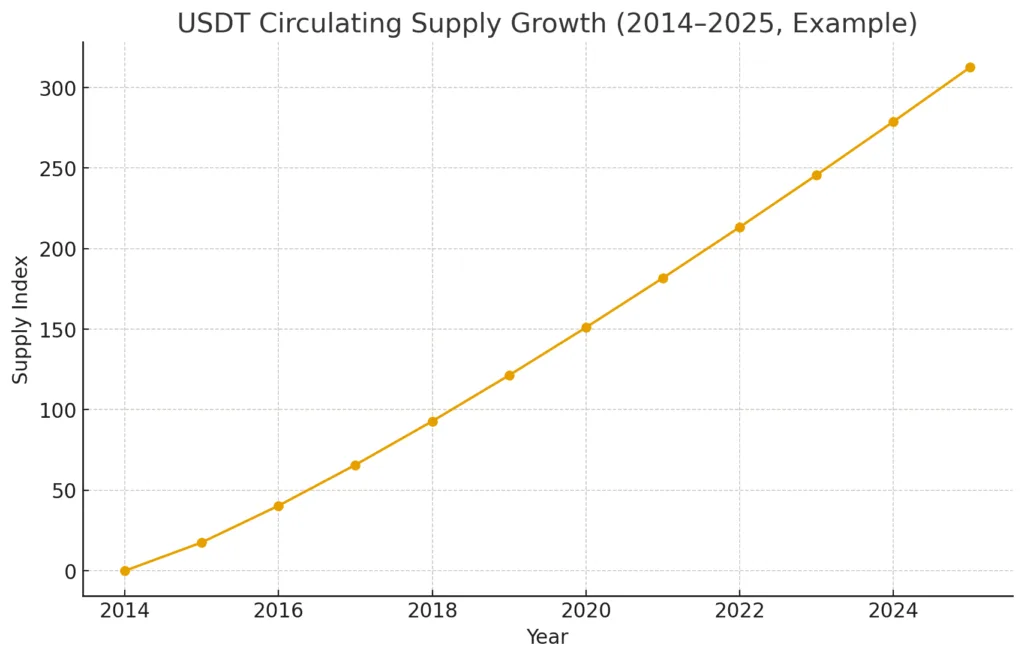

The rise of tether

Tether has been a controversial entity in the cryptocurrency landscape for a long time. Initiated in 2014, the project offered something seemingly straightforward: a token pegged to the dollar that could transfer across blockchains at internet speed. Throughout the years, as competitors such as USDC, DAI, and recent algorithmic initiatives sought to gain market presence, Tether established itself as the preferred liquidity layer. Currently, USDT accounts for over 70% of total stablecoin volume and consistently exceeds Bitcoin and Ethereum in daily trading volume. Its function as the primary currency for crypto exchanges, particularly beyond the United States, has rendered it essential for traders, arbitrage desks, and institutions in need of quick dollar liquidity. That supremacy, however, has not arrived without doubt. Tether’s reserve structure, its international activities, and its past hesitance to undergo audits have attracted attention from regulators and detractors. Despite ongoing skepticism, the company has grown, endured, and is now approaching a valuation that competes with the biggest international banks.

The $500 billion ambition

The $500 billion goal stems from Tether’s intention to offer around three percent of the company in a private equity round anticipated to generate $15 to $20 billion. This would suggest a valuation of $500 billion, positioning Tether alongside JPMorgan Chase, Visa, and Mastercard regarding market capitalization. For a business with fewer than 200 staff members and no physical locations, the contrast is remarkable. Nonetheless, there is reason in the figures. Tether generates significant profits from its reserves primarily in U.S. Treasuries, accumulating billions each year in interest income due to the current higher rates. In 2023, the firm allegedly earned more quarterly profit than BlackRock. If Tether operated as a bank, it would be one of the most lucrative globally. The valuation therefore represents both its existing cash flow robustness and its regarded status as the core infrastructure of digital finance.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

The stablecoin era revealed

The magnitude of this goal signifies the beginning of the stablecoin age. Previously regarded as a specialized instrument for cryptocurrency speculation, stablecoins have evolved into the foundation of worldwide digital markets. In developing countries, USDT frequently serves as an alternative currency, a safeguard against inflation, and a conduit for remittances. In decentralized finance, stablecoins function as collateral, trading pairs, and yield tools. For numerous users in Latin America, Africa, and Asia, the stablecoin represents their primary significant access to liquidity in U.S. dollars. Tether’s valuation reflects not only the financial worth of one company but also the market’s acknowledgment of stablecoins as essential financial instruments.

Risks beneath the ambition

However, underneath the success, there is considerable danger. Stablecoins continue to function within a regulatory gray area. The U.S. has not yet enacted thorough stablecoin laws, making issuers susceptible to varying interpretations from the SEC, CFTC, and banking authorities. The European Union is progressing with its MiCA framework, whereas Asian regions like Hong Kong and Singapore are aiming to regulate stablecoin issuers. Tether, located in the British Virgin Islands, functions worldwide without the level of regulatory oversight that a $500 billion financial institution would typically encounter. Queries regarding reserves, transparency, and systemic risk persist unanswered. A loss of trust in Tether would create shockwaves in crypto markets akin to a bank run, highlighting the vulnerability of this emerging financial tier.

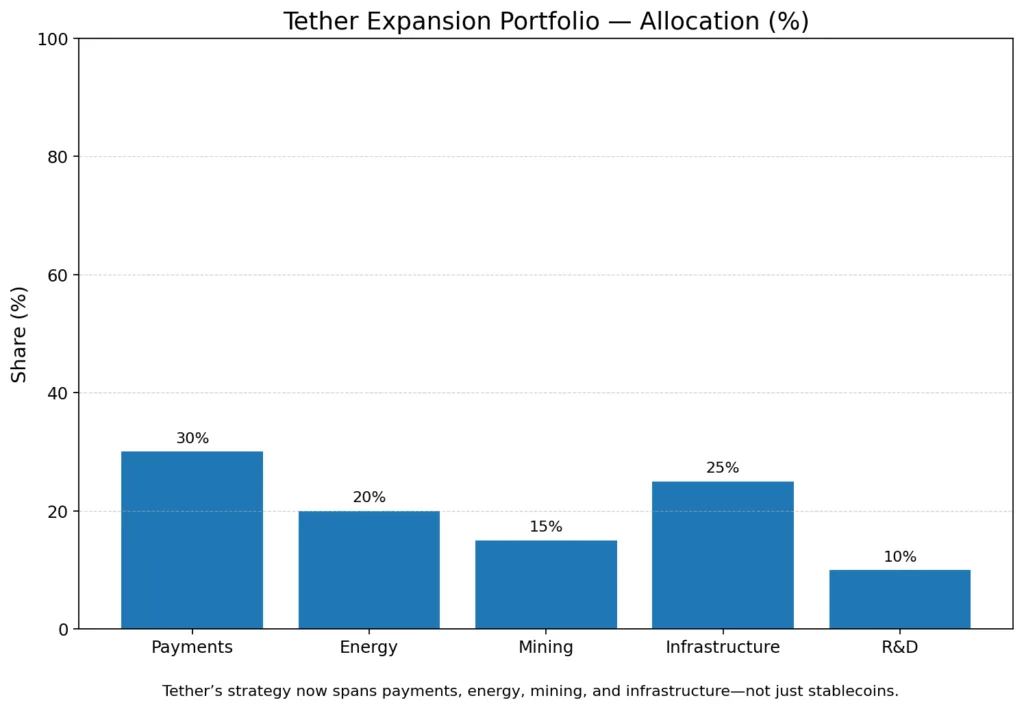

Beyond trading: Tether’s expansion strategy

Tether’s goals reach well beyond cryptocurrency trading. In the past few years, the company has put money into energy initiatives, digital infrastructure, payment technologies, and also Bitcoin mining. These actions are elements of a strategy to establish itself not merely as a stablecoin provider but as a comprehensive financial and technological force. Through the financing of energy grids, internet infrastructure, and payment systems, Tether expresses an intention to become a global financial player, impacting both developing markets and the digital economy. This growth reflects how major financial institutions have traditionally expanded beyond banking into utilities and infrastructure, aiming to influence the settings in which their products succeed.

The future of finance and stablecoins

Tether’s goals reach well beyond cryptocurrency trading. In the past few years, the company has put money into energy initiatives, digital infrastructure, payment technologies, and also Bitcoin mining. These actions are elements of a strategy to establish itself not merely as a stablecoin provider but as a comprehensive financial and technological force. Through the financing of energy grids, internet infrastructure, and payment systems, Tether expresses an intention to become a global financial player, impacting both developing markets and the digital economy. This growth reflects how major financial institutions have traditionally expanded beyond banking into utilities and infrastructure, aiming to influence the settings in which their products succeed.

The signal of a new era

The era of stablecoins consequently raises challenging questions. Are private firms reliable when it comes to the large-scale issuance of digital dollars? How ought regulators address an organization that operates as a bank, a money-market fund, and a payments provider at the same time? What occurs if geopolitical conflicts create divides in stablecoin usage, where certain governments welcome them while others prohibit them? Tether’s path underscores the conflict between innovation and systemic stability, between market-driven currency and government-regulated money.

Like all pivotal moments in finance, the outcome remains unwritten. Tether’s goal of $500 billion is a notable story, but more significantly, it serves as a signal. It indicates that stablecoins have transitioned from being minor experiments to essential tools in global finance. It indicates that the earnings from handling dollar liquidity on a large scale are similar to those of major Wall Street firms. It indicates that the coming decade of financial innovation could be influenced significantly by offshore tech firms alongside central banks and regulators.

The era of stablecoins is not just approaching; it is already here. Tether’s growth represents both the potential and the dangers of that situation. Regardless of whether it achieves its $500 billion goal or not, the endeavor itself demonstrates the significant transformation of the financial landscape.

The actual narrative extends beyond a single company’s worth; it revolves around the acknowledgment that digital currencies created by private entities, supported by reserves, and operating on public blockchains are permanent fixtures in the landscape. The evolution of currency is happening in real time, and Tether’s goal is its most prominent declaration to date.