- Bitcoin’s 30-day implied volatility has fallen to 36.5%, the lowest since October 2023.

- Growing use of ‘covered call’ strategies and other yield-focused products is helping smooth out price swings.

- The change in Bitcoin’s volatility shows it’s starting to behave more like traditional Wall Street assets.

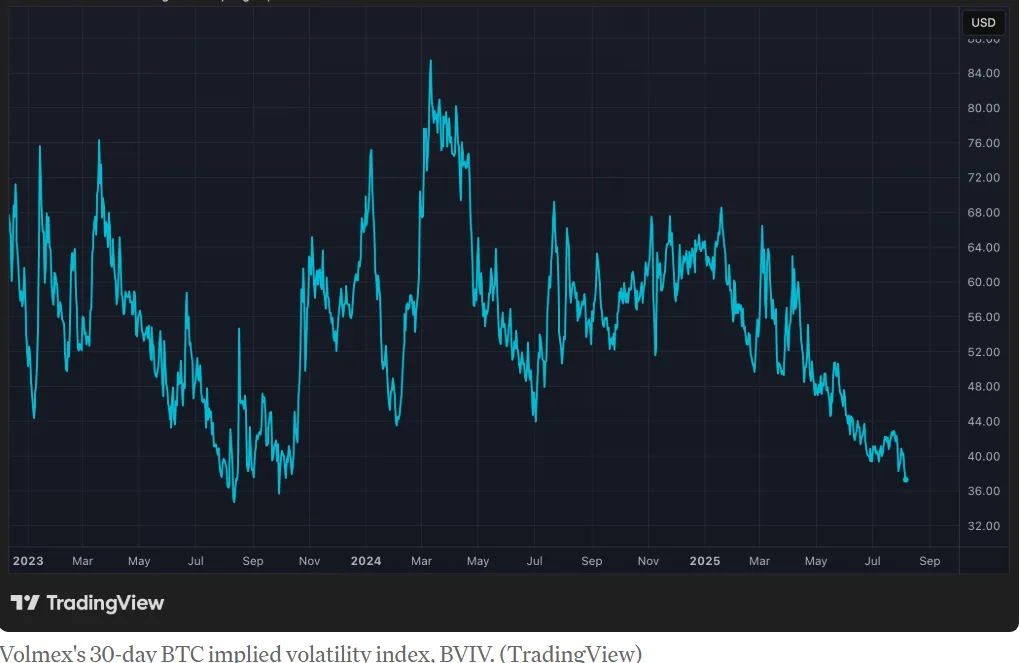

Bitcoin, known for its wild price swings, is suddenly much calmer than usual. Bitcoin’s 30-day implied volatility has fallen to 36.5%, the lowest since October 2023. Back then, Bitcoin was under $30,000, now it has been hovering steadily between $110,000 and $120,000. Notably, this sharp decline in volatility has occurred amid relatively flat price action.

This trend marks a departure from the cryptocurrency’s historically erratic behavior, aligning more closely with patterns observed in traditional equity markets. Much like the stock market’s VIX index, which frequently retreats during steady bull runs, BTC’s implied volatility is dropping even as prices remain elevated. In the stock market, when prices go up steadily, volatility often goes down. Something similar seems to be happening with Bitcoin now.

Structured products shaping market

According to analysts, one reason for this calm is the rise of “structured products,” especially a popular strategy called covered calls. These are investments that make money by giving up some future profits in exchange for steady income. It is this exchange that is dampening broader price swings by smoothening out the big jumps and drops in Bitcoin’s price.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Market signals growing maturity

The growing appeal of such instruments also signifies Bitcoin’s evolving role and maturity. It is increasingly mirroring the risk dynamics of Wall Street rather than its erstwhile status as a volatile crypto asset. It’s no longer just for risk-taking traders hoping to get rich quickly. Now, more professional investors are using smart strategies to manage their risks and earn steady returns.

For the common man, this means Bitcoin might start to feel more like a regular investment and less like a rollercoaster. As traders and institutions deploy more sophisticated hedging and yield-generating strategies, price dynamics are starting to stabilize. But this transition is also raising questions about the long-term implications for BTC’s signature appeal as a high-volatility asset class. Can is still attract investors without its ups and downs?