- Bitcoin and crypto markets recover after a $19 billion liquidation event.

- Optimism over a potential US-China trade deal boosts investor sentiment.

- Markets anticipate a 25-basis-point rate cut ahead of the FOMC meeting.

Cryptocurrency markets rebounded this week following a record $19 billion liquidation event, lifted by renewed optimism surrounding US-China trade negotiations and improving macroeconomic sentiment.

Bitcoin (BTC) briefly surged above $116,400 on Monday its highest level in two weeks as investors positioned themselves ahead of two major events: the Federal Open Market Committee (FOMC) rate decision on Wednesday and a potential trade deal announcement between the US and China expected on Thursday.

The two nations have reached a “preliminary” framework for an import tariff agreement, sparking a recovery in crypto investor sentiment from “fear” to “neutral.”

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Recent optimism surrounding the US-China trade negotiations helped ignite a weekend rally in Bitcoin. Signs of progress have lifted broader risk sentiment.

Trump-Xi meeting drives investor optimism

The rebound comes just days before US President Donald Trump and Chinese President Xi Jinping are scheduled to meet to discuss trade measures aimed at preventing further economic escalation between the world’s two largest economies.

Speaking aboard Air Force One, Trump said he was confident that both sides would “come away with the deal”, according to CNBC.

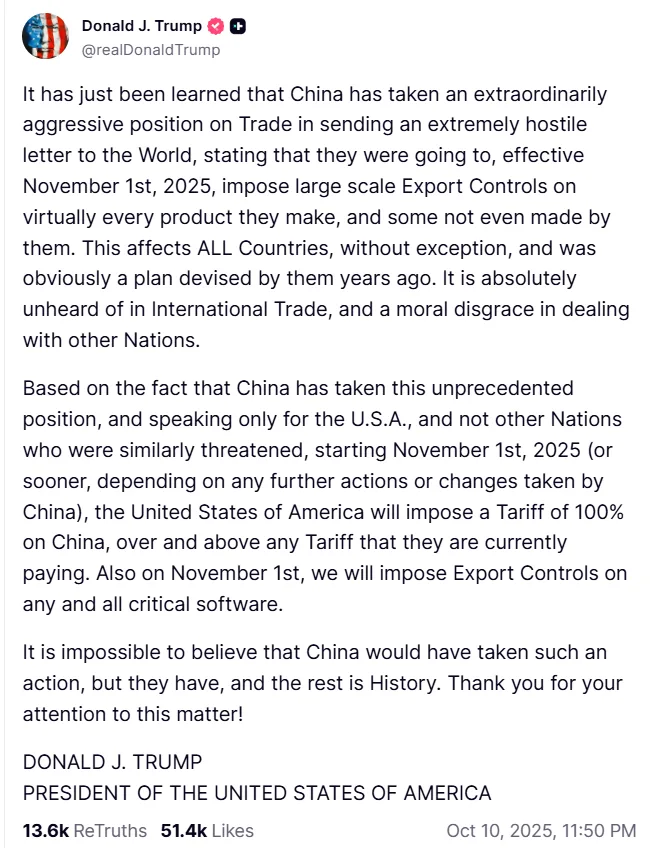

That optimism helped Bitcoin reclaim the short-term holder (STH) cost basis of roughly $114,000 a key technical level lost after Trump’s Oct. 10 tariff threats triggered a sharp crypto market crash. Maintaining this level is critical for Bitcoin’s stability, as STHs are typically more reactive to short-term price movements.

Source: President Donald Trump

Rate-cut expectations add fuel to risk rally

The Federal Reserve’s upcoming interest rate decision on Wednesday is also adding to investor risk appetite.

According to the CME Group’s FedWatch tool, markets are now pricing in a 96.7% probability of a 25-basis-point rate cut, which could further support Bitcoin and other risk assets in the short term.

Trump’s earlier announcement of a potential 100% tariff on Chinese imports starting Nov. 1 had triggered the largest single-week liquidation event in crypto history, sending Bitcoin briefly down to $104,000 on Oct. 17.

Now, with hopes of a trade truce and a softer Fed stance, investors are cautiously reentering the market pushing Bitcoin back into bullish territory above the $116,000 mark.