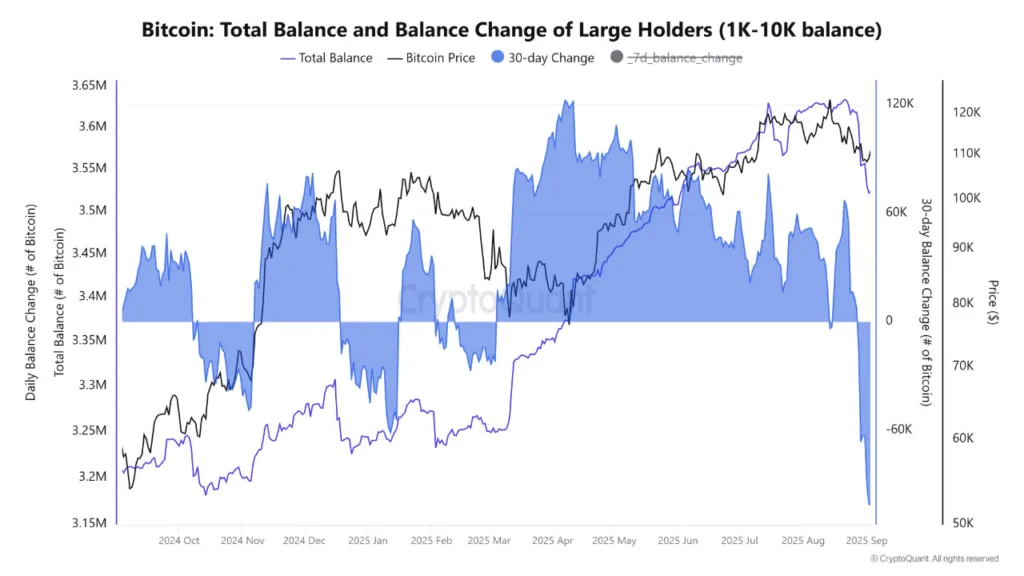

Bitcoin faced heavy selling pressure in August as large holders offloaded nearly 115,000 BTC, the biggest whale-driven sell-off since mid-2022. According to data from CryptoQuant, the 30-day balance change showed a reduction of 114,920 BTC worth approximately $12.7 billion at current market prices as of September 7. Analysts say the aggressive selling has been “penalizing the price structure in the short term,” pushing prices below $108,000 and signaling heightened risk aversion among major investors.

The intensity of selling peaked in early September, when the seven-day balance change reached its highest level since March 2021. More than 95,000 BTC were shifted by whales in the week of September 3 alone. Bitcoin entrepreneur David Bailey suggested prices could surge to $150,000 if two key whales were to stop selling, though market data shows the pace of outflows has already begun to slow. By September 6, the weekly balance change had dropped to about 38,000 BTC, and prices stabilized between $110,000 and $111,000 over the following three days.

Institutions cushion sell-off as long-term trend holds

CryptoQuant defines whales as wallets holding between 1,000 and 10,000 BTC. While their recent selling has rattled markets, analysts note that institutional accumulation has provided a counterweight. “Institutional accumulation adding more BTC during the same period has provided a structural counterbalance,” said Nick Ruck, director at LVRG Research. He added that this divergence suggests whale activity may cap near-term upside momentum, but corporate buying and ETF-driven demand continue to support market resilience. Ruck also cautioned that macroeconomic catalysts, particularly the Federal Reserve’s September rate decision, could ultimately dictate broader price direction.

Despite the turbulence, the broader picture for Bitcoin remains constructive. The asset has corrected only 13% from its mid-August all-time high, a relatively shallow pullback compared with past cycles. Market analyst “Dave the wave” noted that Bitcoin’s one-year moving average has climbed steadily, rising from $52,000 a year ago to $94,000 today. “Next month, it will be through $100,000,” he said, highlighting the long-term strength of the trend.