- Tesla’s Q3 revenue climbed to about $28.1 billion, up ~12% (YoY), but EPS of ~$0.50 missed analyst estimates.

- The EV and robot maker booked an ~$80 million profit from its Bitcoin holdings in Q3.

- Elon Musk says Tesla is entering “a critical inflection point” around autonomy.

EV maker Tesla’s Q3 revenue climbed to about $28.1 billion, up ~12% year-over-year, the company reported on Wednesday. However, EPS came in at about $0.50, missing expectations, while operating income shrank, reflecting margin pressure. Tesla reported a 6% rise in automotive revenue, reaching $21.2 billion compared to $20 billion during the same period last year.

However, net income dropped by 37%, falling to $1.37 billion or $0.39 per share, from $2.17 billion, or $0.62 per share, a year earlier. The company attributed the decline to lower electric vehicle prices and a sharp 50% increase in operating costs, partly driven by spending on artificial intelligence and other research and development efforts. Tesla ended the quarter with cash, cash equivalents, and investments of about $41.6 billion.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Bitcoin boost on Q3 books

Tesla revealed that it held around 11,509 BTC or ~$1.35 billion in value and recognized roughly $80 million in gains from the cryptocurrency’s price rise. It also said that it had not purchased or sold any of its BTC holdings during the quarter. The gain added a nice tailwind to results, though it remains a relatively small line item in the overall results.

Focus on AI & Robotaxi future

Musk used the earnings call to push Tesla’s broader roadmap beyond cars. He reaffirmed confidence in full autonomy and robotaxi deployment, stating that Tesla is at an inflection point in bringing AI into the real world. He also emphasized a mission of “sustainable abundance” and hinted that Tesla’s biggest growth engine might be robotics and autonomy rather than just vehicles.

“Not about to replace Nvidia” says Musk

Musk also used the earnings call to publicly confirm that Samsung is now a co-partner in AI5 chip production. He clarified that Tesla will have both Samsung and TSMC build its next-generation AI5 chip, rather than relying solely on TSMC as earlier assumed. The production will be split between Samsung’s Texas facility and TSMC’s Arizona site.

Musk also added that Tesla’s explicit goal is to run an oversupply of AI5 chips. He said that if the volume exceeds automotive and robotics demand, the excess chips could be deployed into Tesla’s own data centers.

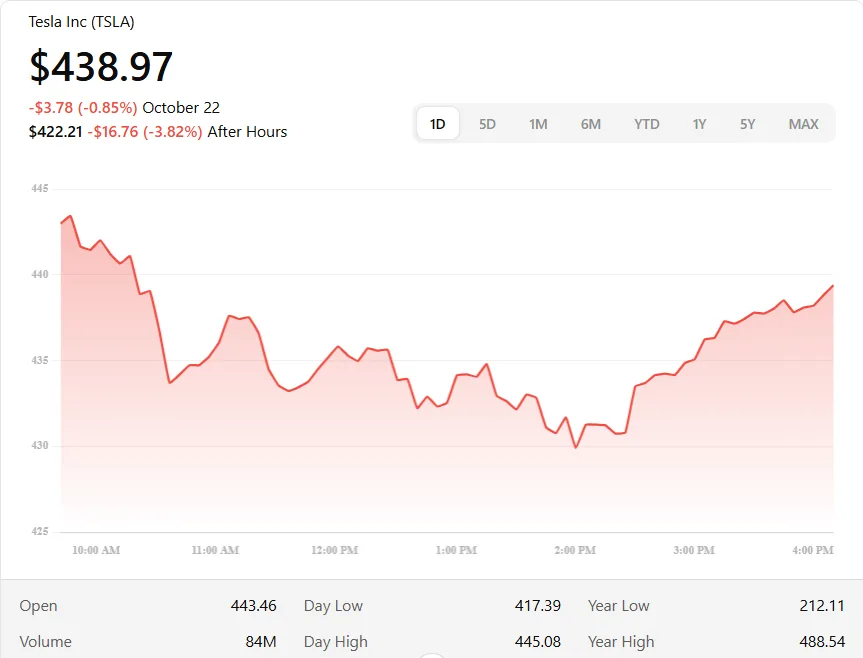

Tesla stock was trading around $438.97 at the time of this report. The shares dipped modestly after the earnings, reflecting investor caution despite the revenue gain and cryptocurrency boost.