- Spot Ether ETFs post $287.6 million in net inflows after four straight days of losses, led by BlackRock’s ETHA with $233.5 million.

- ETF holdings now total 6.42 million ETH worth $27.66 billion, or 5.31% of Ether’s circulating supply.

- Corporate ETH accumulation sparks community debate over its impact on price, staking, and decentralization.

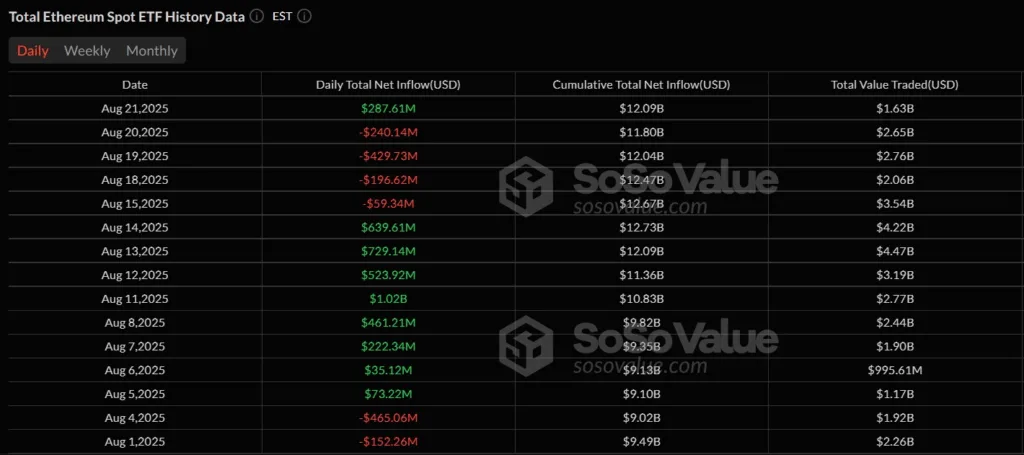

US spot Ether exchange-traded funds (ETFs) attracted $287.6 million in net inflows on Thursday, breaking a four-day streak of withdrawals, according to data from SoSoValue. The recovery comes after more than $924 million exited the market between August 15 and Wednesday. The largest single-day withdrawal during that stretch was $429 million on Tuesday, marking the second-biggest outflow of the month after $465 million on August 4.

BlackRock’s iShares Ethereum Trust (ETHA) spearheaded the rebound, bringing in $233.5 million, while Fidelity’s Ethereum Fund (FETH) followed with $28.5 million. Other ETF issuers averaged around $6 million in inflows each. The fresh wave of investor interest lifted cumulative net inflows above $12 billion, signaling renewed confidence in Ether ETFs after a week of sustained outflows.

Ether ETF and corporate reserves surge

Data from the Strategic ETH Reserve (SER) shows that spot Ether ETFs now collectively hold 6.42 million ETH, valued at $27.66 billion, equivalent to 5.31% of Ether’s circulating supply. On Thursday alone, these funds saw a net inflow of 66,350 ETH.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Beyond ETFs, corporate treasuries and long-term institutional holdings have also swelled, reaching 4.10 million ETH worth $17.66 billion, or 3.39% of supply. Companies such as SharpLink Gaming have made aggressive purchases, acquiring $667 million in Ether on Tuesday near record highs. This lifted SharpLink’s total holdings to over 740,000 ETH valued at $3.2 billion, positioning it as the second-largest corporate ETH holder after Bitmine Immersion Tech, which owns 1.5 million ETH.

Community debate on institutional impact

The increasing concentration of ETH in institutional reserves has sparked debate within the Ethereum community. On Reddit, one user questioned whether corporate “hoarding” adds meaningful value to Ethereum’s ecosystem, arguing that DeFi innovation is the true backbone of the network.

Supporters countered that institutional buying reduces circulating supply and potentially boosts prices, while staking by large entities could enhance network security. However, critics warned that more staking from centralized players could undermine decentralization, a core principle of Ethereum.

Others viewed institutional adoption as a net positive, pointing out that higher ETH valuations increase liquidity and expand DeFi’s utility, given Ethereum’s role as the foundational asset across many protocols. The debate underscores growing tension between decentralization ideals and Wall Street’s rising influence on the crypto space.