-

Trader “White Whale” increases bounty to $2.5 million following MEXC’s request for in-person KYC in Malaysia.

-

MEXC purportedly locked $3.1 million in assets without referencing any service agreement breaches.

-

Other investors, such as Pablo Ruiz ($2 million frozen), mention similar account freezes subject to 365-day evaluations.

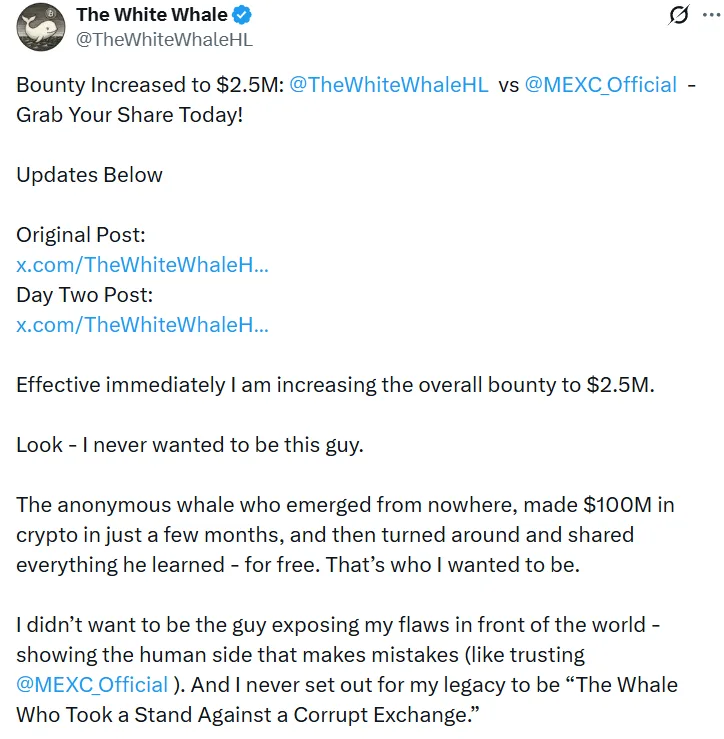

A prominent conflict involving crypto trader “White Whale” and the centralized exchange MEXC has intensified, with the trader increasing his “bounty” to $2.5 million through a social media initiative. The decision comes after allegations that MEXC required an in-person KYC verification in Malaysia to release $3.1 million in personal assets.

The dispute with MEXC

In July 2025, White Whale claimed that MEXC had frozen assets valued at $3.1 million without referencing any violations of terms of service. On Sunday, he initiated a $2 million social media advocacy campaign, urging community backing and increased awareness of the exchange’s methods.

By Tuesday, the initiative intensified as White Whale contributed an additional $250,000, increasing the reward to $2.5 million. Backers received rewards for minting a complimentary NFT on the Base network and tagging MEXC or its COO on X with the #FreeTheWhiteWhale hashtag.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Other investor complaints

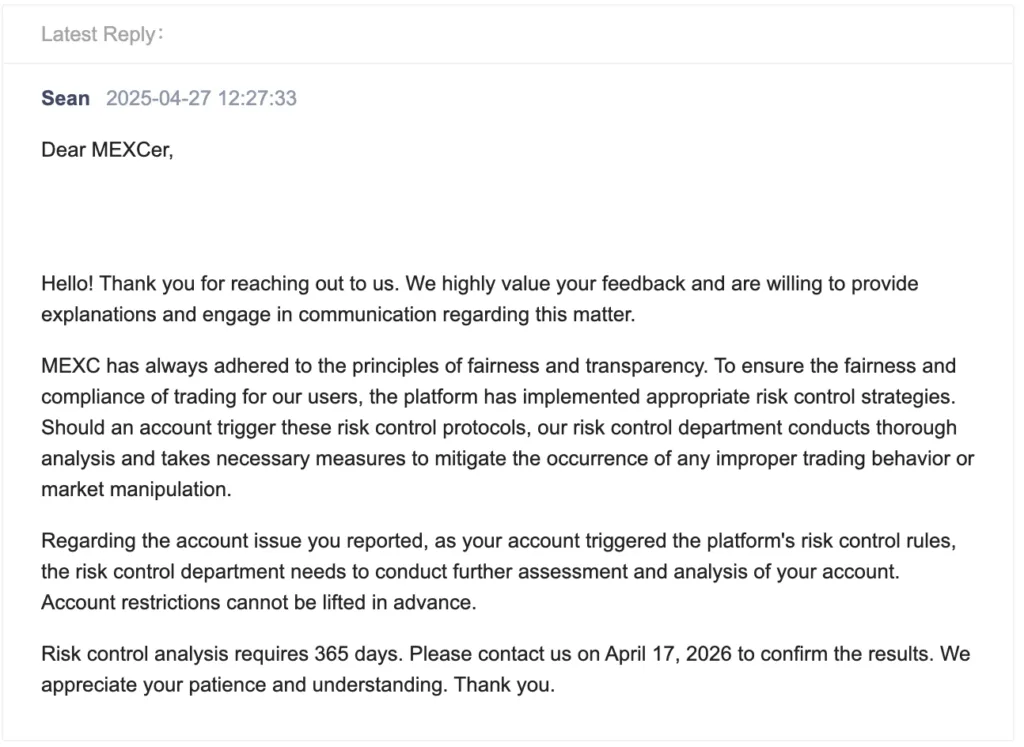

The debate has intensified as additional investors have shared comparable experiences. On April 17, crypto trader Pablo Ruiz announced that his MEXC account containing $2,082,614 USDT was frozen due to “undefined risk management protocols.” He mentioned that he was given no advance warning, justification, or chance to collaborate.

Ruiz mentioned in a July 13 X post that his account was undergoing a 365-day review, which is scheduled to end in April 2026. Even though he was told the review was finished, MEXC’s support team reportedly maintained it was still in progress leading him to describe it as an “internal contradiction and a lack of transparency.

MEXC’s response

Screenshots of official replies indicate that MEXC uses risk management protocols as the reason for fund freezes. In one response, the exchange stated that risk control evaluation takes 365 days, and restrictions cannot be removed prematurely, highlighting the importance of avoiding improper trading or market manipulation.

Industry outlook

The situation underscores persistent conflicts between traders and centralized exchanges regarding transparency of funds, risk management policies, and user entitlements. With millions of dollars involved and increasing pressure from social media, the dispute might impact wider industry discussions regarding accountability and trust in centralized exchange platforms.