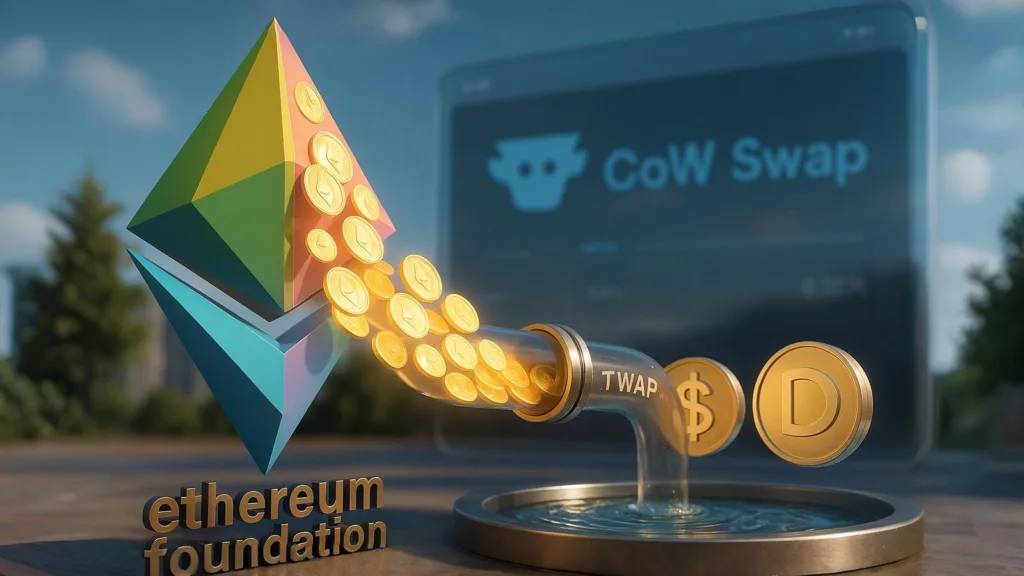

- The Ethereum Foundation (EF) will convert 1,000 ETH into stablecoins using CoWSwap’s TWAP feature, aiming to minimize market impact while meeting treasury cash needs.

- This move comes under EF’s newly published Treasury Policy, which ties ETH sales to operational expenses and cash buffers.

- CoWSwap’s TWAP (Time-Weighted Average Price) method splits a large trade into smaller parts executed over time to reduce slippage and improve average pricing.

On October 3rd, the Ethereum Foundation (EF) announced that it will be converting 1,000 ETH into stablecoins using CoWSwap’s TWAP functionality. The Foundation went on to say that this was ‘a measured way to fund ongoing operations without jolting the market’. Back in June 2025, EF had published its Treasury Policy guidelines, in which it had spoken of ETH sales via fiat off-ramps or on-chain swaps for fiat-denominated assets.

Therefore, this sale is not sudden, but fits into the EF’sTreasury Policy, in which the Foundation has committed to more disciplined asset management. Under that policy, ETH sales are triggered based on cash needs and buffer levels. The idea is that EF should hold enough reserves to cover a certain number of years of operating expenses.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Why use CoWSwap’s TWAP?

TWAP (Time-Weighted Average Price) is a trading approach that divides a large order into smaller pieces spread over time. This helps avoid large price swings or slippage that can happen when dumping a big amount all at once. For example, breaking 1,000 ETH into four parts of 250 ETH yields a roughly 3.5% better average price than selling all at once, based on internal tests.

CoWSwap’s infrastructure is designed for DAO and large-transaction efficiency. It offers MEV protection, routing through order matching mechanisms, and strategies to limit front-running and slippage.

Impact on ETH, the network & market

Because the Ethereum Foundation is a trusted steward in the Ethereum ecosystem, its modest sale is unlikely to spook markets, especially given that TWAP dampens market impact. It signals EF is moving from a passive holder to a more active treasury manager.

In terms of ETH price, 1,000 ETH is relatively small in global supply, so the direct downward pressure should be limited. However, the move may reinforce market confidence that future ETH sales will be methodical and policy-driven, not reactive or discretionary.

For the Ethereum network, this conversion aligns with EF’s goal of sustaining operations like funding grants, development, ecosystem support, etc., while maintaining transparency and predictability. In its new Treasury Policy, EF commits to publishing more frequent reporting and adhering to rules around timing and size of ETH sales.