- Taiwanese prosecutors indict 14 suspects in the country’s largest-ever crypto laundering case worth $72 million.

- Over 1,500 victims were defrauded through fake exchanges and cash deposit machines posing as licensed operators.

- Authorities seized millions in crypto, cash, and assets, while ringleader Shi Qiren faces up to 25 years in prison.

Taiwanese prosecutors have indicted 14 individuals in what is being described as the country’s largest-ever cryptocurrency money laundering case. The Shilin District Prosecutor’s Office said the scheme defrauded over 1,500 victims and laundered more than $71.9 million through non-licensed crypto operations.

Authorities requested the confiscation of 1.275 billion New Taiwan dollars ($39.8 million) obtained from victims, along with an additional $640,000 in USDT, undisclosed amounts of Bitcoin and Tron (TRX), $1.8 million in cash, two luxury vehicles, and $3.13 million in seized bank deposits. The remaining proceeds are expected to be recovered in the course of the case.

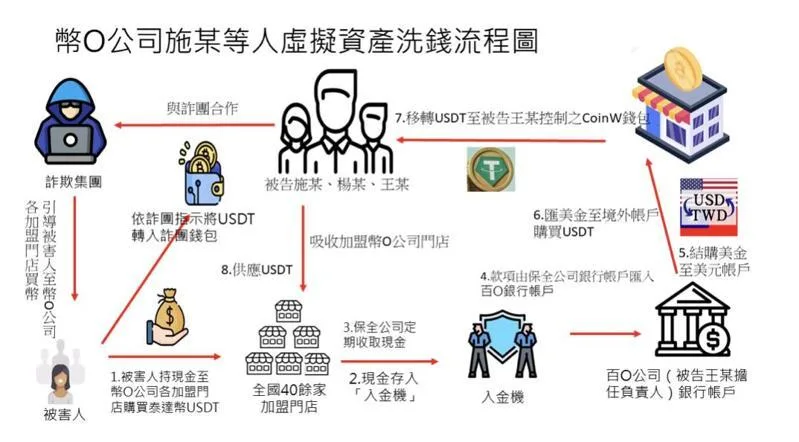

The group funneled illicit cash into foreign currency, then purchased USDT via local exchange BiXiang Technology, effectively moving millions of dollars offshore. Prosecutors released a money laundering flow chart to illustrate how funds moved through the network.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Ringleader faces 25-year sentence

The investigation began in April when the 14 suspects were arrested. Prosecutors identified Shi Qiren as the ringleader, working alongside his wife, Ms. Lin, and a manager surnamed Yang. Together, they allegedly opened 40 storefronts under the brands CoinW and CoinThink Technology Co., Ltd., collecting millions in franchise fees.

By posing as the only firm authorized by Taiwan’s Financial Supervisory Commission, the group tricked 1,539 victims into depositing cash into collection machines, believing they were engaging with a legitimate exchange. Prosecutors allege Qiren could face up to 25 years in prison if convicted, particularly due to his refusal to plead guilty.

Adding another twist, prosecutors said the group itself fell victim to a side scam, when a suspect surnamed Gu allegedly defrauded Shi out of $93,000 by falsely claiming he could secure Anti-Money Laundering registration for the operation.

Also read: Samourai wallet co-founders reverse plea to guilty in $2 billion crypto laundering case

Global context of crypto-related laundering

The indictment comes amid a string of international crypto-related fraud cases. Just days earlier, a crypto influencer was sentenced to one year in prison for laundering funds and committing wire fraud after defrauding cloud computing providers in a large-scale cryptojacking scheme.

Last month, US authorities also exposed a case involving a Russian national who laundered $530 million through US banks and crypto exchanges. That operation relied heavily on USDT to facilitate payments for Russian clients tied to sanctioned banks.