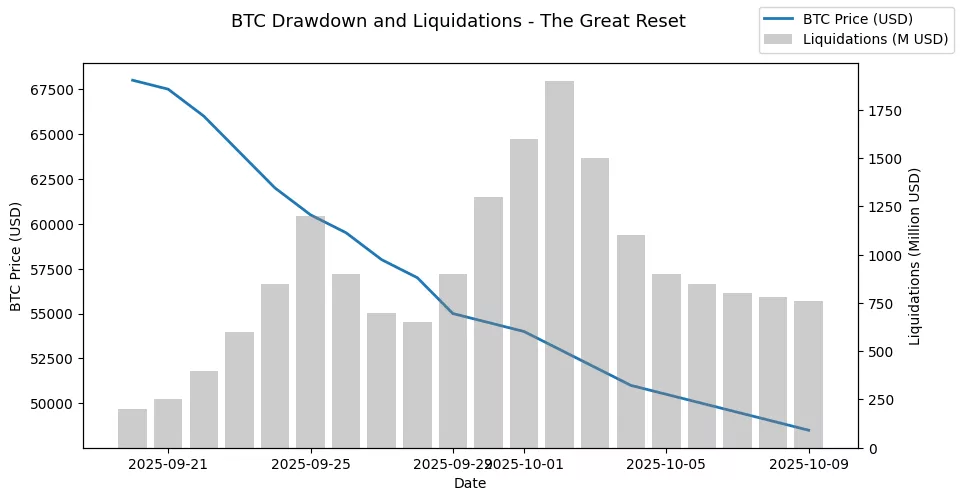

Markets rely on trust, and cryptocurrencies, more than any other asset category, flourish based on momentum and storytelling. However, in recent weeks, that assurance has broken down. Bitcoin fell beneath crucial support thresholds, Ethereum experienced a loss of billions in DeFi TVL overnight, and altcoin liquidity disappeared within hours. The crash was not merely a sell-off; it served as a stress test for the decentralized finance system itself.

Afterward, investors and developers are posing the same inquiry: how could such efficient, liquid, and transparent markets fall so suddenly? The reality is more based on structure than on psychology. From excessive leveraged derivative positions to reliance on stablecoin liquidity and centralized exchange market-making, this collapse exposed the interconnected vulnerabilities that have subtly influenced crypto’s bullish trends.

This “Great Reset” could ultimately lead to beneficial outcomes by eliminating unsustainable initiatives, reinstating logical valuations, and compelling protocols to reconsider their resilience. However, to grasp what follows, we need to analyze what truly failed.

Leverage Unwound — when speculation meets thin liquidity

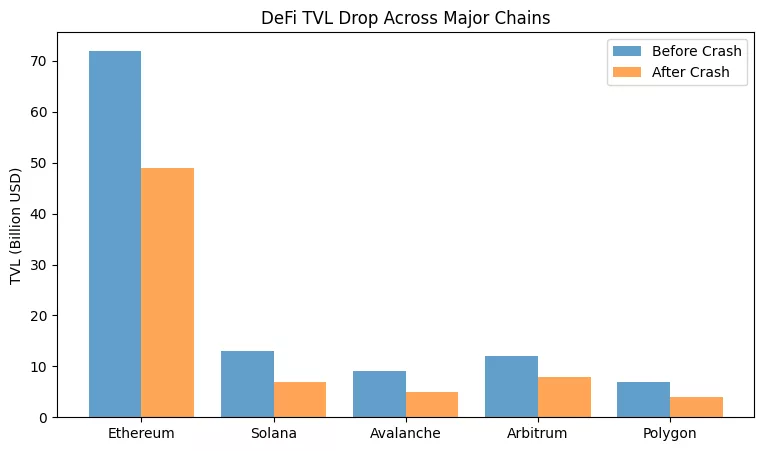

Each bull market creates concealed leverage through perpetual swaps, collateralized loans, staking derivatives, and tokenized debt instruments, enhancing both yield and risk. As Bitcoin started to drop sharply, liquidation cascades occurred on major exchanges. Funding rates turned negative, open interest dropped by 40%, and altcoins with low liquidity were devastated.

Behind the scenes, numerous DeFi positions were secured by fluctuating assets. After ETH and SOL fell beneath liquidation levels, lending protocols initiated automatic sell-offs. The system’s self-referential aspect of borrowing crypto with crypto transformed volatility into a cascading effect. Even advanced institutions encountered margin calls as wrapped tokens lost their peg and cross-chain bridges became inoperative.

This event revealed the lack of genuine circuit breakers in DeFi. Centralized markets can stop trading or provide liquidity; decentralized markets can solely liquidate. Despite its innovations, DeFi is still vulnerable when liquidity disappears. The conclusion: decentralization lacking liquidity means decentralization lacks protection.

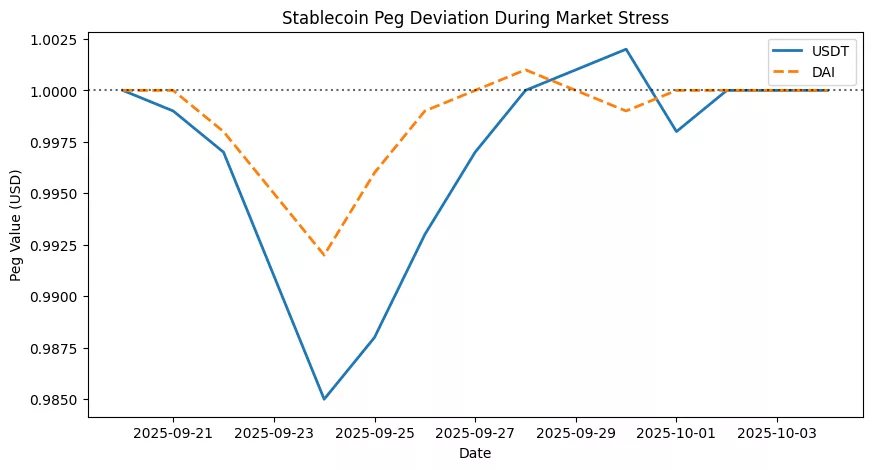

The stablecoin stress test

One of the most telling moments occurred when key stablecoins faced instability. USDT temporarily fell to $0.985 with increased trading volumes, as algorithmic and over-collateralized stablecoins experienced expanded spreads. Traders hurried into fiat gateways, attempting redemptions at an unprecedented speed.

The vulnerability of stablecoins is rooted not just in their design but also in trust and transparency. Even slight uncertainties regarding support or liquidity reserves can trigger disproportionate market responses. During this crash, it became clear that the majority of crypto liquidity in spot, derivatives, and DeFi continues to move through stablecoin pairs. A minor crack in peg trust affects the whole ecosystem.

Furthermore, stablecoin creators function as unrecognized central banks. The way they mint, redeem, and manage reserves influences global liquidity in cryptocurrency. As redemptions increase, reserves shrink, diminishing the liquidity that supports exchange depth and yield strategies. This crash served as the initial real stress evaluation for the “crypto dollar” framework, and the outcomes were revealing.

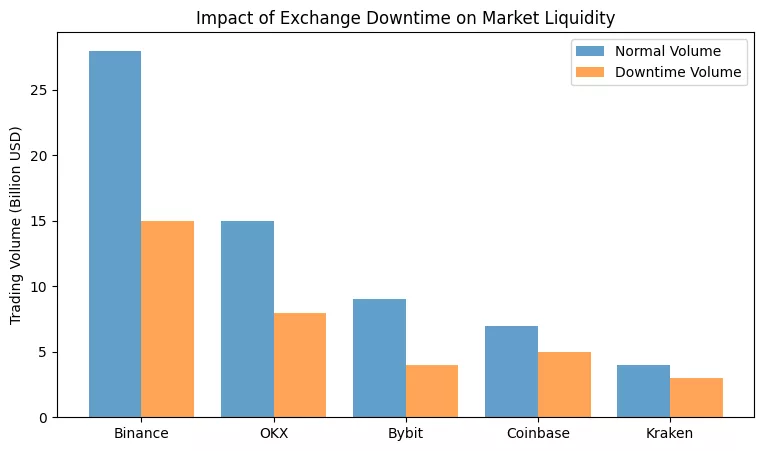

The illusion of decentralization

The market chaos revealed the extent of centralization in crypto. Liquidity suppliers, custodians, and infrastructure firms are focused within a limited number of organizations. When two primary exchanges went offline, the whole market came to a standstill. DeFi protocols dependent on oracle updates experienced setbacks, exacerbating price discrepancies.

Furthermore, “community-governed” initiatives demonstrated a sluggish response. Emergency governance decisions to modify collateral ratios or freeze assets endured hours, feeling like an eternity in volatile conditions. This highlighted the conflict between decentralization and responsiveness: the more dispersed the decision-making, the slower the management of crises.

Ironically, the same decentralization principle that fuels crypto’s innovation also amplifies systemic risk. In the absence of a last resort lender, coordination system, or liquidity support, every participant turns into both a counterparty and a transmission agent for contagion. The Great Reset has demonstrated that decentralization should progress not towards centralization, but towards resilience via protocol-level risk management, adaptive oracles, and improved governance automation.

What comes next — From fragility to anti-fragility

History indicates that every crash alters crypto’s fundamental nature. The 2014 Mount. The Gox failure led to improved custody protocols; the 2018 downturn spurred the growth of DeFi; the 2022 contagion event prompted on-chain proof-of-reserves. This recent collapse will probably lead to the advent of risk-sensitive protocol systems that incorporate circuit breakers, adaptive collateralization, and AI-enhanced liquidity routing.

Institutional participants will require transparency that extends beyond real-time stress testing of smart contracts, risk metrics across assets, and capital efficiency dashboards. Retail investors are also changing: current sentiment supports sustainability rather than hype. Builders who endure this phase will focus on protecting capital rather than increasing tokens.

The Great Reset, then, is not a conclusion but a realignment. The enduring worth of crypto is found not in its price, but in the framework it creates following each upheaval. If history repeats itself, the structures currently being reconstructed could shape the upcoming decade of digital finance.