Gold prices rose by 0.9% on the day that Israel launched a critical missile strike targeting the Natanz nuclear facility in Iran. In retaliation, Iran launched a barrage of ballistic missiles targeting Tel Aviv and Haifa, which led to the death of at least 8 people. Both countries continue their offensive.

Global markets have been volatile since, but Gold came close to hitting a $3,500 an ounce, a level that was previously seen in April. The precious metal traded in a positive range for 4 straight sessions and continues its upwards momentum, trading around $3415 levels at the time of reporting.

Source: investing.com

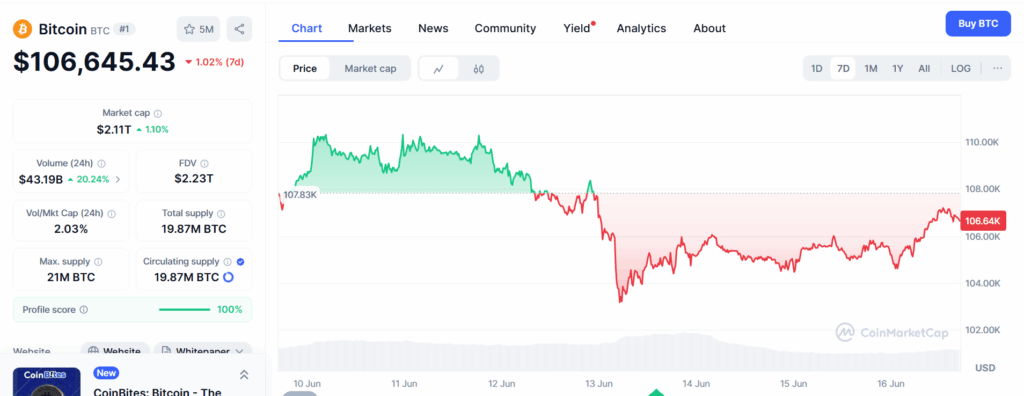

The attacks also caused a sharp reaction in the cryptocurrency market. About $1 billion worth of Bitcoin long positions got liquidated in the crypto market, with nervousness creeping up across digital assets. Given the risk-off sentiment, one would ideally see investors flee from digital assets and choose safer havens like gold, but Bitcoin managed to hold ground and didn’t buckle under pressure. On that day, Bitcoin touched a low of $103,256, shaving off 4%, but managed to climb back up to $106,900 levels since then.

Source: coinmarketcap.com

During times of conflict, investors typically choose assets that hold value over long periods, and gold has traditionally been used to hedge against such market downturns. But Bitcoin has been catching up, with its steady performance, speculators have used it successfully to store value and hedge against corrections and recessions.

Comparison in times of conflict

Let’s look at some historical data of the two asset classes- gold and bitcoin and how they have performed during conflicts. Gold has been known to go up during times of conflict or geopolitical tensions. During key events such as the Soviet invasion of Afghanistan, America’s invasion of Afghanistan, and the Russian-led invasion of Ukraine, Gold has typically spiked in price.

Source: herobullion.com

Bitcoin’s price movement typically falters and goes downwards during notable conflicts, although the asset class does not have as much data as gold to prove any clear pattern. The price of Bitcoin slid below $35,000 at the beginning of the Russia-Ukraine conflict, a drop of 8% from the previous day, as per a CNN report.

Then again, a year later, at the start of the Israel-Hamas conflict, the price of Bitcoin dipped by 1.2%, hovering above $27,000 as investors moved away from equities and parked their funds in more stable asset classes.

The experts weigh in

Prominent Bitcoin critic Peter Schiff, who has repeatedly bashed the digital asset, took to X to talk about the price movement of bitcoin and gold during the Iran-Israel skirmish and questioned why Bitcoin was considered as digital gold, when it doesn’t add up in terms of its performance.

Meanwhile, Robert Kiyosaki, the Author of Rich Dad Poor Dad, urged individuals to protect their financial futures by investing in hard assets. He sees Bitcoin as the sole reliable haven for financial security. “As I have said for years, gold and silver are ‘Gods money.” Bitcoin is “people’s money,” he tweeted.

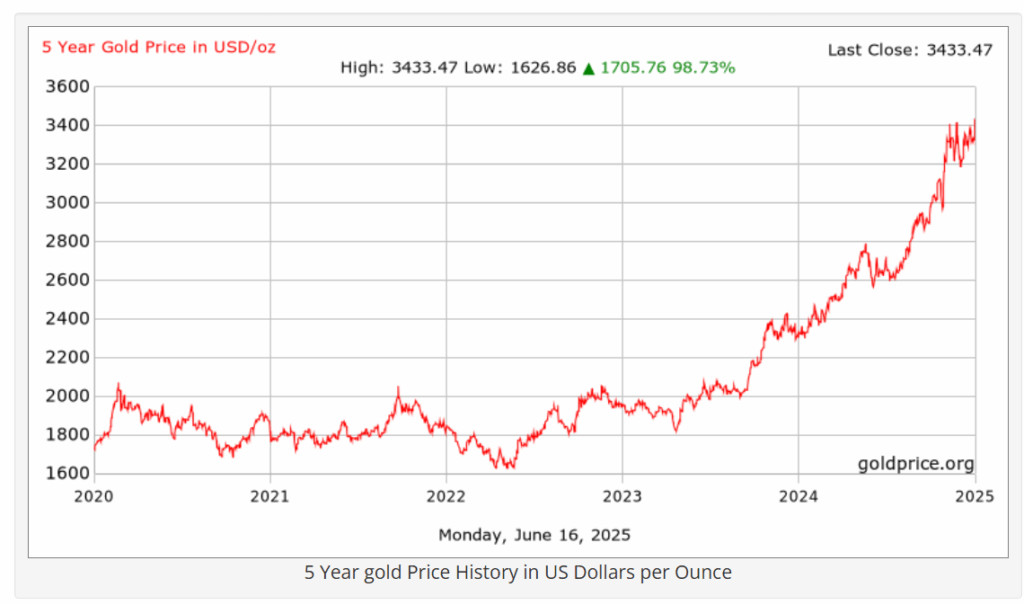

For more perspective, the 5-year price charts of Bitcoin and gold are listed below, reflecting the difference in price fluctuations between the two asset classes. Giving investors a 98.73% return, gold seems to have moved from $1626/oz levels to $3433/oz, whereas Bitcoin has grown exponentially in these 5 years, giving investors a 1,020.42% return.

Source: goldprice.org

Source: coinmarketcap.com

One can safely conclude that during the escalation of conflict, the utility of Bitcoin as an asset in portfolios may start to mimic gold. Both Bitcoin and Gold offer unique advantages as potential safe havens, but the right choice ultimately depends on an investor’s risk appetite, time horizon, and belief in traditional versus digital assets.