US Internal Revenue Service has appointed veteran insider Trish Turner amid leadership shakeup post two key crypto leaders departing.

Trish Turner, a 20-year IRS veteran and former senior adviser in the Digital Assets Office, has been appointed to lead the agency’s digital assets division following the abrupt exits of two top crypto-focused executives.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Turner’s elevation marks a return to internal leadership at a time of uncertainty and shifting policy, as IRS grapples with mounting pressure to regulate the fast-evolving cryptocurrency space.

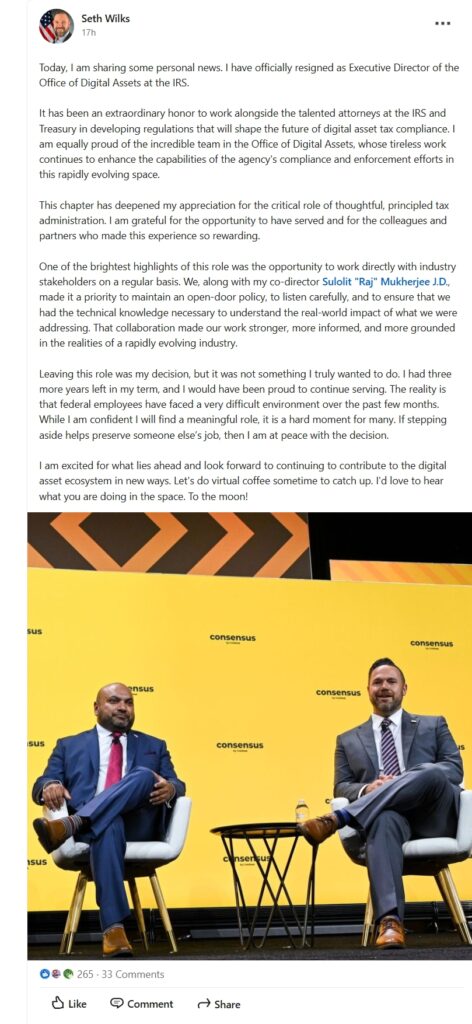

The departure of Sulolit “Raj” Mukherjee and Seth Wilks—private-sector experts brought in to steer crypto strategy—signals turbulence within the IRS’s digital assets unit. Both resigned on May 5 after just a year on the job. Mukherjee had overseen compliance and implementation, while Wilks led strategy and development. Wilks, in a reflective LinkedIn post, hinted at broader internal strains, writing, “If stepping aside helps preserve someone else’s job, then I am at peace with the decision.”

Turner’s extensive institutional IRS experience is expected to offer continuity and stability as the agency intensifies investigation of cryptocurrency transactions, moving aggressively ahead with audits and criminal investigations.

With the Trump administration back in power, federal agencies are scaling back regulations perceived, “stifling” to digital asset innovation.

In this sense, Turner steps in at a pivotal time for both IRS and the broader regulatory landscape surrounding crypto. Her navigation of tension between enforcement and innovation is said to shape the IRS’s role in digital finance for years to come.

The IRS has intensified its focus on cryptocurrency over the past few years, increasing audits and criminal investigations of digital asset transactions.

It also aimed to impose broad crypto broker reporting requirements, which drew intense backlash from industry participants. These were however later withdrawn by President Donald Trump.