- Avalanche sees 66% surge in transactions, with 11.9 million transactions and 181,000 active addresses in the past week

- DeFi trading and whale speculation on DEXs are the primary drivers of blockchain activity

- Trader Joe DEX and Benqi Protocol are key players in Avalanche’s growing blockchain ecosystem

Avalanche, a smart contract blockchain, has witnessed a remarkable surge in blockchain activity, driven by growing decentralized finance (DeFi) trading and increasing speculation from large crypto investors.

Avalanche’s transactions grew by 66% in the past week, reaching 11.9 million transactions across over 181,000 active addresses. This surge indicates growing investor interest and attention on the blockchain, with decentralized exchanges (DEXs) and memecoin speculation being key contributors.

The milestone follows a landmark adoption by the US Department of Commerce, which included Avalanche among nine other public decentralized blockchains used to publish the country’s real GDP data, as reported by Cointelegraph on August 29.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

However, a research analyst at Nansen, cautioned that despite the growing institutional and governmental adoption of Avalanche, the transaction surge cannot be solely attributed to the government’s adoption for GDP purposes.

Source: Nansen

DeFi and whale speculation driving the growth

Nansen’s analysts attribute Avalanche’s transaction growth to three key drivers: DeFi traders, miner extractable value (MEV) trading bots, and whales speculating on the next emerging memecoin.

The transaction surge is driven by: 60% DeFi protocol activity (Trader Joe, Aave, Benqi), 25% automated trading bots and MEV, and 10% whale trading and memecoin speculation, Sondergaard told Cointelegraph. He added that 5% of the activity is linked to blockchain gaming and non-fungible tokens (NFTs).

Decentralized exchanges and whales lead the charge

Most of the blockchain activity on Avalanche is attributed to cryptocurrency trading on decentralized exchanges (DEXs), with Trader Joe DEX acting as the primary driver. The platform recorded over $333 million in Avalanche Wrapped Ether (WETH.e) trading volume in the past week.

Whales, identified as high-balance traders on Nansen’s top 100 leaderboard, have been driving this surge, making significant six-figure trades. Meanwhile, Aave, a lending protocol, has also contributed to the activity with $624,000 in flash loan transactions facilitated through DEX aggregators.

The Benqi Protocol has gained significant traction, receiving over $650,000 in deposits from cryptocurrency trading bots. Additionally, automated trading bots and high-balance whale addresses have contributed to a $14 million trading volume in the Black (BLACK) token, with some whale addresses amassing up to $95,000 worth of tokens.

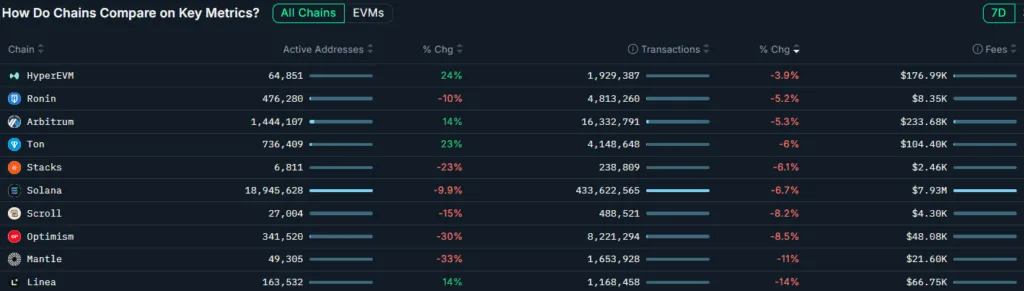

In comparison, Solana, one of Avalanche’s competitors, saw a 6.7% decline in weekly transactions, registering 433 million transactions across 18.9 million active addresses. Like Avalanche, DEX trading was the dominant force behind Solana’s blockchain activity, with Raydium DEX leading the way.