- BlackRock’s crypto ETF inflows rose from $3B in Q1 to $14B in Q2, up 366%

- Crypto now accounts for 16.5% of total ETF inflows, up from 2.8% in Q1

- Despite crypto growth, overall inflows fell 19% due to a large institutional redemption

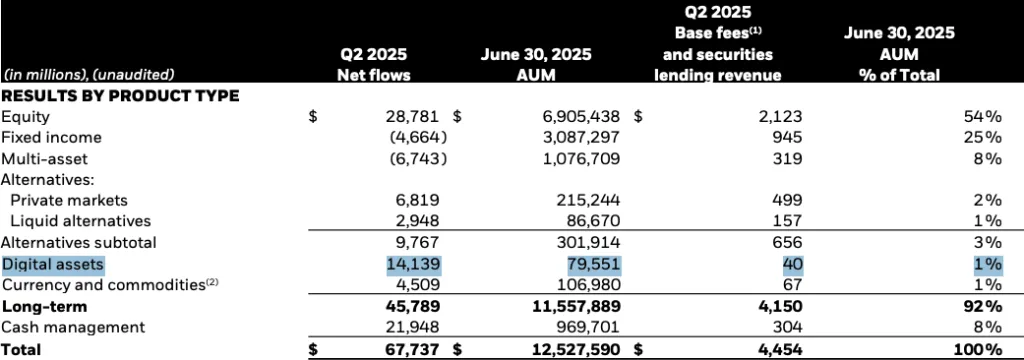

BlackRock, the world’s largest asset manager with $11.5 trillion in AUM, saw a significant increase in crypto-related activity in Q2 2025, according to its earnings report released Tuesday.

Inflows into BlackRock’s iShares crypto ETFs surged to $14 billion, up from $3 billion in Q1, marking a 366% increase. The crypto segment accounted for 16.5% of all ETF inflows, up sharply from just 2.8% the previous quarter.

At the same time, BlackRock’s total net inflows dropped 19%, falling from $84 billion in Q1 to $68 billion in Q2, a decline the firm attributed to a “$52 billion partial redemption” by a single institutional client from a lower-fee index product.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Source: BlackRock

Digital assets still small, but growing in revenue impact

As of June 30, digital assets contributed $40 million in base fees, accounting for about 1% of BlackRock’s long-term revenue. This represents an 18% increase from $34 million in Q1.

While digital assets account for just 1% of base fees, their rapid growth signals increasing revenue contribution potential.

Digital assets key to new investor generation

BlackRock firm’s broader success in attracting new capital through innovation and global reach.

iShares ETFs had a record first half in flows, and technology ACV growth reached a fresh high of 16%. Attracting new and increasingly global generation of investors through things like digital assets offerings and recently launched funds in India through joint venture Jio BlackRock.

The firm’s Q2 results underscore a shift in focus toward digital and emerging market strategies, even as broader inflow figures reflect temporary institutional rebalancing.