With the Financial Services Commission (FSC) drafting a government bill that is anticipated to be presented to the National Assembly in October, South Korea is getting closer to implementing a stablecoin legal framework. As part of the second phase of the Virtual Asset User Protection Act, the next proposal will establish guidelines for stablecoin issuance, collateral management, and internal control systems.

Democratic Party Representative Park Min-kyu disclosed during a policy discussion that he had received a briefing on the FSC’s stablecoin regulation path, according to local publication MoneyToday. The government law would be available in the upcoming months, he affirmed. Through its virtual asset committee, the FSC has been developing the framework since 2023 in an attempt to give the nation’s crypto service providers more precise guidelines.

Reducing reliance on dollar-pegged Stablecoins

The new framework coincides with an increase in interest in stablecoin laws around the world. South Korea is advancing its own won-pegged alternative to lessen dependency on the US currency, even as the US steps up measures to control dollar-backed stablecoins.

Since President Lee Jae-myung promised support during his campaign, the notion has gained traction. Since then, lawmakers have put forth a number of proposals, such as Representative Min Byung-deok’s Digital Asset Basic Act, Representative Ahn Do-gul’s Act on the Issuance and Circulation of Value-Stable Digital Assets, and Representative Kim Eun-hye’s Act on Payment Innovation Using Value-Pegged Digital Assets.

The financial industry in South Korea is advancing as well. To defend the Korean currency against the growing dominance of the dollar, key domestic banks said in June that they will work together to develop a won-pegged stablecoin, which is anticipated to emerge by late 2025 or early 2026.

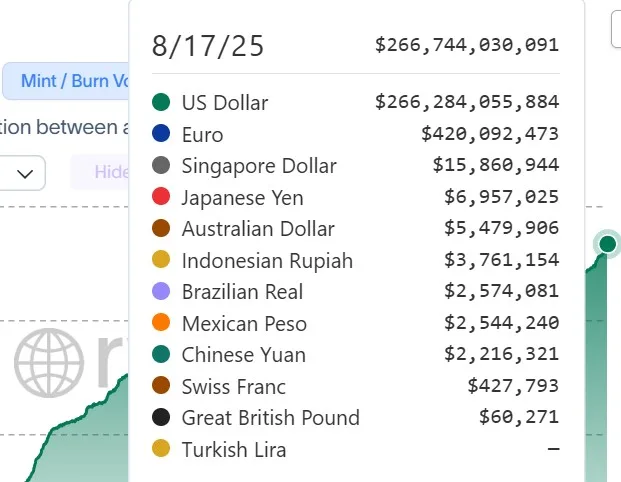

The importance of diversity is underscored by the fact that, according to RWA.xyz, dollar-based tokens hold 99.8% ($266.3 billion) of the $266.7 billion worldwide stablecoin market.

Also read: Companies plan stablecoins under new law, but experts say hurdles remain

South Korea clamps down on tax evaders

South Korea has strengthened enforcement against tax avoidance involving digital assets in conjunction with the regulatory rollout. Nearly 3,000 people who owed a total of $14.2 million in arrears had their cryptocurrency holdings frozen and seized by Jeju City tax authorities on Monday.

The crackdown highlights the government’s two-pronged strategy, which aims to ensure compliance with current tax regulations while creating a controlled framework for digital assets.