- CEA Industries’ stock surged 566% in five days after revealing a $1.25B plan to become the largest publicly traded BNB treasury firm in the U.S.

- The deal is backed by 10X Capital and YZi Labs, a firm previously associated with Binance co-founder Changpeng Zhao.

- CEA plans to acquire BNB, stake, lend, and offer traditional investors a regulated way to access the BNB Chain ecosystem.

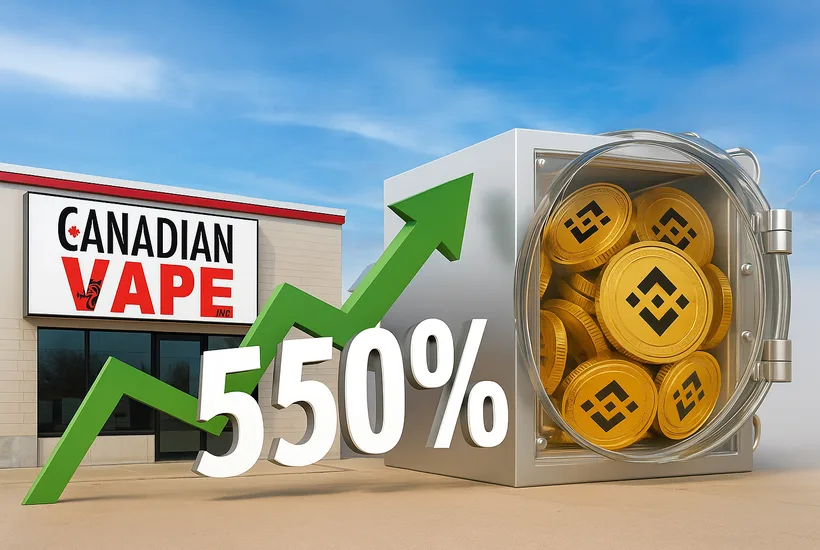

CEA Industries Inc. saw its shares skyrocket by over 550% after revealing plans to become the largest publicly traded BNB treasury company in the U.S. The initiative is backed by investment firm 10X Capital and YZi Labs — a company that previously branded itself as the family office of Binance co-founder Changpeng Zhao.

In a statement on Monday, incoming CEA CEO David Namdar — also a senior partner at 10X Capital and former co-head of trading at Galaxy Digital — emphasized the project’s role in bridging institutional capital with the BNB Chain ecosystem.

“By creating a U.S.-listed treasury vehicle, we are opening the door for traditional investors to participate in a transparent way,” said Namdar. “BNB Chain is one of the most widely used blockchain ecosystems globally, yet institutional access has been limited until now.”

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

CEA Industries plans to grow its BNB holdings over the next two years through additional at-the-market offerings and other treasury strategies, including staking and lending.

CEA Industries Inc. jumped from $8.88 to $57.59 on July 25, 2025, after announcing its $1.25B pivot into a BNB treasury firm.

Binance and BNB: deep ties

BNB remains deeply connected to Binance, which launched the token and its blockchain in 2017. Despite Binance no longer managing the BNB Chain directly, investors still view BNB as a proxy for exposure to the Binance ecosystem. In February 2025, Zhao disclosed that 98.5% of his crypto portfolio was held in BNB. As of mid-2024, a report by Forbes stated that Zhao and Binance controlled approximately 71% of the total circulating supply of BNB.

Although Zhao is now legally prohibited from managing Binance — following his plea deal with U.S. authorities over money laundering charges — he remains the platform’s largest shareholder and a central figure in the broader BNB narrative.

CEA Industries also confirmed that multiple 10X Capital executives will take over key roles at the company. David Namdar will become CEO, Russell Read will serve as Chief Investment Officer, and Saad Naja, formerly of Kraken, will also join the leadership team.

Earlier in June, CEA Industries expanded into Canada’s nicotine vape market by acquiring Fat Panda, a prominent vape retailer and manufacturer. Monday’s announcement marks the firm’s most dramatic shift yet — from a vape-focused business to a digital asset treasury vehicle tied to one of crypto’s most prominent ecosystems.