-

The Bitcoin holdings of treasury firms reached a record 840,000 BTC this year, with Strategy controlling more than three-quarters of the total.

-

Accumulation slowed sharply in August, with Strategy’s purchases dropping from a 14,000 BTC peak to 1,200 BTC, while other firms cut buying by 86%.

-

Bitcoin itself has cooled, falling over 10% from its mid-August high to around $111,200, fueling concerns that the treasury boom may face turbulence.

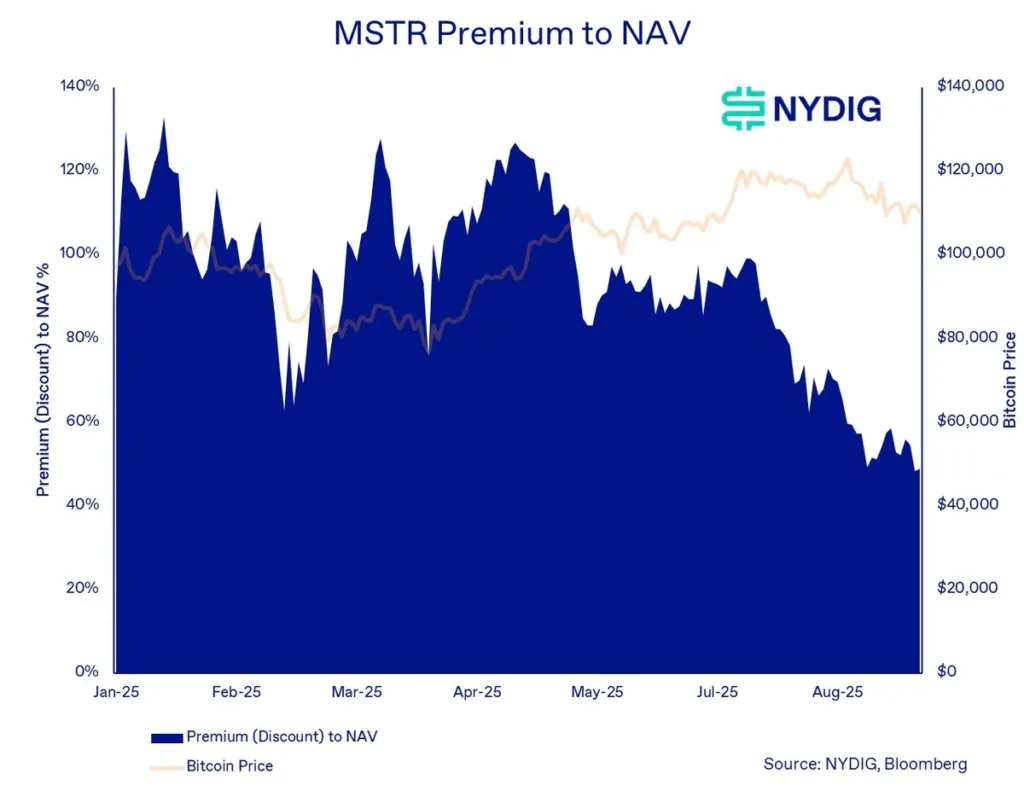

The premium gap between share prices and underlying asset values of Bitcoin treasury companies is tightening, raising concerns of heightened volatility in the sector. According to New York Digital Investment Group (NYDIG), the trend may accelerate unless firms implement corrective measures such as buyback programs.

Greg Cipolaro, NYDIG’s global head of research, noted that the compression between stock price and net asset value has persisted even as Bitcoin trades near record highs above $111,000. He pointed to a combination of investor anxiety over forthcoming supply unlocks, shifting corporate objectives, increased share issuance, profit-taking, and a lack of differentiation among treasury strategies as drivers behind the trend. “The forces behind this compression appear to be varied,” Cipolaro explained, warning of a “bumpy ride” ahead as several firms prepare for financing deals or public listings that could unleash a substantial wave of selling from existing shareholders.

The warning comes as crypto treasury firms businesses that hold Bitcoin as part of their balance sheet strategy have become increasingly popular on Wall Street. Investors use the premium or discount to net asset value as a key health indicator, comparing stock prices to the value of the digital assets held. Companies such as KindlyMD and Twenty One Capital are already trading at or below the value of recent fundraises, raising the risk that prices could fall further once shares become freely tradeable. Cipolaro emphasized that share buybacks could be the most effective tool to stabilize valuations, recommending that firms retain some of the capital raised specifically for this purpose.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

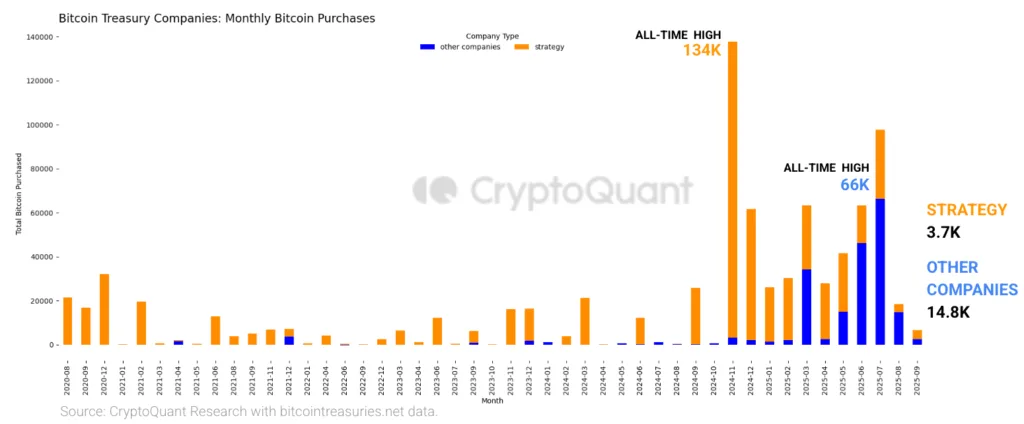

Treasury growth slows as Bitcoin momentum fades

At the same time, the Bitcoin holdings of treasury firms have hit new highs this year, collectively reaching 840,000 BTC, according to CryptoQuant. Strategy remains the dominant player, controlling approximately 637,000 BTC or 76% of the total while 32 other companies account for the remainder. Despite the milestone, the pace of accumulation slowed in August, with Strategy’s average purchase size dropping to 1,200 BTC compared to its 2025 peak of 14,000 BTC. Other firms also reduced their exposure, acquiring 86% less Bitcoin than their March high of 2,400 BTC.

The deceleration in purchases has led to weaker growth in holdings. Strategy’s monthly growth rate fell to just 5% in August, down from 44% at the end of 2024. Other companies grew their holdings by only 8% last month compared to a surge of 163% earlier this year. This cooling trend underscores the fragility of the current treasury boom, where appetite for large-scale purchases appears to be waning even as Bitcoin remains near all-time highs.

Bitcoin itself has also shown signs of cooling momentum. The cryptocurrency is trading around $111,200 after falling more than 10% from its mid-August peak of $124,000, according to CoinGecko. With compressed premiums, slowing purchases, and increased uncertainty in public markets, analysts suggest the treasury boom may be entering a more turbulent phase.