- Neural networks have transformed from an experiment in decentralized finance to a crucial element of risk management.

- Conventional risk models such as VaR and Monte Carlo are inadequate for addressing the speed, transparency, and composability of DeFi.

- LSTMs, CNNs, and Transformer architectures are currently predicting defaults, liquidity shortages, and systemic disruptions.

- Protocols like Aave and Compound are testing AI-based collateral modifications and predicting liquidations.

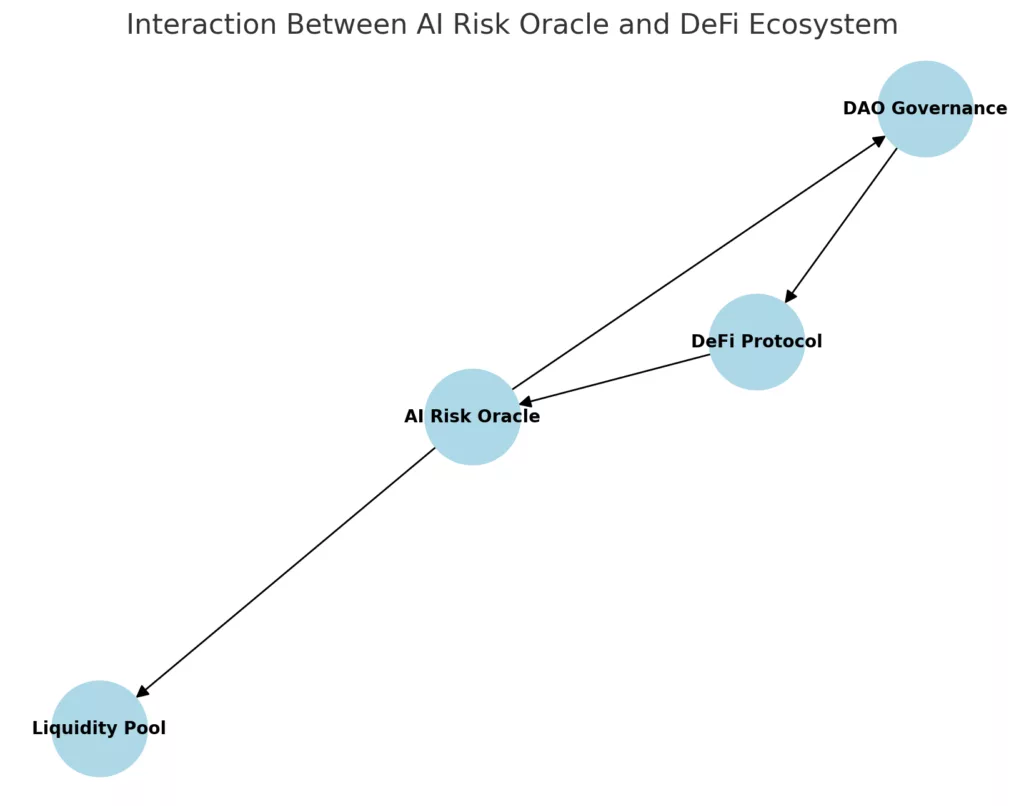

- The upcoming advancement is AI-driven risk oracles, delivering real-time risk assessments straight into DAOs and governance frameworks.

The worlds of artificial intelligence and decentralized finance are colliding in ways that could redefine the very foundation of risk management. For years, DeFi has been synonymous with opportunity and innovation, but also with constant vulnerability. Protocol hacks, liquidity cascades, and sudden oracle failures have left investors and developers struggling to keep up with the pace of risk. Traditional financial models like Value-at-Risk and Monte Carlo simulations were never designed for the speed, transparency, and composability of blockchain systems. Today, neural networks are beginning to fill that gap, stepping in not as supporting tools, but as engines that could transform DeFi’s survival strategy.

The DeFi risk dilemma

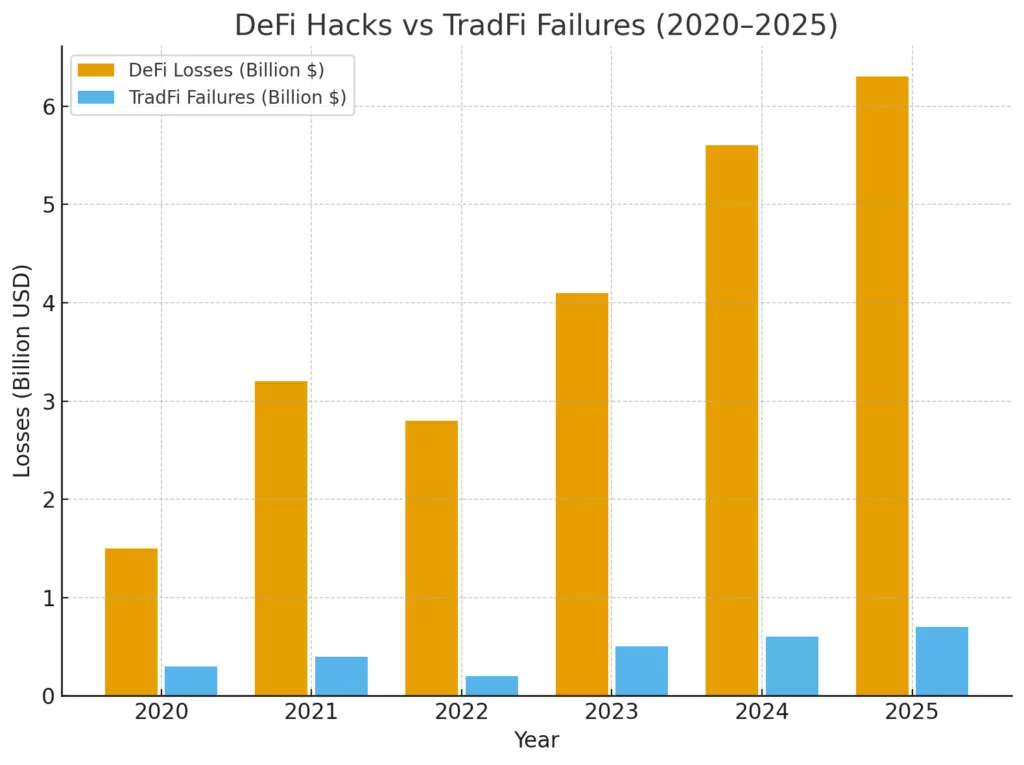

Decentralized finance flourishes through transparency, yet that transparency incurs a price. Each new lending pool, governance token, or liquidity farm brings new risks. Protocols such as Aave and Compound encounter borrower defaults that conventional credit models are unable to predict. Automated market makers can fail due to liquidity shocks that propagate through various protocols in moments. Governance can also be distorted through flash loans and inadequately constructed voting systems. Within just one year, billions of dollars have been lost to exploits that regulators, auditors, and developers did not anticipate. What DeFi requires is a novel type of intelligence, capable of learning from the infinite patterns of on-chain data and adjusting to unforeseen disruptions. Neural networks, capable of uncovering hidden patterns in chaotic time series, are becoming that intelligence.

Source:Generated with Python,DeFi’s risk profile diverges dramatically from traditional finance.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Neural networks enter the scene

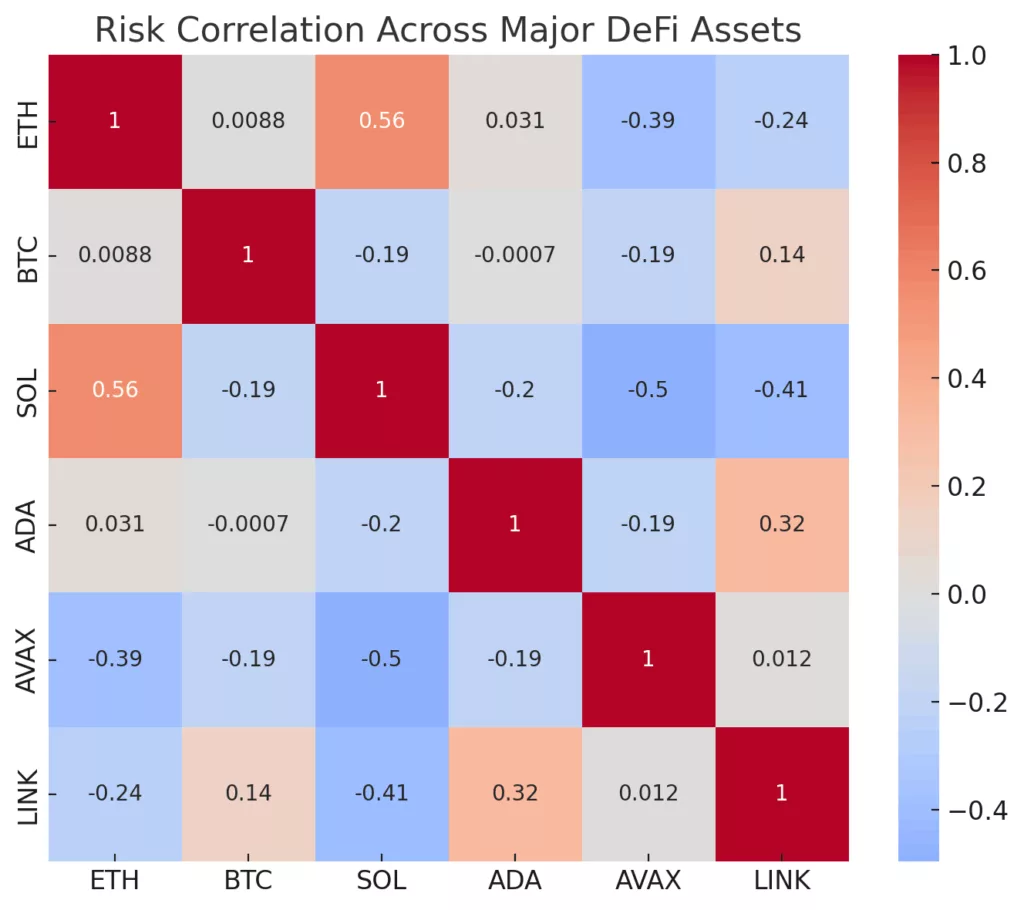

The transformation starts with information. In contrast to traditional markets, DeFi provides an instantaneous update of all transactions, liquidations, and governance votes. Neural networks can flourish in this setting. Long Short-Term Memory networks, which were initially created for sequence prediction such as language, are now utilized to anticipate lending defaults or unexpected liquidity crises. Convolutional Neural Networks can convert price charts into images, detecting volatility spikes that are not visible to humans. Transformer models, which transformed natural language processing, are being restructured to track multivariate risk factors across linked DeFi protocols. In essence, this implies that neural networks can forecast when a lending pool faces the threat of cascade liquidations or when an automated market maker might lose its peg.

Case studies: Where AI meets DeFi

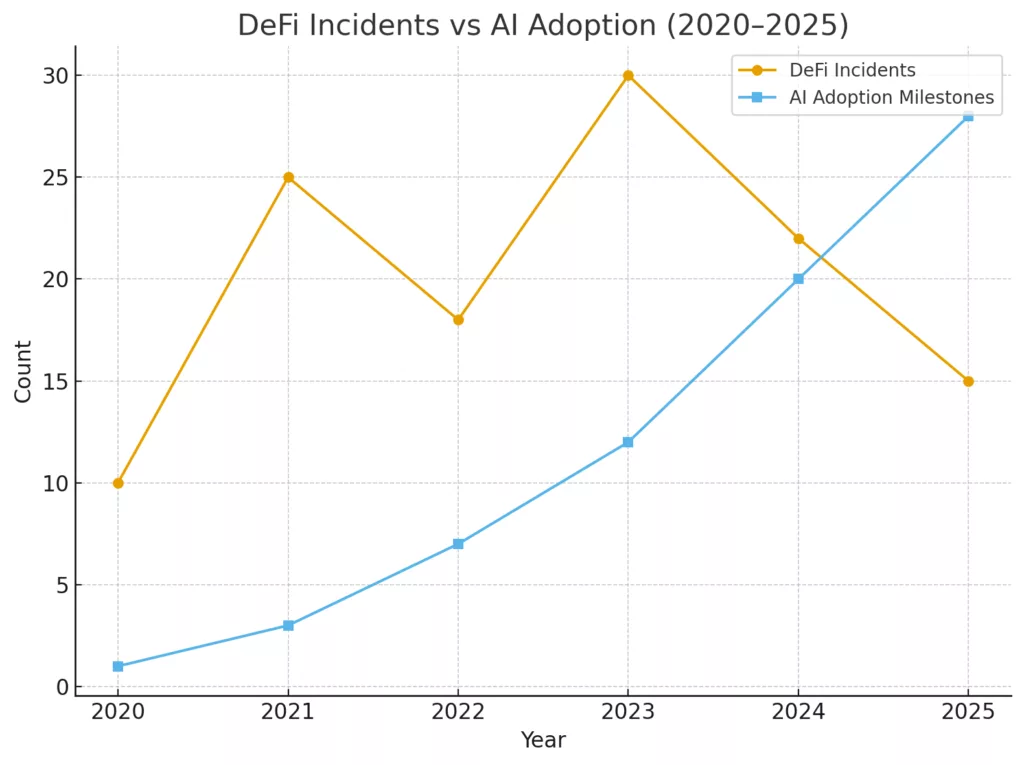

This is no longer a concept. Protocols are currently testing machine learning to strengthen their risk models. Aave and Compound are investigating neural forecasting to flexibly modify collateral ratios prior to defaults escalating. Decentralized exchanges and aggregators utilize AI to enhance routing, reduce slippage, and safeguard liquidity. On-chain insurers are utilizing anomaly detection to identify exploit patterns that might deplete treasuries. Even organizations are taking notice. JPMorgan’s Onyx system and BlackRock’s Aladdin have demonstrated the effectiveness of machine learning in analyzing portfolio risk. DeFi, due to its distinct data granularities, could be in an even better stance to employ neural networks as immediate defenses against systemic failure.

The dark side of AI in DeFi

However, the resolution introduces fresh challenges. Neural networks are famously unclear. They are frequently referred to as black boxes, producing predictions without transparent justifications. In an environment founded on transparency, this presents a significant cultural and governance obstacle. The issue of limited data availability also exists. Although DeFi generates vast quantities of raw data, a significant portion of it pertains to uncommon or extreme occurrences. Models are prone to overfitting, forecasting the previous crisis rather than the upcoming one. The contradiction is evident: DeFi aims for systems that require no trust and are verifiable, yet its most effective safeguards may be those that are difficult for most to understand or evaluate. This brings up troubling issues for DAOs tasked with overseeing protocols informed by AI suggestions.

The future: AI-powered risk oracles

Nevertheless, the momentum is unmistakable. It’s easy to envision the future of DeFi infrastructure featuring AI-driven risk oracles. These would operate like current price oracles, but rather than providing ETH/USD rates, they would consistently deliver risk scores for lending pools, liquidity vaults, or governance proposals. DAOs might vote to modify collateral ratios, rebalance treasuries, or suspend liquidity incentives informed by the signals from these neural networks. Just as Chainlink established price data as a foundation of DeFi, neural oracles could serve as the cornerstone for DeFi risk management. At that moment, the connection between AI and DeFi would transition from being experimental to being crucial.