- Cryptocurrency as Economic Framework – Digital currencies go beyond speculation, providing a global financial system grounded in transparency, scarcity, and accessibility.

- From Inflation to Innovation – In countries where fiat currency collapses, stablecoins and Bitcoin offer liquidity along with enduring value stability.

- DeFi as the New Financial System – Decentralized finance transforms access into a fundamental right, enabling billions neglected by traditional banking.

- Blockchain for Accountability – Unchangeable records enhance transparency in governance, converting corruption into identifiable data.

- The Upcoming Economic Renaissance – The merging of AI, blockchain, and tokenized assets signifies the transition to programmable, borderless economies

The economic crisis of trust

Every significant financial crisis, from the Great Depression to contemporary hyperinflation, shares a common factor: the breakdown of trust. Confidence in governments to safeguard currency worth. Rely on banks to protect your savings. Confidence in organizations to allocate resources equitably. However, as debt rises, currencies diminish in value, and international systems stay ineffective, the worldwide financial framework exhibits indications of serious disintegration.

At the core of the current economic upheaval exists a contradiction. The world is wealthier than ever before, but also more unequal. Technology has progressed more quickly than governance. Billions continue to exist outside the established financial system, as trillions of dollars move in speculative markets disconnected from actual production. It’s a world where money is present, but opportunities are lacking.

Cryptocurrency arose from this split not as a mere speculative trend, but as an answer to systemic collapse. When the genesis block of Bitcoin included the message “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks,” it served more than simply as a timestamp. It was a statement of autonomy. A declaration that humanity might, for the first occasion, create a financial system free from reliance on politicians, central banks, or Wall Street.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Fifteen years on, this concept has evolved into a system of programmable, borderless, and transparent economies. From stablecoins supporting countries in distress to DeFi platforms providing yield and lending independent of traditional banks, the crypto sector has transformed into an experimental space for addressing long-standing economic shortcomings.

This aspect examines how cryptocurrency is not just a new category of assets but also a framework for transforming global finance. It explores how digital currencies can tackle global economic issues ranging from inflation and inefficiencies in remittances to corruption, inequality, and social exclusion. The aim isn’t to glamorize crypto, but to analyze its true potential to transform the dynamics of money, value, and trust in a globalized economy.

A broken global financial architecture

In spite of the appearance of globalization, the financial system continues to be divided, antiquated, and skewed in favor of centers of power. The World Bank states that the average cost of transferring money internationally is 6.4% for each transaction. In certain African or Middle-Eastern routes, fees exceed 10%, resulting in migrant workers forfeiting billions in remittance expenses annually funds that could elevate families from poverty.

At a broader scale, $1.2 trillion in remittance transactions, $4 trillion in daily foreign exchange trading, and $350 trillion in worldwide debt rely on centralized intermediaries each introducing additional friction, expenses, and lack of transparency. Advanced economies face challenges too: SWIFT transactions still require 2–5 days; correspondent banks impose compliance fees that exclude smaller entities; and the devaluation of fiat currency discreetly shifts wealth from savers to governments.

This inequality is not solely technical; it is also ethical. The financial system was created for the 20th century but functions in a 21st-century environment of rapid information and worldwide movement. The outcome is exclusion: 1.7 billion adults lack bank access, while others experience inflation so extreme that their savings disappear suddenly.

Cryptocurrency emerges in this turmoil not as a separate realm, but as an alternative structure a system founded on transparency, speed, and mathematical scarcity instead of reliance on institutions that have consistently let us down.

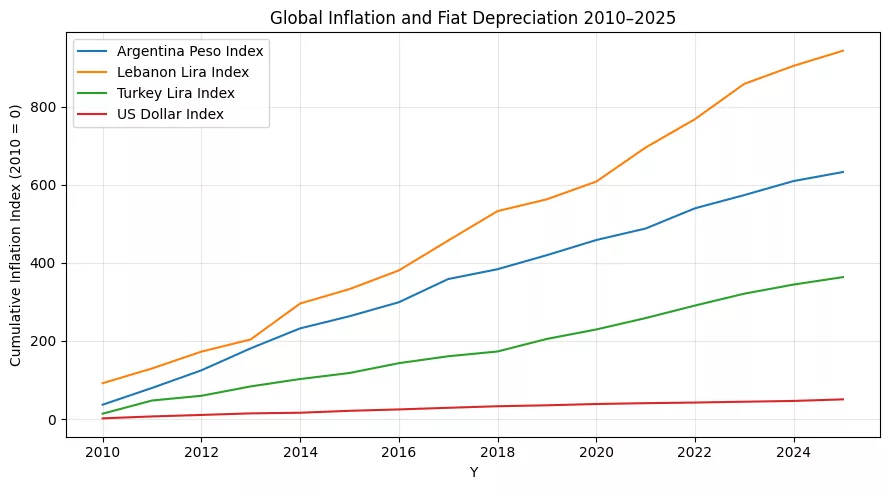

Source:Generated with Python,cumulative inflation patterns show that emerging-market currencies like the Lebanese lira, Argentine peso, and Turkish lira have depreciated significantly more compared to the U.S. dollar since 2010, highlighting the vulnerability of the global fiat system.

Borderless value transfer – The core of the crypto revolution

The real strength of cryptocurrency is found not in speculation, but in its capacity to transfer value without needing approval. In a world where moving $1,000 from Lagos to Beirut can take days and incur fees over 10%, cryptocurrency removes the obstacles that have characterized international finance for ages.

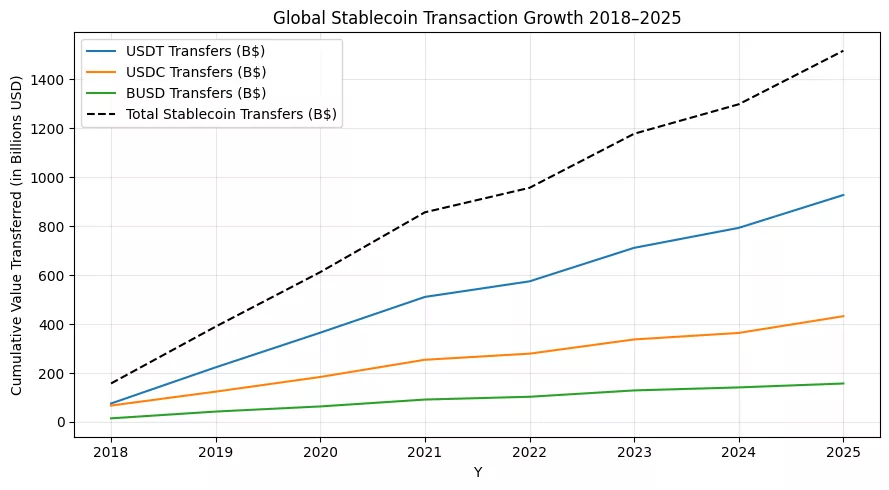

Traditional finance depends on intermediaries such as banks, payment processors, and correspondent networks that serve as gatekeepers between economies. Every member in this chain contributes to increased costs, delays, and risks. In contrast, cryptocurrency substitutes trust with verification, enabling peer-to-peer transactions internationally in seconds. A transaction on the Lightning Network can be confirmed in less than two seconds with minimal fees, and in emerging markets, stablecoins such as USDT and USDC are now utilized more frequently than even local currencies.

Use Argentina and Nigeria as illustrations. In both countries, citizens are increasingly depending on stablecoins as an alternative to ineffective national currencies. In Nigeria, the naira’s plunge in the black market boosted the use of USDT on peer-to-peer platforms such as Binance and Paxful. In Argentina, freelancers and small enterprises now embrace cryptocurrency payments in stablecoins to avoid the peso’s instability and governmental limitations.

The figures are remarkable: Chainalysis reveals that more than $600 billion in stablecoin value was exchanged worldwide in 2024, with developing countries at the forefront of transaction volume. For the first time ever, people in countries facing inflation can make global transactions in digital dollars without needing a bank account, applying for credit, or waiting for international wire transfers to clear.

This is not just financial progress; it’s economic freedom. Transfer of value without borders allows wealth to flow at internet speed. It breaks down geographic advantages and reallocates access to opportunities, allowing for a universal financial language where all can engage equally.

The inflation hedge and digital gold standard

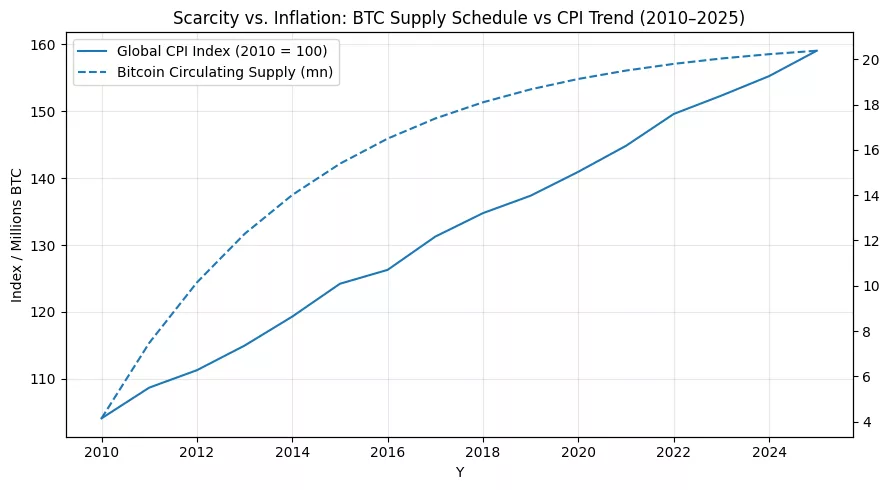

For many around the globe, inflation isn’t just news; it’s a constant burden on their existence. When a currency fails, the banking system acts as a conveyor belt transferring purchasing power from savers to the government. Bitcoin’s counter-design features a capped supply of 21 million, consistent issuance, and open custody, providing a savings option that is unaffected by political issues and geographical boundaries. It’s not flawless currency; it’s reliable currency in an environment of policy unpredictability.

The comparison of “digital gold” goes beyond mere marketing. Similar to gold, Bitcoin is limited, worldwide, and owned by the holder. In contrast to gold, it can be divided into eight decimal places, transfers at nearly no additional cost, and finalizes without requiring trusted third parties. This blend of scarcity and immediate settlement renders Bitcoin particularly well-suited as a long-term safeguard against currency debasement, especially in economies where access to USD savings is limited or trust in banking has deteriorated.

Stablecoins address spending needs; Bitcoin addresses saving needs. In environments of high inflation, households frequently utilize a dual-asset approach: maintain daily liquidity in stablecoins and preserve long-term value in BTC. On-chain data consistently indicates that coins held for over a year (“long-term holder supply”) rise after macro shocks, highlighting BTC’s function as a last-resort safety asset. In the meantime, self-custody removes counterparty risk, transferring the center of trust from institutions to cryptographic methods.

Critics highlight instability, and they’re correct in the immediate term. Volatility is the cost of monetization: as acceptance grows and liquidity expands (ETFs, institutional reserves, worldwide exchanges), prolonged drawdowns decrease while fresh cyclical peaks create an upward floor. The overarching narrative is straightforward: traditional currencies are designed for flexibility; Bitcoin is designed for limited supply. When inflation, capital restrictions, or banking turmoil occur, that engineering distinction turns into a lifeline.

Financial inclusion and DeFi empowerment

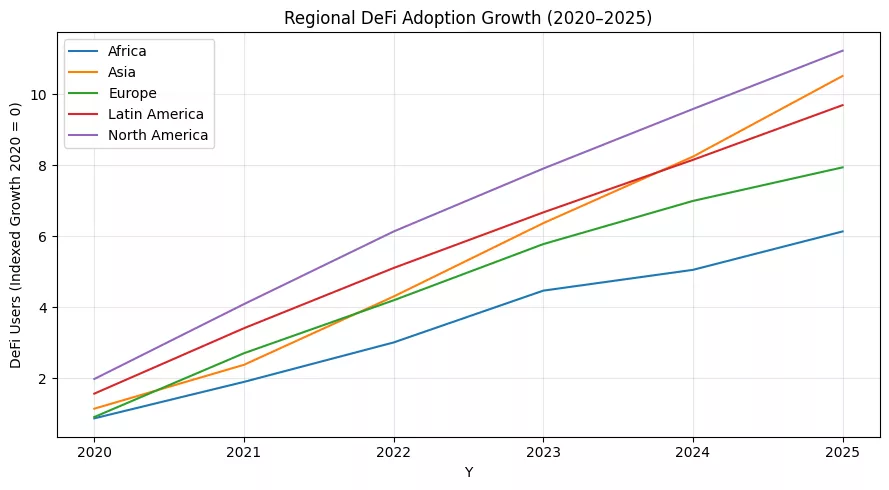

For many years, obtaining financing has relied on location, paperwork, and social standing. Living in a country with weak banking infrastructure would automatically limit your economic potential. Without collateral, borrowing was impossible. If you received payments in a depreciating currency, your savings dwindled quicker than you could accumulate. This widespread exclusion has resulted in 1.7 billion adults lacking banking access, a quiet inequality that cryptocurrency directly confronts.

Decentralized Finance (DeFi) transforms the concept of “possessing a bank account.” Using just a basic smartphone and internet access, individuals can lend, borrow, save, or invest worldwide without needing to visit a branch. Smart contracts enforce agreements on their own, eliminating the need for human intermediaries and substituting bureaucracy with clarity.

Platforms such as Aave, Compound, and Uniswap are not merely speculative gambling sites; they function as decentralized liquidity engines enabling users to borrow stablecoins by using crypto assets or generate yield from unused capital. In Kenya, digital micro-lenders utilize blockchain technology to assess credit scores derived from mobile transaction records. In the Philippines, small business owners accept payments in USDT from international clients, completely avoiding conventional remittance delays.

This change is significant: for the first time in contemporary finance, code provides access that banks refuse. A person in rural Nigeria or southern Lebanon can access the same liquidity pools as a hedge fund in London. The unbanked can no longer be overlooked; they are now active members of a limitless digital economy.

Critics frequently label DeFi as “high-risk,” and they are correct; innovation invariably involves risk. However, the danger of inaction is more significant: staying ensnared in antiquated systems that inherently maintain inequality. DeFi, similar to the early internet, is chaotic and developing, but it contains the foundation for a future where access to capital depends on connectivity rather than privilege.

Blockchain governance and anti-corruption power

In numerous nations, corruption is not a coincidence; it’s a systemic issue. Public money gets lost in unclear bureaucracies, procurement information disappears, and financial reporting turns into a display of figures separated from reality. The World Bank calculates that corruption amounts to more than $3.6 trillion in losses for the global economy each year, undermining trust in institutions and denying citizens essential services.

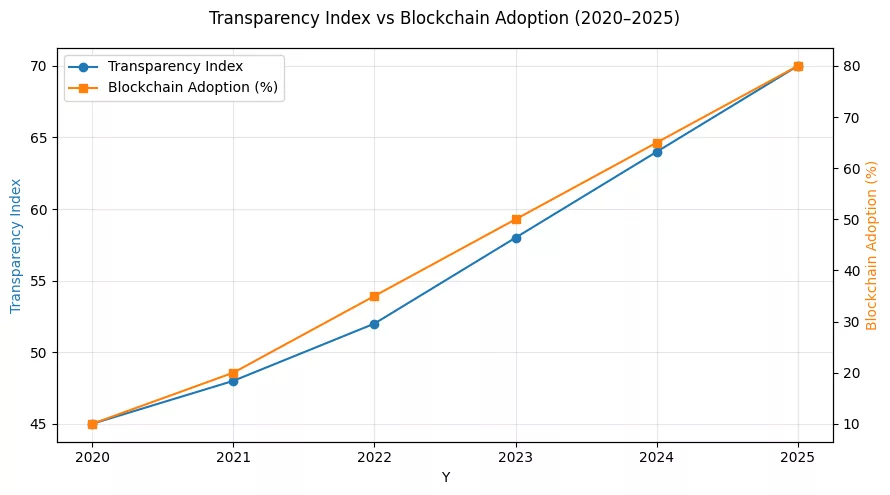

The unchangeable and clear characteristics of blockchain present a revolutionary option: a framework in which transactions are inherently verifiable. Each record on a blockchain is marked with a timestamp, verifiable, and can be tracked, removing the necessity for citizens to “trust” that their taxes, contributions, or government initiatives are carried out truthfully. In this regard, blockchain changes governance from a system of judgment to one of authentication.

Examples from the real world are already surfacing. Estonia, a leader in e-governance, maintains public records on blockchain systems, allowing citizens to monitor the usage of their data and taxes. Dubai’s Blockchain Strategy 2030 focuses on converting all governmental records to blockchain technology to prevent document fraud and enhance transparency. In Ukraine, officials released wartime donation records directly on-chain, transparently revealing the allocation of crypto assistance.

Envision a realm where each dollar of government expenditure, be it in education, healthcare, or defense, is permanently documented. Smart contracts can automatically disburse funds upon achieving milestones, thereby stopping embezzlement before it occurs. Development organizations could tokenize grants, enabling immediate monitoring of fund distribution. Elections might also gain increased security thanks to decentralized identity verification and secure voting systems resistant to tampering.

Blockchain not only guarantees transparency but also compels responsibility. It provides citizens with the resources to monitor governments and guarantees that authority can no longer conceal itself behind bureaucracy. With the rise of transparency worldwide, corruption shifts from an expected norm to a thing of the past.

CBDCs and the decentralization dilemma

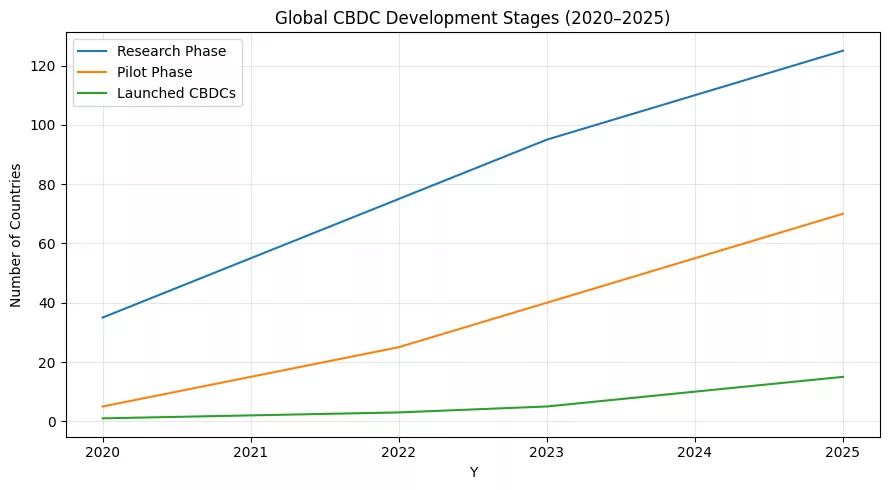

With the rise of cryptocurrency, governments have reacted by developing their own digital alternatives known as Central Bank Digital Currencies (CBDCs). These are government-supported digital forms of national currencies aimed at merging the effectiveness of cryptocurrencies with the regulation of traditional money. Over 130 nations, accounting for over 98% of worldwide GDP, are currently investigating or testing CBDCs, indicating the most substantial monetary change since the withdrawal of the gold standard.

In principle, CBDCs offer quicker transactions, decreased reliance on cash, and enhanced financial inclusion. Payments may turn instantaneous, international remittances less expensive, and monetary policy more accurate. Yet beneath this storyline exists a core philosophical clash: CBDCs maintain centralization, whereas cryptocurrencies break it down. The very characteristic that makes Bitcoin revolutionary control over one’s finances is the same aspect that most governments are reluctant to accept.

In countries such as China, the e-CNY incorporates programmable monetary regulation: officials can monitor transactions, limit spending categories, or even establish expiration dates for funds. These mechanisms, although effective for financial management, may lead to a surveillance-driven economy. In contrast, decentralized cryptocurrencies such as Bitcoin and Ethereum operate on open ledgers that are transparent, borderless, and resilient to censorship.

A hybrid future seems unavoidable: CBDCs for widespread infrastructure and compliance; decentralized assets for self-custody, investment, and worldwide mobility. United, they can coexist, but the struggle for control over financial resources will shape the upcoming age of economic dominance.

Challenges and ethical concerns

No uprising occurs without resistance. With the growth of cryptocurrency and blockchain technologies, a new array of technical, ethical, and environmental challenges emerges that need to be resolved for the system to develop sustainably.

The primary and most referenced issue is volatility. Although Bitcoin and Ethereum have produced remarkable gains in the last ten years, their volatile price fluctuations impede widespread use as a method of payment. This instability arises from a limited market size, speculative trends, and the lack of lender-of-last-resort systems. Stablecoins have alleviated some of this issue, yet the threat of de-pegging (evident in the 2022 Terra collapse) serves as a reminder that stability necessitates trust, even within decentralized systems

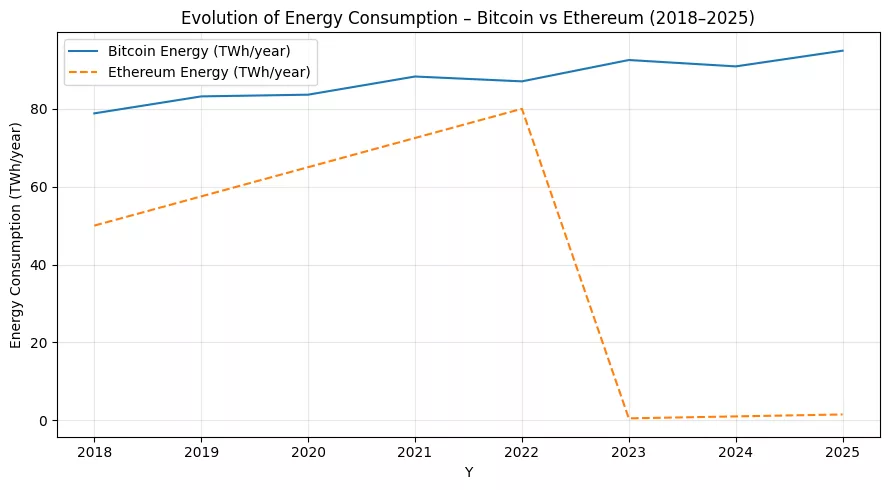

The effect on the environment continues to be a topic of dispute. Proof-of-work (PoW) protocols such as Bitcoin utilize a large amount of energy, resulting in concerns regarding carbon output. However, this story is changing: Bitcoin mining’s reliance on renewable energy has surpassed 56%, and advancements in proof-of-stake (PoS) systems have cut network energy usage by over 99%. Ethereum’s shift to PoS in 2022 established a benchmark, demonstrating that sustainability and decentralization can operate together.

Regulatory ambiguity is similarly disruptive. Governments find it challenging to harmonize innovation and investor safety. Countries such as Singapore and Switzerland have implemented innovative frameworks that draw in capital and talent. Some, such as the U.S., continue to be split among agencies, resulting in confusion and hindering institutional acceptance. The ethical challenge is evident: excessive regulation threatens to stifle innovation, whereas insufficient regulation leaves users vulnerable to fraud and systemic breakdowns.

Ultimately, there exists an educational aspect related to humanity. Millions enter cryptocurrency without grasping private key management or the risks associated with DeFi. Lacking digital literacy, decentralization may paradoxically recreate inequality, benefiting those who are tech-savvy. For cryptocurrency to address economic issues globally, accessibility needs to be accompanied by education and responsibility.

Future vision – A decentralized economic renaissance

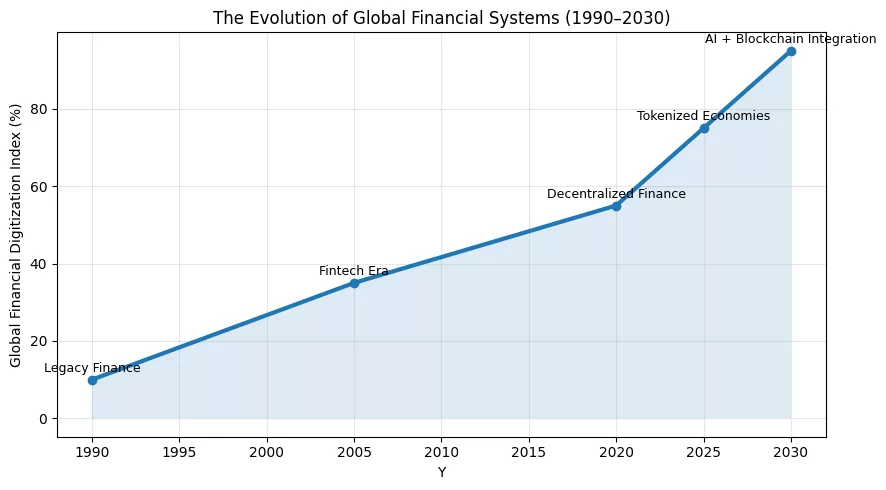

The narrative of cryptocurrency extends beyond digital currency; it encompasses a reimagining of the economy. Just as the Internet made information access more democratic, blockchain is currently enabling more equal access to value creation. The upcoming phase of finance will be characterized not by institutions, but by interconnected systems, token-based economies, and algorithmic clarity that enhance individual empowerment over intermediaries.

We are observing the emergence of a decentralized economic revival. With the tokenization of real-world assets (RWAs), people will soon have the opportunity to possess fractional ownership of real estate, carbon credits, or infrastructure projects assets that were previously limited to institutional investors. Global liquidity will be free from geographical limitations; a farmer in Kenya can obtain investment capital from Singapore within moments. Smart contracts will oversee not only finance but whole economies of programmable value including automated tax frameworks, decentralized insurance, and universal micro-pensions.

Artificial Intelligence (AI) combined with blockchain will create the next advancement in digital governance. AI is capable of examining on-chain data to predict resource requirements, enhance aid allocation, and identify fraud proactively. Blockchain, on the other hand, offers an unchangeable record that guarantees those forecasts are clear and responsible. Collectively, they create a symbiotic structure for trustless collaboration, transforming not only markets but also societies.

In this perspective, cryptocurrency ceases to be an “alternative” economy and transforms into the basis of a new economic system. One that cherishes privacy yet incentivizes transparency, promotes entrepreneurship while upholding fairness, and fosters prosperity not through privilege but through involvement.

The global economic issue of unequal opportunity access can ultimately be resolved not through policy, but through protocol. The tools are available; what is left is the shared desire to utilize them wisely.