- Liquidity sets the drift: expansion in compliant on-ramps and stablecoin float powers sustained upside.

- Conviction tightens float: rising long-term-holder share reduces sell pressure and supports trends.

- Leverage is the accelerant: open interest climbing faster than spot demand signals liquidation risk.

- Correlation is the conduit: tighter cross-asset coupling turns local stress into market-wide drawdowns.

- Playbook for the next phase: size by microstructure, add into forced selling, and manage positions by bull/base/bear scenarios not point targets.

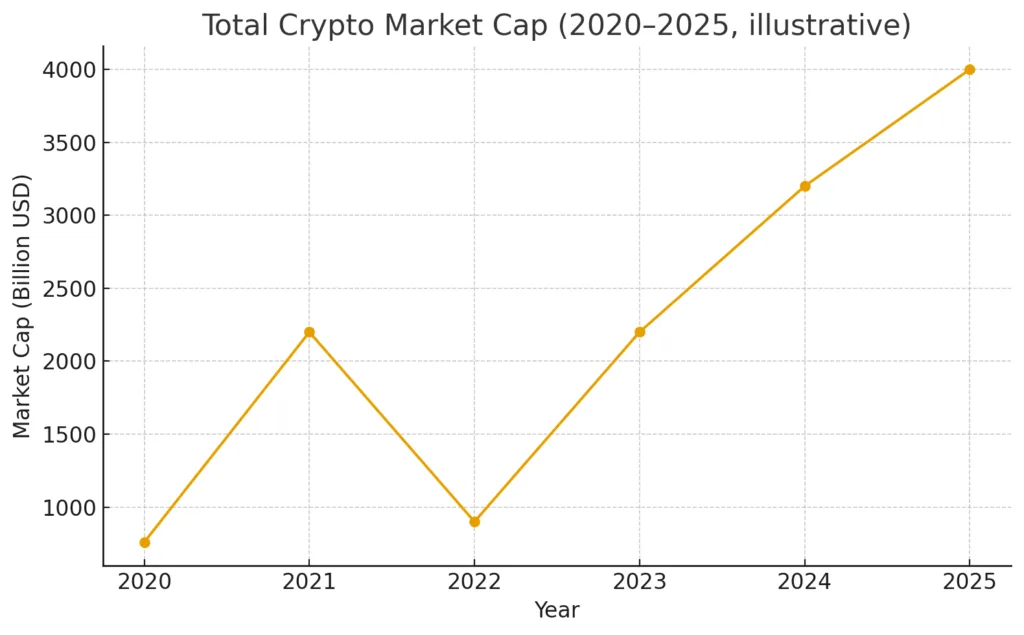

Where we are in the cycle

Cryptocurrency has transitioned from a speculative sector to a market that instantly responds to global liquidity, risk tolerance, and regulatory transparency. The previous cycle’s extremes reshaped positioning universally: retailers recognized the importance of volatility, institutions discovered that custody and compliance hold greater significance than stories, and developers moved to chains that aligned in fees, throughput, and development experience with their needs. The three influences that currently dictate the way forward are capital, conviction, and contagion. Capital dictates the amount of fuel accessible for risk; conviction influences whether holders allocate that fuel or retain it; contagion assesses if a localized shock escalates into a market-wide blaze. The rebuild following 2022 has been more mechanical than euphoric: stablecoins have reemerged, on-chain activity more accurately mirrors actual usage, and while policy guardrails may be flawed, they are clearer. To understand what follows, observe the plumbing where money flows, who possesses supply, and how closely assets correlate during times of stress.

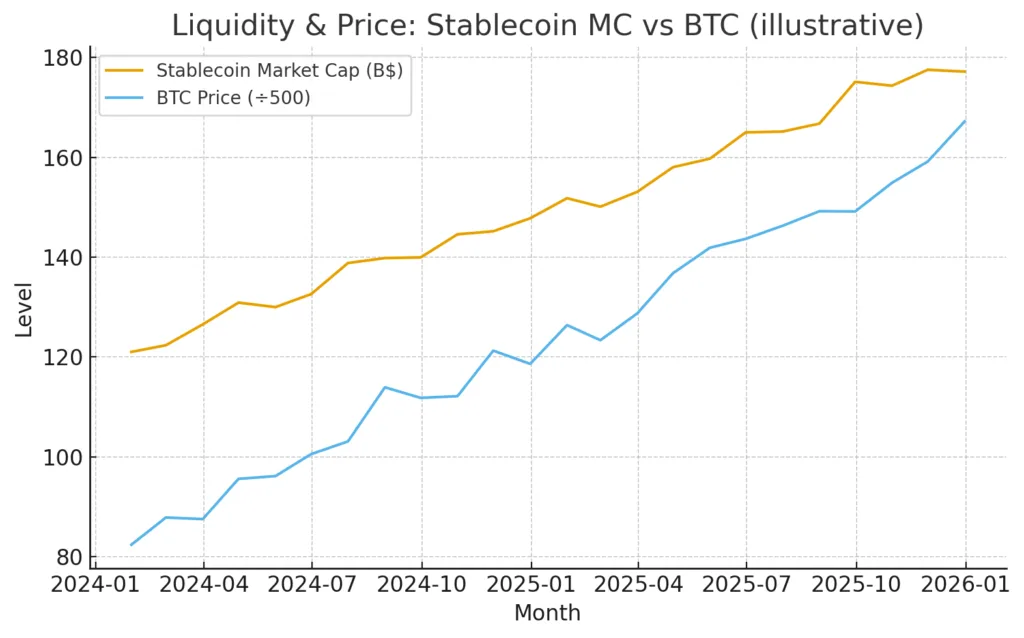

Capital: Follow the flow

Each cryptocurrency bull market starts in the same manner: with new money and borrowing. In this market, capital mainly flows through two channels. The initial channel is the fiat on-ramp through ETFs, brokerages, and regulated exchanges; the second channel is the stablecoin ecosystem, serving as the internal money market of cryptocurrency. As the supply of prominent stablecoins increases, market makers have more inventory and can offer narrower spreads; derivatives platforms experience enhanced liquidity; and taker demand more readily translates into price. Simultaneously, institutional channels influence the stickiness of capital: pension and wealth platforms generate gradual, ongoing inflows that soften drawdowns and reduce volatility. Inflows don’t have to be dramatic to affect price; they must be steady and reliable enough for systematic funds to follow the trend. The indicator to observe is the correlation between stablecoin supply and spot market demand. If the float increases while the price stabilizes instead of rising sharply, the market is accumulating momentum. If the float halts while the price rises, you are surviving on empty.

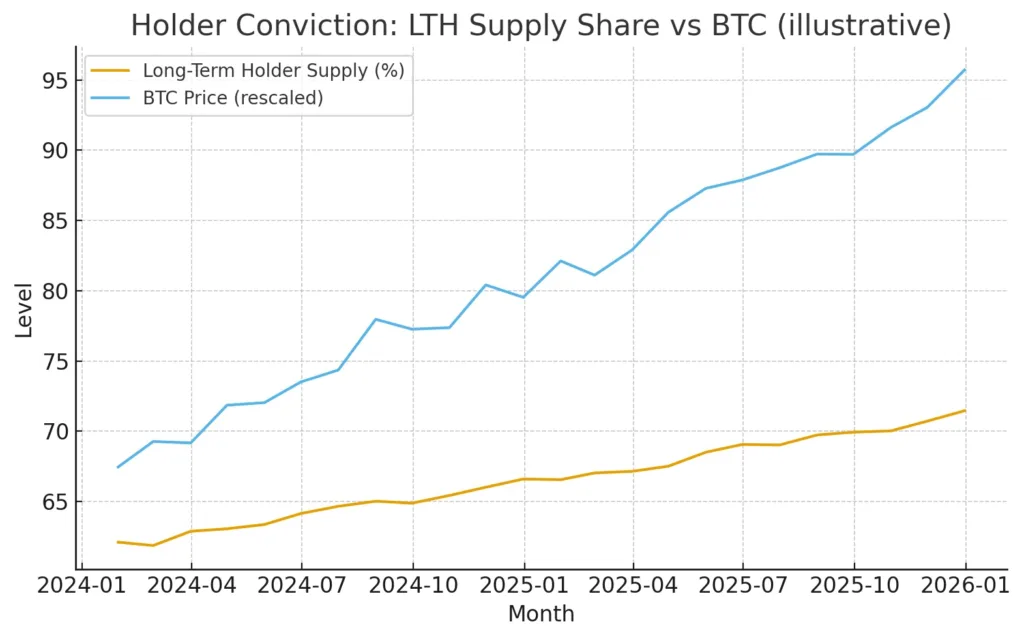

Conviction: Who owns the float?

Capital establishes the upper limit; conviction determines the lower limit. In reality, conviction manifests as the share of long-term holder (LTH) supply, the inactivity of coins, and the speed at which profitable groups distribute into strength. As LTH shares increase, the available float decreases, and price rallies necessitate less marginal demand to shift prices. That effect intensifies when miners and treasuries act as disciplined sellers instead of being compelled to sell. The 2024–2025 period has seen a significant increase in patient availability, even as prices escalated, indicating that purchasers were taking over weak positions instead of encouraging a return. However, conviction depends on the path taken. An abrupt policy change or lack of liquidity can prompt long-term investors to sell, particularly if their unrealized gains are significant. Thus, reading conviction is not focused on a specific metric but rather the whole picture: increased LTH share, consistent realized gains, and restrained investing during rallies indicate a market inclined to trend with slight pullbacks; rising spent-output profit ratios signal that fuel is transitioning from tanks to tailpipes.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

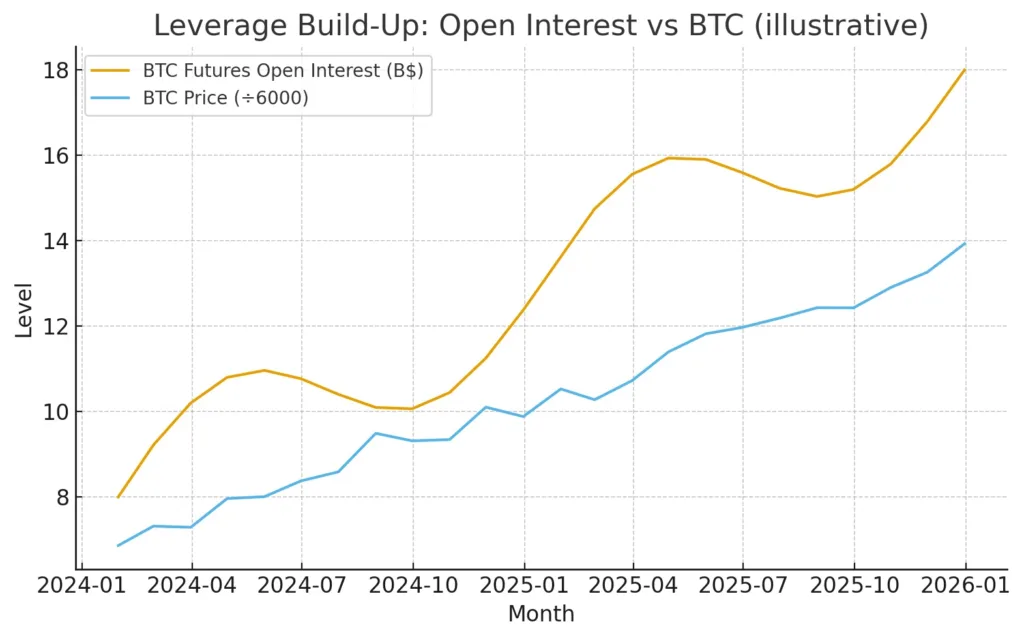

Leverage: The dry timber for wildfires

Leverage acts as the catalyst that transforms regular disruptions into significant market occurrences. In cryptocurrency, it focuses on perpetual futures open interest and options gamma. A consistent rise in open interest without a corresponding spike in spot demand is a typical precursor to chaos: basis narrows, funding becomes lopsided, and a slight catalyst sparks liquidation cascades that exacerbate the situation. The post-FTX period has witnessed improved collateral practices, yet the desire for leverage reemerges when there’s positive drift and low volatility. The principle is straightforward: align the leverage with the tape. When the price moves sideways and open interest increases, anticipate a corrective move; if the price increases alongside stronger spot volumes and consistent funding, leverage is being utilized responsibly instead of aggressively. Managers who endure understand how to downsize with the spring gales and to purchase what liquidations compel to be sold, rather than what headlines indicate is trendy.

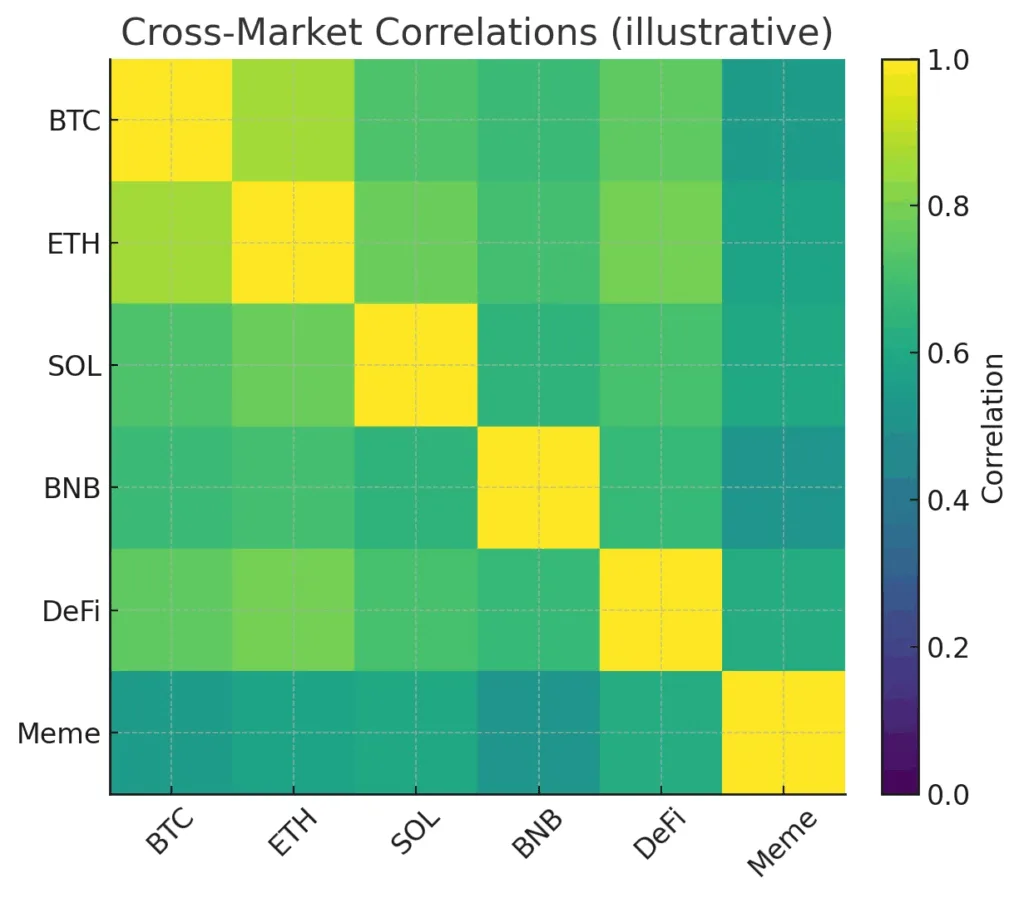

Contagion: correlation is the conduit

Contagion involves more than just defaults; it concerns how swiftly balance-sheet pressure transforms into a price-discovery occurrence across various assets. In tightly integrated markets, correlations rise to one when liquidity diminishes, irrespective of fundamentals. That connection is structural in crypto since numerous participants are cross-collateralized: they leverage BTC to purchase SOL, utilize SOL as margin to maintain basis on ETH, and hold alt risk while financing in stablecoins that depend on banking infrastructure. When one venue or asset encounters a problem, risk managers reduce exposure across the portfolio, liquidating what is feasible, not necessarily what they prefer. The remedy for contagion lies in segmentation with varied collateral, stronger spot volumes, and locations capable of failing without pulling their neighbors down. Up until that point, correlation maps are just as significant as balance sheets. When majors separate from high-beta sectors in times of stress and re-align during calm periods, it indicates a healthier microstructure; if all aspects move in sync constantly, your diversification is merely illusion.

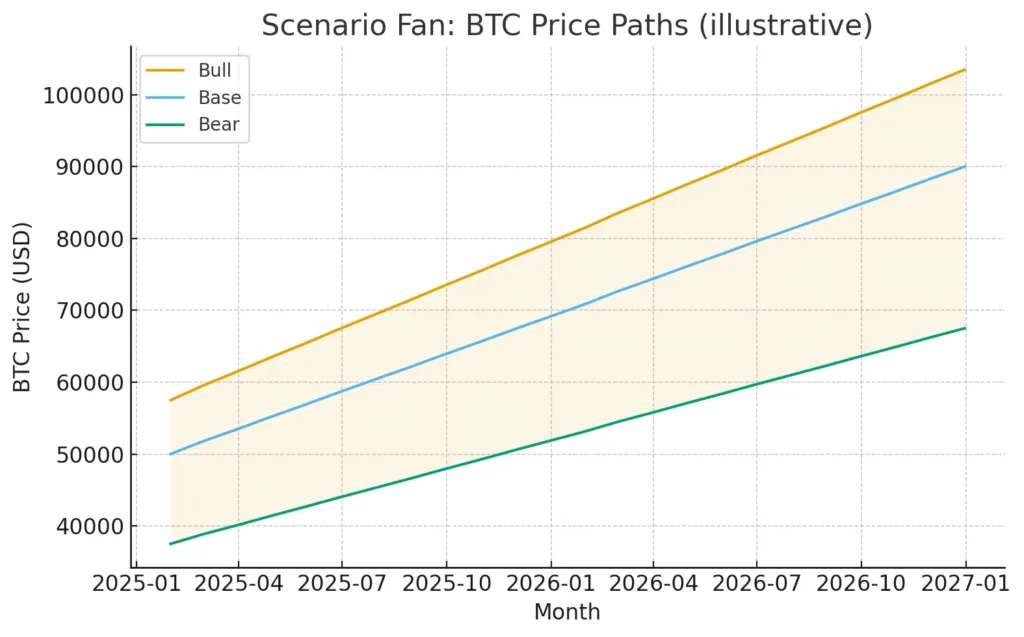

The playbook: Position for paths, not points

Predictions are unstable; scenarios are resilient. The foundational trajectory for the upcoming stage of cryptocurrency is a consistent rise supported by ongoing institutional investments, gradual growth in the stablecoin supply, and a rhythm of practical adoption stories in payments, gaming, and tokenized markets. The bullish trend speeds up if clear policies enable new distribution like retirement platforms and more spot products, while developer innovations drive usage past speculation. The bear market emerges when leverage surpasses spot demand and regulatory surprises limit the fiat on-ramp, necessitating liquidation from patient groups.

The operator’s guide remains uniform across avenues: allow capital and belief to carry the weight, utilize contagion surges to increase selectively, and adjust sizing according to microstructure instead of broad momentum. Cryptocurrency continues to be a reactive asset category; cash movements influence prices, prices generate narratives, and narratives attract new cash movements. Observe the pipes, honor the holders, and always remember that the same wiring that energizes positivity can also deliver a jolt.