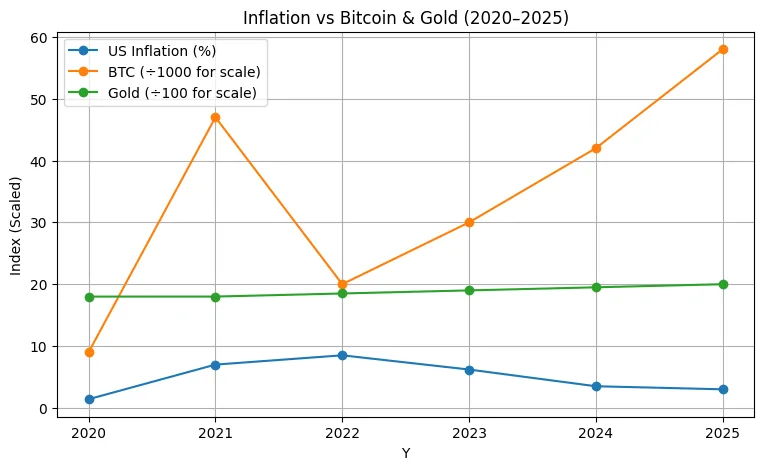

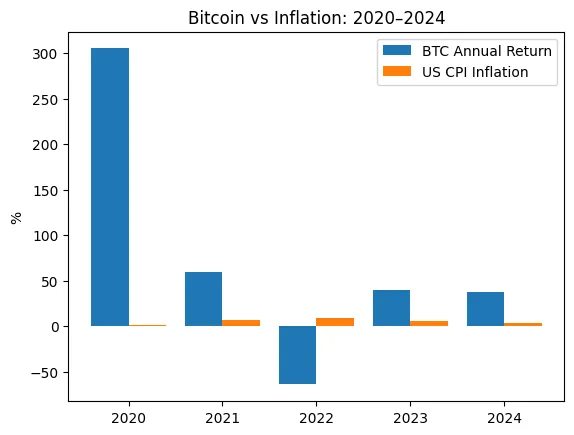

- Bitcoin versus Inflation: BTC has surpassed inflation over extended periods but is still too unstable for consistent paycheck-like reliability.

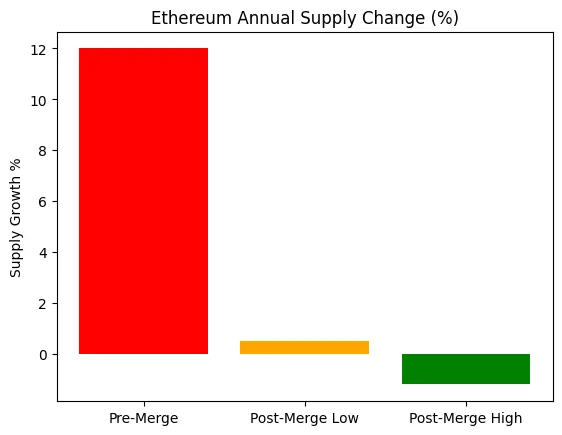

- Ethereum’s Merge Impact: ETH transitioned from an inflationary supply to deflationary dynamics, strengthening its “ultra sound money” narrative.

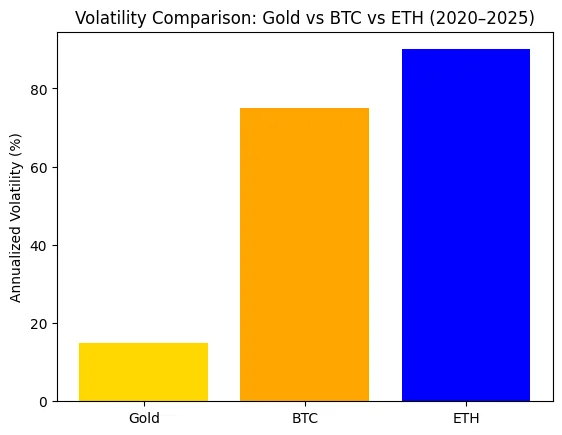

- Gold Continues to Be the Standard: Gold is still the most secure inflation safeguard, exhibiting low volatility and support from central banks, whereas crypto serves as a high-risk alternative.

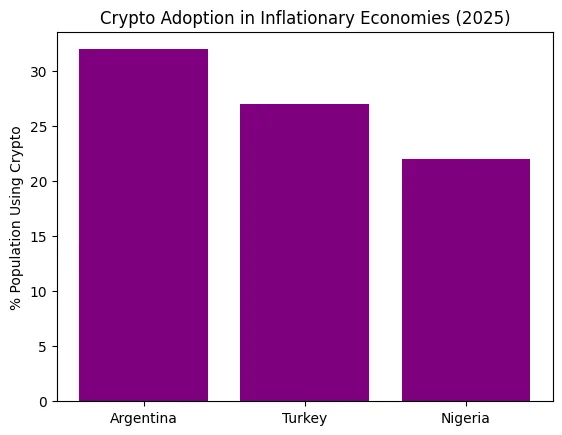

- Emerging Market Reality: In Argentina, Turkey, and Nigeria, the need for crypto adoption arises serving as protection against failing currencies and systemic crises.

- Hybrid Hedge Future: Bitcoin and Ethereum are becoming hybrid assets speculative in the short term, yet progressively serving as digital gold in extended periods.

The inflation hedge debate reignited

As inflation reached multi-decade peaks from 2021 to 2023, the financial community revisited a timeless inquiry: how can investors safeguard their wealth when the purchasing power of money is declining? Historically, the response was gold. For hundreds of years, the yellow metal has served as a reliable store of value amid economic turmoil.

However, the cryptocurrency sector presented a revolutionary option: Bitcoin as virtual gold. With a fixed limit of 21 million coins, Bitcoin’s anticipated scarcity attracted those concerned about central banks generating trillions of dollars during the pandemic. Ethereum, the second-largest blockchain, subsequently joined the discussion following its EIP-1559 upgrade and transition to Proof-of-Stake, introducing a deflationary element to its supply dynamics.

With inflation having eased yet still high relative to levels before 2020, the discussion has resurfaced: are Bitcoin and Ethereum genuinely embodying the digital gold concept, or do they remain too unstable to serve as effective hedges.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Scarcity meets volatility

The limited supply of Bitcoin is its most compelling defense narrative. With halvings occurring every four years, its stock-to-flow ratio increasingly mirrors that of gold, establishing it as a digital substitute for limited resources. This architectural framework guarantees that Bitcoin cannot be devalued by governments or central banks.

Nevertheless, actual performance reveals a more complex situation. In 2022, as inflation soared past 8% in the US, Bitcoin plummeted more than 60% from its peaks. Rather than serving as a hedge, it functioned more like a speculative tech stock, moving in sync with the Nasdaq during times of monetary tightening.

However, when looking at the broader perspective over five years, the scenario shifts. A person who purchased Bitcoin in 2020 would have significantly exceeded both gold and inflation, even while experiencing several crashes.

Ethereum from digital oil to store of value aspirant

Ethereum has often been referred to as “digital oil,” fueling DeFi, NFTs, and smart contracts. Since its EIP-1559 fee burn (2021) and transition to Proof-of-Stake (2022), Ethereum has progressively adopted traits of a store of value.

The fee burn established a system wherein a segment of each transaction fee was eliminated, decreasing supply. Combined with staking rewards and a significant reduction in issuance after the Merge, Ethereum’s annual net inflation decreased by 90%. During times of elevated network activity, ETH even turned deflationary.

This trend has led investors to see ETH not just as a utility token but also as a hedge-like asset featuring an inherent scarcity mechanism. Additionally, staking returns of 3–5% provide a bond-like income source, further strengthening its position in diversified portfolios.

The benchmark hedge

Gold remains the ultimate benchmark. Central banks hold it as reserves, and during the inflation spikes of the 1970s and again in the 2020s, it preserved value. Between 2020 and 2025, gold prices hovered between $1,800 and $2,000/oz, offering slow but steady appreciation.

Compared to crypto, gold’s volatility is far lower. Investors who needed a reliable monthly hedge against inflationary pressure fared better with gold than Bitcoin or Ethereum.

This dichotomy suggests a hybrid framework: gold as a low-volatility inflation hedge, and Bitcoin/Ethereum as high-beta hedges that may outperform over longer horizons but cannot guarantee stability during crises.

Regional adoption when inflation becomes crisis

As investors in developed markets debate whether Bitcoin or Ethereum effectively serve as inflation hedges, the situation appears starkly different in regions where inflation is not just a theoretical concept but a daily challenge. In nations experiencing hyperinflation or swift currency decline, the use of cryptocurrency is frequently more than a speculative investment; it often serves as a means of survival.

Consider Argentina, where yearly inflation exceeded 100% in 2023, rapidly diminishing the peso’s value. To millions of Argentinians, the notion of saving in their local currency turned into something unimaginable. Many opted for alternatives like Bitcoin and dollar-pegged stablecoins such as USDT, utilizing them as a complementary savings method that provided security against persistent currency devaluation. In contrast to a bank account linked to the peso, stablecoins offered a form of financial stability and the capability to maintain purchasing power

Turkey conveys a comparable narrative. The Turkish lira has experienced a significant fall over the last ten years, with inflation rising to distressing highs and interest rates unable to instill trust in the local economy. In this scenario, the need for both Ethereum and stablecoins increased as individuals looked for methods to avoid the fluctuations of their national currency. For numerous Turks, crypto turned into both a safeguard against inflation and an entry point to global markets, enabling them to maintain value and engage internationally in ways their faltering currency no longer permitted.

Nigeria exemplifies another instance of cryptocurrency’s practical function amid economic turmoil. In spite of governmental limitations and stringent currency regulations, Nigeria boasts one of the highest levels of cryptocurrency adoption globally. People depend on Bitcoin, Ethereum, and stablecoins for remittances, international payments, and as a safeguard against the declining naira. For numerous Nigerians, cryptocurrency is not seen as a risky wager on future finance but rather as a daily financial instrument that offers access, liquidity, and a level of stability lacking in the local banking system.

In all these areas, the accessibility, resistance to censorship, and stability in dollars are more significant issues than the volatility of Bitcoin and Ethereum.In this manner, crypto acts as a safeguard, not only against inflation in the traditional sense but also against wider financial instability. For communities facing ineffective systems, digital assets serve as a crucial support that conventional gold or banking systems frequently fail to offer.

Hedge, speculation, or hybrid asset?

The issue of whether Bitcoin and Ethereum serve as genuine inflation hedges lacks a straightforward response. In certain aspects, they perform exceptionally, but in others, they do not meet expectations.

Over extended periods, both assets have demonstrated the capacity to maintain and even enhance purchasing power. The programmed scarcity of Bitcoin and the deflationary features of Ethereum, along with increasing adoption, indicate that individuals holding either asset for multiple years have typically surpassed inflation rates, even when including periods of decline. From this viewpoint, they appear like a hedge operating in cycles, rewarding patience and enduring belief.

However, when evaluated in relation to the immediate requirements of families or organizations, their significant fluctuations weaken their position as reliable safeguards. An asset capable of losing 50% of its value in just a few months isn’t suitable as the stable, paycheck-like safeguard that gold has traditionally offered.

In reality, it might be most precise to consider crypto as a high-beta inflation hedge. In emerging markets, where national currencies are failing and banking systems struggle, crypto serves as an effective hedge for individuals. It safeguards assets from losing value and offers access to worldwide liquidity in ways conventional systems are unable to. For institutional investors in advanced markets, Bitcoin and Ethereum are becoming more regarded as additional exposures, positioned alongside gold, treasuries, and stocks within diversified portfolios.

The narrative of digital gold is still unfinished but is evidently developing. Every Bitcoin halving, every Ethereum enhancement, and every surge of adoption advances these assets toward realizing the potential of acting as long-term hedges in a digital age. While they might not completely supplant gold, they are progressively establishing their position as next-gen hedges hybrid assets that merge aspects of speculation, growth, and inflation protection into one of the most innovative financial instruments of our time.

Rita Dfouni

Rita Dfouni