- Crypto’s $100B exposure gap leaves less than 2% of assets insured.

- Institutional adoption stalls without standardized risk models and coverage.

- Global insurers are testing the waters, but structural flaws persist.

One of the biggest weaknesses of the cryptocurrency sector, which is growing into a multitrillion dollar economy, is still being ignored: the absence of a strong insurance market. With almost no complete risk coverage, over $100 billion in assets are still exposed across exchanges, custodians, DeFi protocols, and wallets. One of the primary obstacles keeping cryptocurrency from becoming widely accepted is this blind spot.

Insurance serves as the unseen framework that enables markets to operate in traditional finance. The FDIC protects deposits, custodians have broad coverage, and reinsurance behemoths offer additional security layers that guarantee resilience in the event of catastrophes. In comparison, insurance in the crypto space is still dispersed, undeveloped, and inadequate. Because of this discrepancy, institutional investors’ expected safety nets are still absent, leaving capital vulnerable to threats like exchange failures and smart contract attacks.

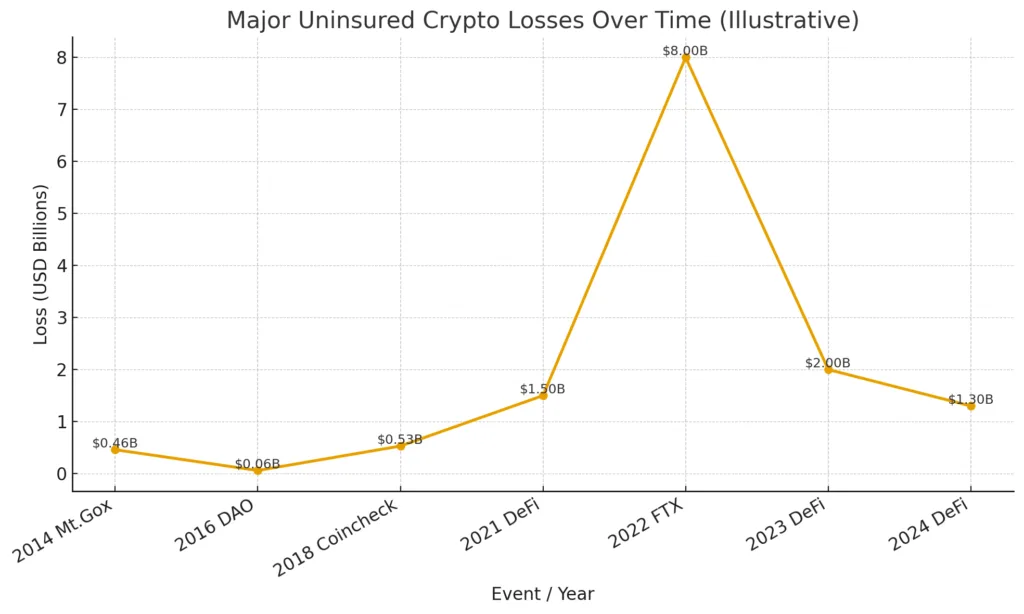

The most obvious example of the issue is still FTX’s collapse in 2022. Overnight, billions of customer assets vanished, leaving both institutional and retail investors stranded without insurance to cover losses. DeFi exploits have cost over $4 billion since 2021, and victims have had little to no recourse. Crypto is a self-insured ecosystem that depends on its own resilience rather than outside protections in the absence of sufficient risk-transfer mechanisms.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

According to industry estimates, less than 2% of crypto assets are currently insured, meaning that over $100 billion is essentially uninsured. A false sense of security is produced when coverage that is available is frequently capped at amounts much lower than actual customer deposits. The absence of adequate insurance is a major barrier for a sector that aims to draw in enterprises, pension funds, and sovereign wealth managers. An industry where the risk of catastrophic loss cannot be hedged is unlikely to attract large pools of money.

Why crypto’s future depends on insurance

There has been some tentative improvement. While Munich Re and Aon are looking into ways to model risks particular to cryptocurrency, traditional insurers like Lloyd’s of London have started underwriting limited policies for custodians. Although their reach is still limited in comparison to the scope of the problem, initiatives like Nexus Mutual and InsurAce have surfaced within the crypto ecosystem to offer decentralized coverage. The issue is that insurers find it difficult to determine risk prices in a sector with limited historical data, erratic laws, and dangers that change more quickly than models can be created.

Piecemeal attempts alone will not suffice to solve the problem. To give insurers dependable frameworks, standardized risk models for wallets, custodians, and DeFi systems must be created. In order for insurers to underwrite policies without worrying about existential liability, regulators will need to offer guidelines. In order for reinsurance companies to backstop significant liabilities, insurers themselves will need to incorporate cryptocurrency into international capital markets. Only then will the sector be able to create the kind of safety blanket that traditional finance investors take for granted.

The lack of insurance is a structural flaw that jeopardizes the future expansion of cryptocurrency, not merely a technical one. The industry will continue to be exposed to the very risks it has long pledged to mitigate unless it is addressed. Once written off as a conservative safety net, insurance could end up serving as a link between the experimental present of cryptocurrency and its institutional future.