- Conventional finance uses yield curves for risk pricing, whereas cryptocurrency still does not have a long-term risk-free rate to act as a standard.

- DeFi returns continue to be scattered, unstable, and linked to liquidity trends instead of underlying principles.

- Without a reliable yield curve, Web3 is unable to accurately assess risk or achieve widespread institutional acceptance.

In the realm of Web3, though, no such standard exists. Crypto, despite its advancements, still does not have a globally recognized long-term risk-free rate, which is fundamental for pricing and risk evaluation in conventional markets. Absence of it causes decentralized finance (DeFi) to function within a divided environment where yields are frequently misunderstood, risks are inadequately valued, and sustainable growth continues to be questionable.

The importance of the yield curve

In conventional finance, government bonds are considered the nearest option for a “risk-free” investment. The yield curve derived from these bonds clarifies how risk and return change across various maturities. When the curve inclines upward, investors see it as an indication of anticipated growth and increasing rates. When it flips, it is frequently viewed as a signal of an approaching slowdown or recession.

This framework offers additional insights beyond steering macroeconomic policy. It enables companies to lend and borrow more effectively, investors to protect themselves from inflation or deflation, and families to comprehend how upcoming interest rates could affect their savings or mortgages. In essence, the yield curve serves as more than a financial instrument; it is the cornerstone of reliability and confidence in contemporary markets.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

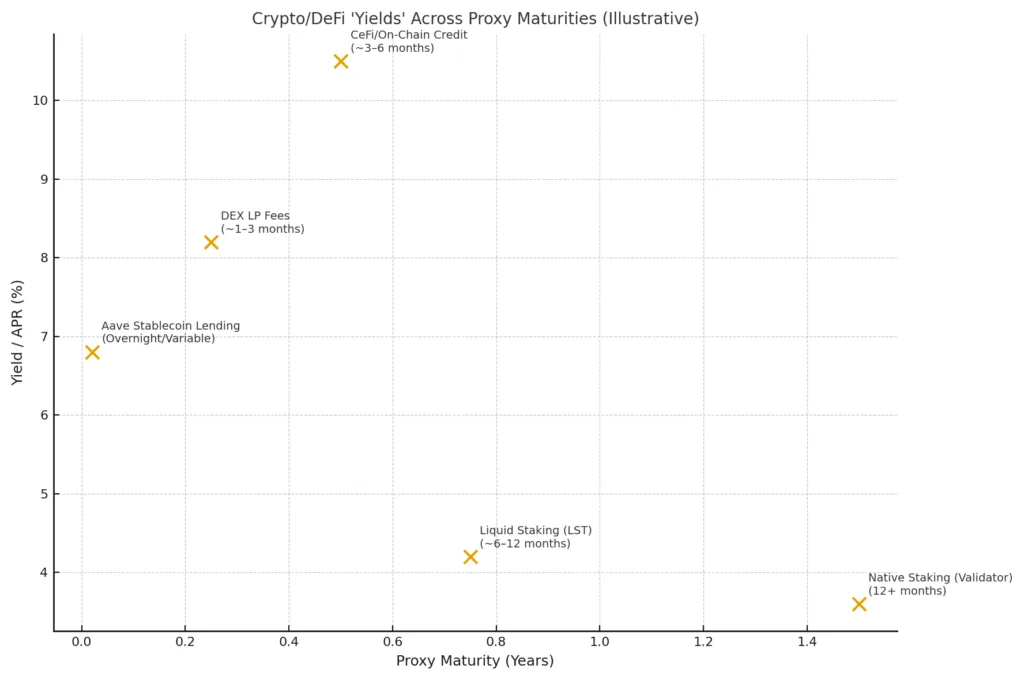

Crypto is missing this foundation. DeFi platforms generate returns via lending, borrowing, staking, or liquidity provision, but these yields fluctuate independently without being linked to a universally trusted standard. The outcome is a market that presents possibilities, but lacks a reliable method to assess if those opportunities are being valued accurately.

The fragmented world of DeFi yields

DeFi’s promise is attractive on the surface: annual percentage yields (APYs) that can exceed anything available in traditional markets. Protocols like Aave, Compound, or decentralized exchanges often display double-digit returns. But what do these numbers really represent?

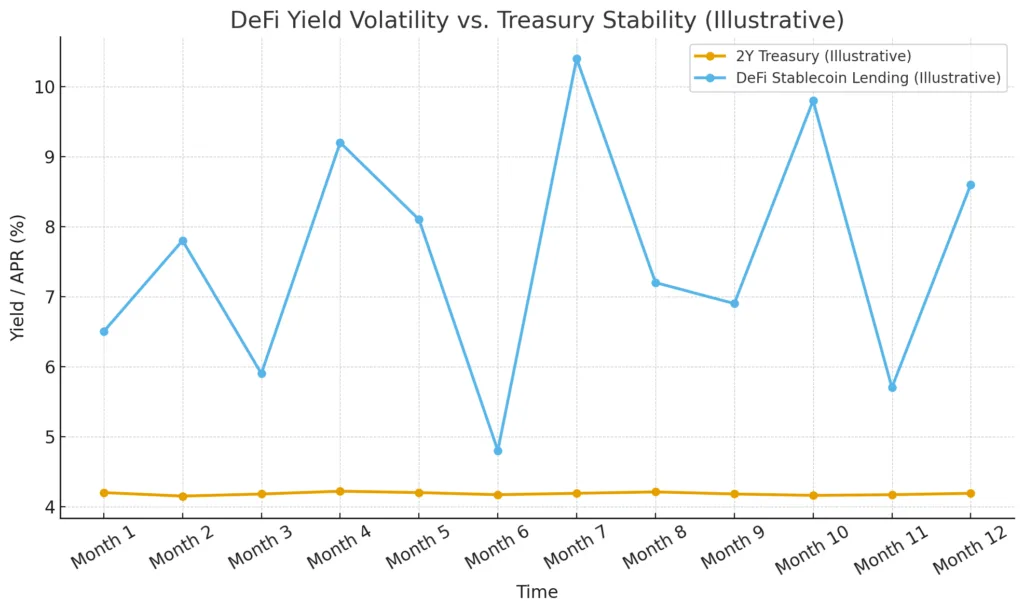

Unlike Treasuries or government bonds, which rest on sovereign creditworthiness, DeFi yields are often determined by the immediate balance of supply and demand for liquidity. If many users want to borrow stablecoins, lending rates spike; if liquidity floods the protocol, yields collapse. This makes them highly volatile and difficult to use as long-term benchmarks.

Even staking rewards, often seen as more predictable, do not provide a genuine risk-free rate. They are tied to protocol-specific factors such as inflation schedules, validator performance, or governance decisions. While staking rewards reflect the health of individual blockchains, they cannot serve as a universal yardstick across the crypto economy.

Attempts to create a benchmark

Attempts have been made to create yield standards in cryptocurrency. At times, stablecoin lending rates have been utilized as substitutes, based on the belief that dollar-pegged assets might serve as a neutral reference point. However, stablecoins come with their own risks: events of depegging, dependence on centralized reserves, and unclear regulations weaken their reputation as a risk-free basis.

Tokenized government bonds have also become popular, with initiatives providing access to U.S. Treasuries in a blockchain format. These offerings introduce the comfort of conventional finance to the blockchain realm, yet they still link back to centralized entities and outdated systems. They offer visibility, but not autonomy. Crypto still does not possess a genuinely native risk-free asset capable of supporting a yield curve entirely constructed within Web3.

Why this matters for Web3

The lack of a crypto yield curve is more than merely an academic issue. A structural constraint hinders DeFi from reaching its full potential. In the absence of a universally accepted risk-free rate, institutions are unable to allocate capital to crypto markets with confidence, create derivatives with predictable pricing, or hedge risks as efficiently as they do in traditional markets.

This disparity also skews shopping patterns. Numerous users pursue the highest APYs without grasping if they signify appropriate risk compensation or merely indicate temporary liquidity discrepancies. Over time, these dynamics raise the chances of misallocation, volatility, and abrupt failures as liquidity diminishes.

For DeFi to compete with or enhance traditional finance, it needs to develop a method for mimicking the function of the yield curve. Without it, the ecosystem may be considered speculative instead of essential.

DeFi lending rates swing sharply with liquidity demand, while Treasury yields remain relatively stable underscoring crypto’s lack of a reliable long-term benchmark.

The road ahead

Creating a crypto-focused yield curve will be challenging. Achieving agreement on what defines “risk-free” would be necessary in a landscape where every asset entails some level of technological, regulatory, or governance risk. Certain individuals think that well-collateralized stablecoins might develop into these benchmarks if they obtain adequate transparency and robustness. Some believe that the future development of decentralized counterparts to sovereign bonds, potentially supported by protocol income or fees from the entire network, might lay the essential groundwork.

It is evident that without a yield curve, Web3 remains unfinished. Crypto has addressed numerous issues, from trustless transactions to programmable currency, but it hasn’t yet created a dependable framework for assessing risk over time. Reaching that milestone might enable institutional involvement on a level greatly surpassing the current liquidity pools.

Conclusion

Crypto takes pride in its innovation, but creativity without a solid framework can only achieve limited success. The absent yield curve underscores a crucial disparity between conventional finance and decentralized markets. Unless Web3 establishes a reliable, crypto-centric risk-free rate, it will find it difficult to achieve the efficiency, predictability, and capital depth of traditional financial systems.

The opportunity, however, is immense. A true crypto yield curve would not just enable better pricing of loans or derivatives it would cement DeFi as a legitimate pillar of global finance. In that sense, solving this challenge may be the key to transforming crypto from an alternative system into a mainstream one.