- Bitcoin’s drop to $100K tested solid support, leading to long-term accumulation and indicating structural market resilience.

- Washington’s clear regulations are setting the stage for greater institutional adoption of crypto.

- Ethereum holds steady above $4,100, backed by increased Layer 2 adoption and growth in staking.

- Solana, XRP, and Cardano demonstrate ecosystem strength and accumulation even amidst significant volatility in the news.

- The $100K decrease might signal the start of a persistent, regulation-led bullish trend.

A market shaped in DC

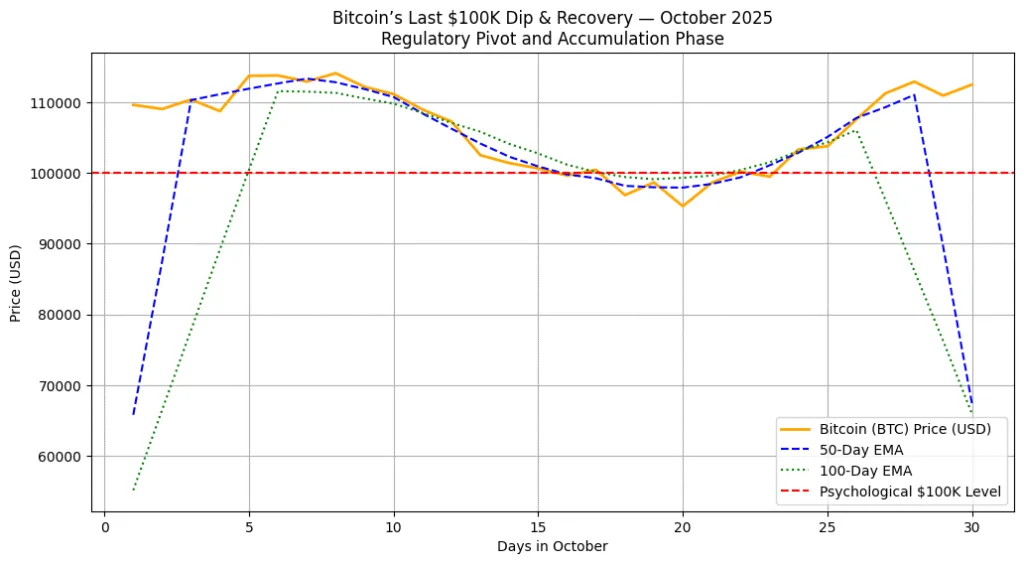

October 2025 signaled a pivotal moment for the cryptocurrency market. Bitcoin’s decline to the symbolic $100,000 threshold was not merely a technical setback; it represented a larger regulatory story coming from Washington. In contrast to earlier corrections caused by liquidity shocks or global market fluctuations, this decline happened alongside the U.S. Securities and Exchange Commission indicating increased examination of cryptocurrency exchanges and token listings.

Initially, investors viewed these signals as a negative jolt, leading to short-term profit-taking and increased market unease. However, underneath the surface, the market’s reaction suggests a deeper truth: a development of the crypto ecosystem due to regulation, instead of a life-threatening crisis. The final drop to $100,000 could, ironically, signal the onset of a bullish period fueled by authentic, institutional-friendly structures.

Washington’s regulatory pulse and market psychology

In the last month, U.S. policymakers defined more precise limits for digital assets. Although the announcements were presented as centered on enforcement, the underlying message indicated a developing framework for institutional involvement. By clarifying the definitions of security and utility tokens, the SEC and other federal regulators unintentionally established a guide for market participants to develop compliant frameworks.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Market psychology reacted in two stages. In the near term, retail traders sold heavily as news heightened anxiety. Simultaneously, long-term investors and institutional players saw the regulatory clarity as a factor contributing to stability. On-chain metrics back this view: Bitcoin exchange reserves fell to multi-year lows, showing accumulation by investors prepared to endure the uncertainty. In the past, times of stricter regulations that clarify market rules often come before lasting bull markets, as institutional investments are released in a legally structured setting.

The last $100K dip structural implications

Bitcoin’s drop to $100,000 did not violate essential structural supports, indicating that demand zones stayed solid. Technical analysis indicates that the $100,000–$102,000 range served as a strong support level, absorbing selling pressure without causing cascading liquidations. Momentum indicators, though momentarily bearish during the drop, bounced back quickly as institutional funds returned to the market.

The dip also emphasized the market’s increasing separation from macro risk. Although stocks and commodities faced fluctuations due to interest rate unpredictability, Bitcoin’s steadiness at $100,000 demonstrated the persistent faith in its limited supply and value retention characteristics. Investors more and more perceive Bitcoin as a hybrid asset, serving as a link between digital innovation and macro hedging, instead of just a speculative tool susceptible to short-term market fluctuations.

Regulation as a bullish catalyst

Interestingly, the Washington pivot might act as a fundamental catalyst for the forthcoming bull cycle. Regulatory clarity reduces uncertainty, allowing institutional investors such as hedge funds, family offices, and corporations to increase their exposure without worries about compliance breaches. Once legal structures are in place, offerings like regulated ETFs, staking options, and on-chain derivatives become more attractive.

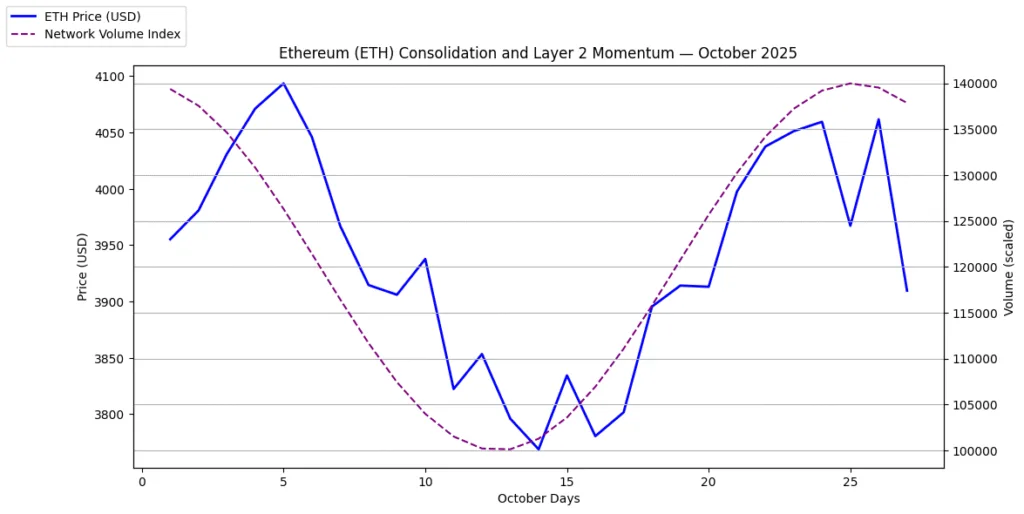

Ethereum and Layer 2 solutions also benefit. Clearly outlined regulations motivate developers and organizations to build applications on secure, compliant platforms. Solana, XRP, and Cardano may see greater adoption as institutional investors seek diverse, regulated opportunities in networks that provide distinct value propositions. The developing narrative shifts from speculative thrill to a managed expansion of digital assets, setting the stage for sustainable price rises.

Technical and on-chain evidence of accumulation

Although the headline decline suggests otherwise, on-chain activity indicates a positive outlook. Bitcoin’s long-term investors are boosting their accumulation, the demand for staking Ethereum keeps growing, and the network activity for XRP stays robust. Exchange reserves for key cryptocurrencies have decreased, suggesting that supply is shifting from liquidity platforms to custody solutions or institutional vaults.

Technical patterns confirm this accumulation phase. Bitcoin’s 50-day and 100-day moving averages remain well-aligned, forming a support structure around $105,000. Ethereum holds above its $4,000 support, with Layer 2 transaction volumes steadily rising. Solana’s volatility compression suggests an imminent breakout, while XRP and Cardano maintain structural integrity within their respective trading ranges. Together, these signals imply that the market has absorbed the regulatory shock and is positioning for a resumption of the uptrend.

Macro context liquidity, risk, and institutional entry

The regulatory shift engages with larger macro factors in ways that enhance its importance. Yields on U.S. Treasury bonds have eased, as appetite for risk in stocks and commodities has resurfaced. Liquidity conditions continue to be advantageous, allowing capital to enter digital assets. Institutional investors, now confident due to legal certainty, are slowly raising their exposure via direct investments and structured financial products.

This dynamic supports the argument that the $100,000 drop is neither a peak nor a fundamental breakdown. Rather, it acts as a purchasing chance for long-term investors, driven by the alignment of regulation, liquidity, and market development. The last months of 2025 may signify the initial phases of a bull cycle based not on hype, but on structural validity and institutional involvement.

A regulator-driven bull cycle?

Looking forward, the market might face occasional fluctuations as news continues to affect liquidity, but the general direction is positive. Bitcoin is ready to bounce back and challenge previous peaks over $120,000. Ethereum and Layer 2 solutions are expected to gain from increased adoption and staking interest, whereas Solana, XRP, and Cardano persist in their unique ecosystem development.

The overarching argument is evident: regulation has shifted from being a hindrance to serving as a structural catalyst. With growing institutional adoption and stabilized market infrastructure, digital assets may experience a bull cycle marked by consistent, sustainable growth instead of brief speculative surges. The final drop to $100,000 could certainly be recalled as the purging setback that came before the genuine bull market of 2025–2026.