The unseen backbone of the digital economy is now stablecoins. They were created as basic digital dollars for traders to park money between erratic assets and are pegged to fiat currencies. However, they have developed into a trillion-dollar settlement layer that is comparable in size to traditional payment networks in less than ten years. Most people are unaware that stablecoin issuers like Tether and Circle are now working as DeFi’s covert Central banks, controlling markets, directing liquidity, and even affecting international monetary flows while evading Central bank supervision.

The rise of a shadow monetary system

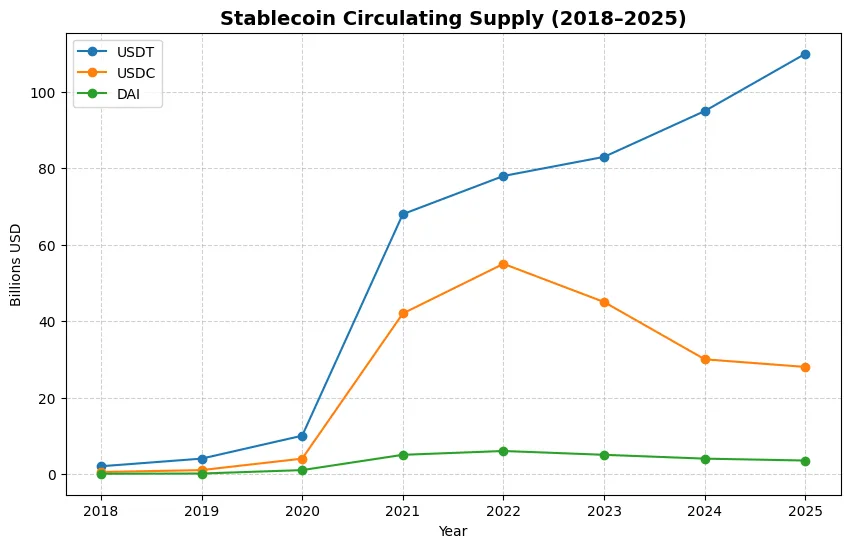

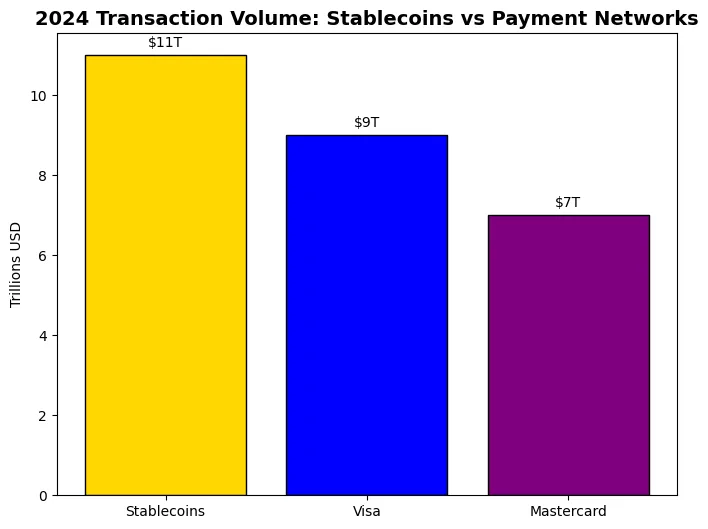

Stablecoins primarily solved the problem of storing and transferring funds between global cryptocurrency exchanges without relying on unreliable tokens or slow banks. Stablecoins consequently became very popular. With a combined circulation of over $120 billion, Tether (USDT) and Circle’s USD Coin (USDC) currently control the majority of the market. Together, they will transact more than $11 trillion in 2024, surpassing Visa’s annual transaction volume.

In 2024, stablecoins subtly overtook Visa and Mastercard, handling more than $11 trillion in transactions, solidifying their position as the foundation of the cryptocurrency industry.

This extensive adoption has led to the establishment of a shadow monetary system. Stablecoins, as opposed to Bitcoin or Ethereum, are the standard unit of account for traders, investors, and even everyday consumers in developing nations. Customers in countries where capital controls or hyperinflation are a problem can access dollarized liquidity using stablecoins, which their governments cannot enforce. In nations like Nigeria, Argentina, and Turkey, stablecoins have become the digital dollar’s lifeblood, supporting cross-border parallel markets.

Tether (USDT) is the market leader, and the quantity of stablecoin has increased from less than $3 billion in 2018 to over $140 billion in 2025. Stablecoins continue to be the foundation of cryptocurrency liquidity despite USDC’s decline in market share.

The new central bankers of crypto

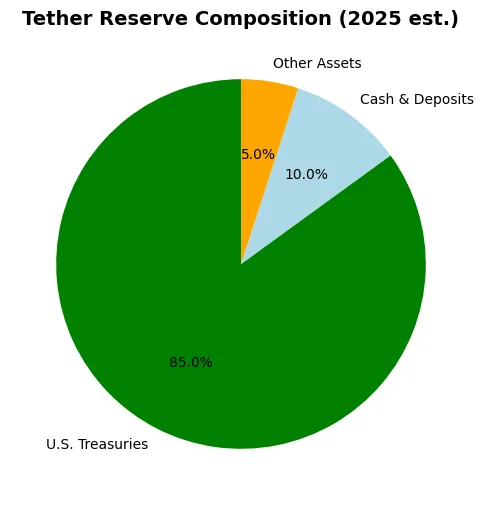

Tether’s reserves are dominated by U.S. Treasuries, effectively making it one of the largest private holders of U.S. debt a role traditionally filled by nation-states and central banks.

The size of the reserves that support stablecoins is just as significant as their function in payments. Issuers store billions in assets, primarily short-term U.S. Treasuries and cash equivalents, to preserve their pegs. According to some estimations, Tether currently ranks among the world’s largest holders of U.S. Treasury bills, comparable to mid-sized nation-states or sovereign wealth funds.

Stablecoin issuers are in a unique position because, although being private businesses, they can behave like central banks by changing the amount of money in circulation. They eliminate supply when demand spikes and generate new, reserve-backed tokens when demand spikes. Every issue and redemption has an impact on global markets, which indirectly affects liquidity in traditional finance as well as cryptocurrency.

According to critics, this poses systemic risks. Stablecoin issuers are not answerable to the public, unlike central banks, and their reserve statements have frequently been ambiguous. The question of whether Tether actually possesses similar reserves has been raised repeatedly. Even Circle is operating in regulatory ambiguity despite its efforts to increase openness. These businesses essentially have central bank authority without having central bank duties.

Regulation struggles to catch up

Stablecoin classification and regulation are issues that regulators around the world are struggling with. One of the first extensive regimes is the European Union’s MiCA framework (Markets in Crypto-Assets Regulation), which mandates that issuers register, maintain enough reserves, and submit to audits. Singapore and Hong Kong are heading toward comparable models.

But there is still division in the United States. The classification of stablecoins as banks, money market funds, or a different category has been up for debate among lawmakers. The uncertainty has hindered innovation in the United States, but it has not stopped stablecoins from dominating the world market. The Biden administration and the Federal Reserve, meantime, are discreetly aware that stablecoins may have an effect on U.S. monetary policy, particularly if their size rivals that of traditional bank deposits.

Stablecoins as the backbone of DeFi and RWAs

Stablecoins currently support the majority of decentralized finance (DeFi) beyond payments. They serve as the base pair for derivatives and NFT markets, the settlement asset in decentralized exchanges, and the main collateral in lending protocols. Stablecoins are also necessary for the liquidity of Real World Assets (RWAs), which include tokenized treasuries, bonds, and stocks.

Stablecoins are, in many respects, the only cryptocurrency product that is widely used. Both speculative traders and institutional investors experimenting with tokenization depend on them since they bridge the gap between onchain and offchain economies.

A double-edged sword

While stablecoins empower users, they also concentrate power in the hands of a few issuers. Tether, Circle, and a handful of rivals control the money supply of the crypto economy. Their decisions whether to freeze assets, blacklist wallets, or adjust reserves carry real consequences for millions of users.

Additionally, there are geopolitical ramifications. Even as nations like China encourage alternatives, stablecoins successfully export the dominance of the US dollar into every sector of the cryptocurrency ecosystem, so solidifying dollar hegemony. In fact, some observers contend that stablecoins which are created by private businesses rather than central banks are the most useful instrument the US dollar has in the digital age.

The future: integration or confrontation?

The big question is what comes next. Will regulators integrate stablecoins into the financial system, treating them as digital bank deposits? Or will they attempt to dismantle their dominance by launching central bank digital currencies (CBDCs) as state-backed competitors?

If CBDCs gain traction, stablecoins may be forced into a regulated niche. But if CBDCs falter weighed down by privacy concerns, surveillance fears, and limited innovation stablecoins could become the default digital currency of the internet age.

For now, stablecoins remain the lifeblood of DeFi’s hidden central banks quietly powering a global shadow economy worth trillions. Their rise poses a fundamental challenge: when private companies act as central banks, who really controls the future of money?