- Institutional accumulation is altering the foundation of the crypto market, indicating maturity rather than momentum.

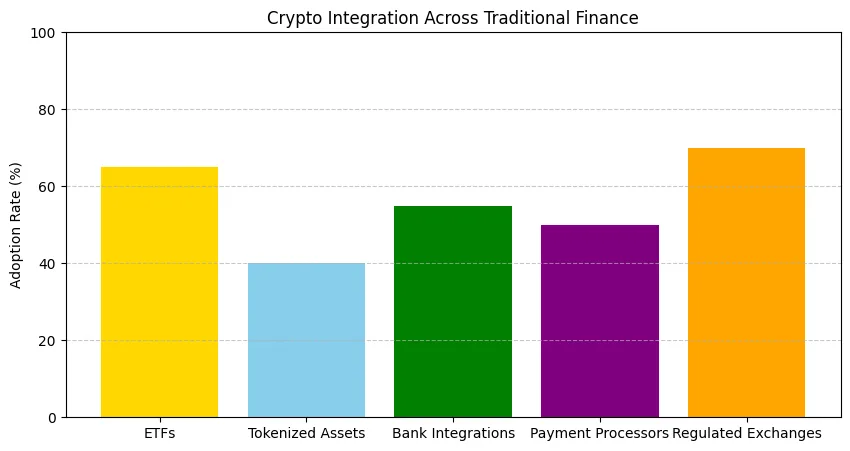

- The inclusion of ETFs, tokenized assets, and payment systems integrates cryptocurrency into the foundation of global finance.

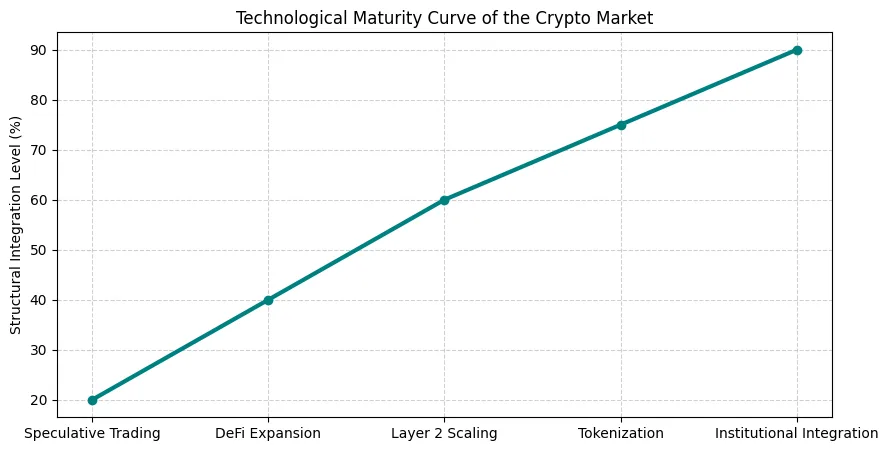

- Layer 2 scaling, tokenization, and the growth of DeFi are integrating digital assets into everyday economic practices.

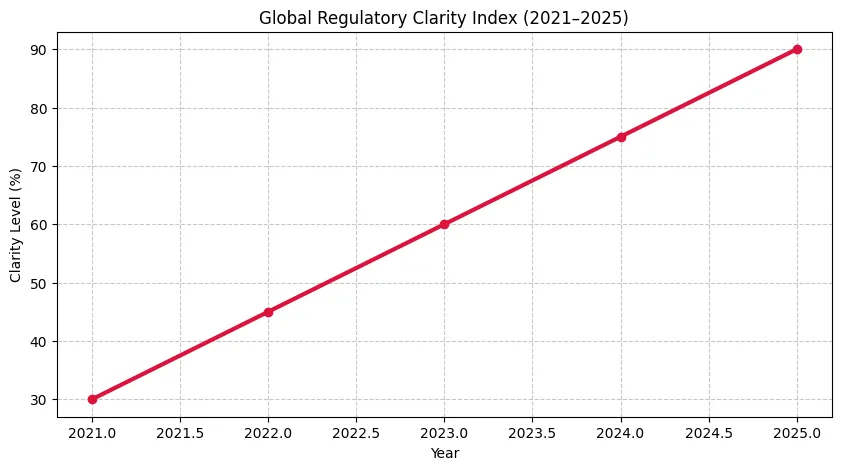

- Regulation, once dreaded, now serves as a driver for structural integration and credibility.

- On-chain and institutional signals indicate a gradual yet enduring growth on the horizon.

The calm gathering stage

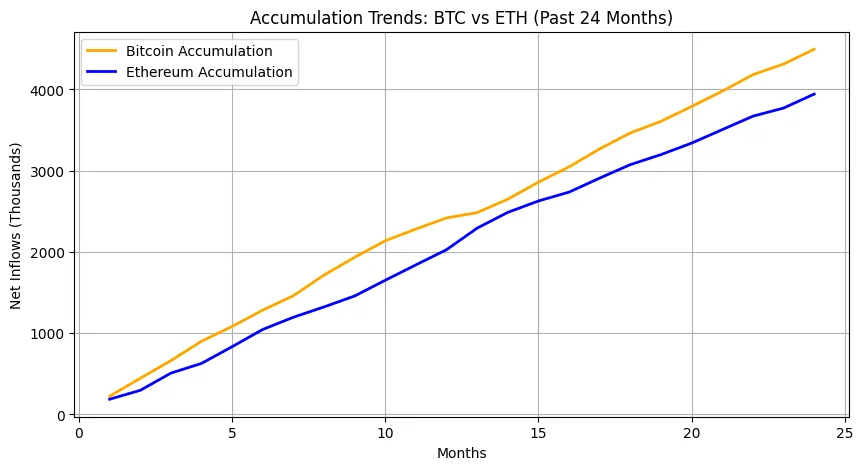

In the last eighteen months, the cryptocurrency market has been anything but quiet. However, the noise hasn’t originated from parabolic rallies or viral memes; it has resulted from a subtle, intentional accumulation by institutional investors and long-term retail holders alike. Although headlines frequently highlight volatility and abrupt spikes, the true narrative is structural: informed investors have been building positions, diversifying among Bitcoin, Ethereum, and thoughtfully chosen altcoins, often in manners undetectable to retail traders. On-chain data indicates consistent inflows to cold wallets and tactical buildup in exchange-managed accounts, suggesting calmness over fear. This accumulation stage serves as a precursor to a structural change, laying the groundwork for a cycle that might be less chaotic and more sustainable than those before it.

Embedding in traditional finance

Cryptocurrency is no longer limited to specific areas of the internet; it is becoming more integrated into the structure of conventional finance. Exchange-traded funds (ETFs), tokenized assets, and regulated exchanges are connecting digital markets with traditional ones. Banks and payment processors are incorporating crypto services, facilitating smooth transactions and custody options for corporate clients. This structural embedding converts crypto from a speculative asset into a practical element of larger financial systems. The implication is significant: the upcoming market cycle will not rely only on retail excitement or social media buzz. Rather, it will be underpinned by the influx of funds from organizations, companies, and conventional investors whose involvement is more stable and better aligned with sustained growth.

Technological stratification and market framework

The silent transformation of this market phase is not only about finance it’s also about technology. The emergence of Layer 2 networks, interoperability protocols, and enhanced custody systems has fostered a more robust market structure. Transaction expenses have significantly decreased on platforms like Optimism, Base, and Arbitrum, enabling capital to flow smoothly throughout the ecosystem. Simultaneously, tokenized tangible assets and enhanced DeFi liquidity frameworks are uniting on-chain and off-chain economies.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

This structural change indicates that crypto no longer relies on speculative stories to generate activity. Rather, it is integrating itself into everyday practices from settlements and credit markets to supply chain finance and tokenized equity platforms. The upcoming cycle’s growth will focus less on price surges and more on the efficiency improvements these technologies provide. Fundamentally, the market is evolving from digital gold to digital framework.

Regulation as a driver, not a barrier

Regulation used to be the major concern looming over the crypto industry. However, in 2025, it has transformed into the main force propelling structural adoption. The atmosphere in Washington, Brussels, and Singapore has transformed from enforcement to integration. More defined regulations regarding custody, stablecoins, and token issuance have enabled institutional involvement that was once immobilized by ambiguity.

In the United States, the approval of spot Bitcoin and Ethereum ETFs signified a turning point recognizing that cryptocurrency is a permanent fixture. In Europe, the implementation of MiCA has started aligning market standards, guaranteeing stability and compliance across borders. Asia’s regulatory environment has also evolved, establishing hubs such as Hong Kong and Dubai as entry points for capital movement.

This regulatory clarity not only legitimizes crypto; it integrates it. As traditional compliance, tax, and audit methods align with blockchain standards, crypto assets are moving from being seen as “alternative investments” to established financial instruments. In other terms, regulation isn’t the tumult preceding the tranquility it’s the framework for the upcoming growth stage.

Indications of the upcoming phase

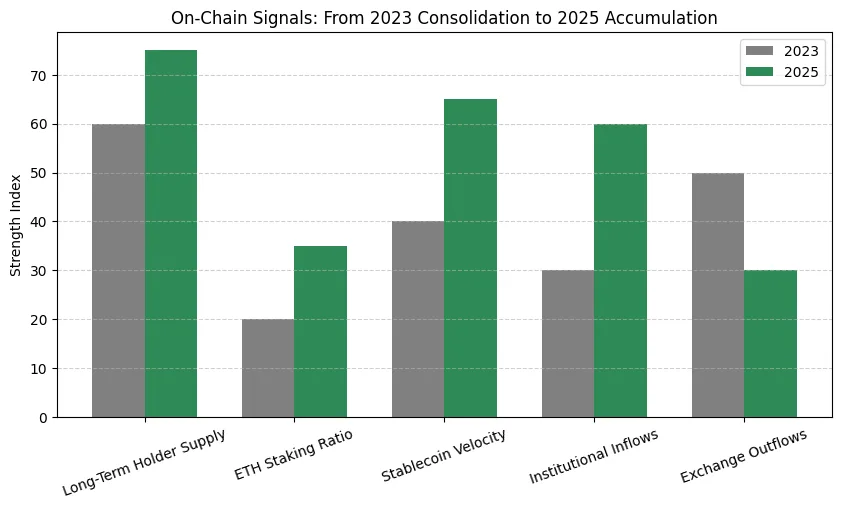

Each significant crypto bull market starts off subtly well ahead of the news, well before the masses come back. The indicators of the upcoming cycle are already apparent to those who know where to search. On-chain metrics indicate a consistent increase in long-term holder supply, all-time high staking ratios for Ethereum, and a leveling off of exchange outflows signs of consolidation prior to growth. Institutional funds are also indicating assurance: digital asset inflows have increased for six straight months, with the majority of investments directed towards structured crypto products instead of speculative altcoins.

Additionally, the velocity of stablecoins is rising a measure frequently linked to market liquidity and the rotation of capital. This isn’t the ecstatic purchasing of 2021; it’s a strategic, data-informed realignment. The foundation of the market is now stronger, its participants better skilled, and its infrastructure more effective. The upcoming cycle is expected to progress more slowly but last longer, driven by true adoption instead of speculative frenzy.