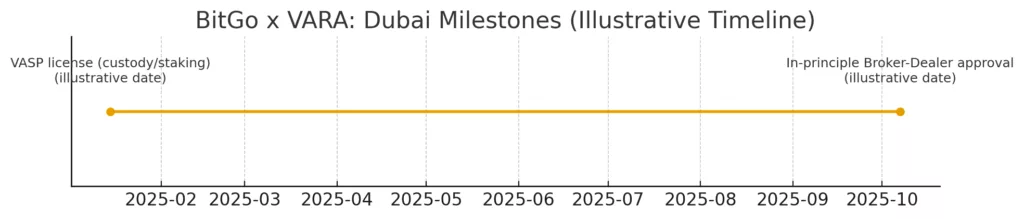

- BitGo’s Dubai branch progresses from a custody license to provisional broker-dealer approval under VARA, connecting safekeeping and execution.

- Institutional obstacles in MENA evolve: controlled custody and monitored trading enable capital allocation by sovereign funds, pension schemes, and family offices.

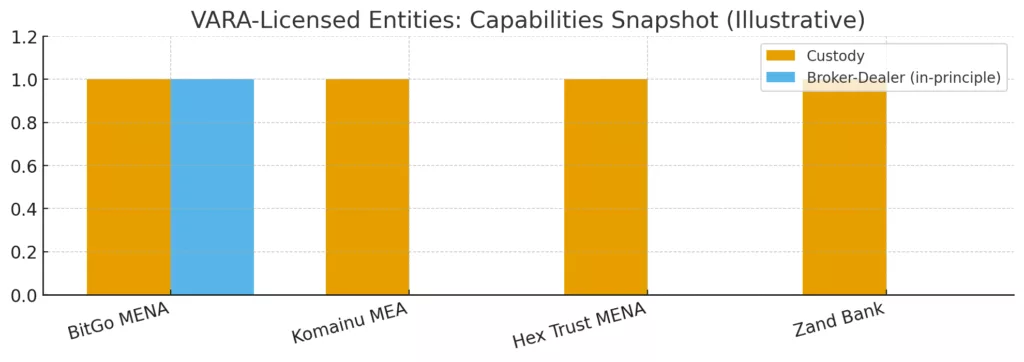

- VARA’s licensing framework fosters confidence and motivation, promoting the use of licensed custodians by financial institutions and trading platforms.

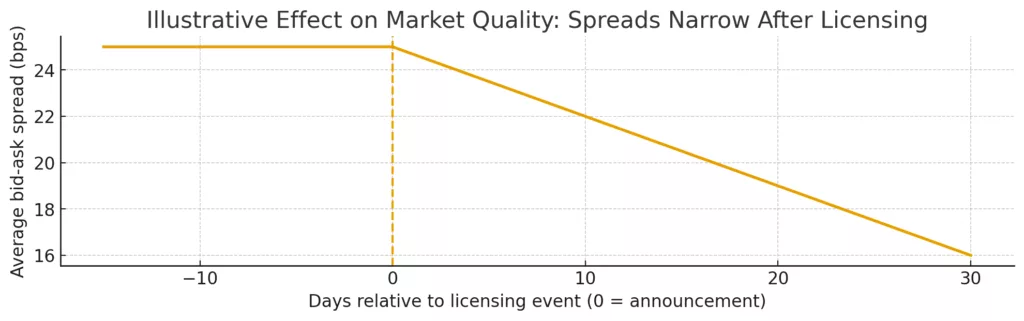

- As Dubai strengthens its position as the crypto hub of the region, deeper liquidity, narrower spreads, and new institutional-quality products are anticipated.

- The shift indicates a fundamental change for MENA: transitioning from retail speculation to infrastructure sophistication, aligning Dubai with New York, London, and Singapore.

Dubai not only included another logo in its virtual-asset registry this quarter; it reinforced the framework for a regional bridge for institutional capital. BitGo’s Dubai branch has progressed from a custody-first approach to a broker-dealer stance under the UAE’s Virtual Assets Regulatory Authority (VARA), transforming a former compliance requirement into a broader channel for investment, risk management, and structured crypto offerings throughout MENA. The distinction is slight yet crucial: custody ensures asset security; broker-dealer allowances link that security to execution, liquidity, and ultimately portfolio development. When those rails are established within a reliable regulatory framework, volatility transforms from a deterrent into a factor that can be evaluated, utilized, and managed for risk.

For regional investors such as sovereign wealth funds, banks, insurers, pensions, and family offices, the challenges were not solely related to belief in cryptocurrency’s potential gains. They were functional: counterparty risk, ambiguous licensing, insurance, auditability, and the capacity to execute transactions within a regulated framework. An initial step is having a local custodian with institutional controls. The second is a locally monitored channel for trading. They collaboratively change Dubai from a hub for remote execution to a location where mandates can be drafted, risk committees can approve, and compliance officers can rest easily. In other terms, the focus shifts from speculation to infrastructure.

That change should spread along three paths. Initially, liquidity depth is considered. With increased institutional capital moving to licensed platforms, order books expand, spreads narrow, and slippage decreases. These dynamics don’t remove crypto’s inherent volatility, but they refine it, transforming air pockets into tradable noise instead of life-threatening risks. Next is productization. The MENA region is ready for tokenized funds, custody-supported derivatives, and yield instruments related to staking designed for pensions and private banks instead of just retail investors. Next is competition. Local platforms will either collaborate with licensed custodians and execution venues or contend with an escalating competition in controls, reporting, and risk management. Both routes elevate the area’s baseline.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

The initial urge is to consider this a story exclusive to Dubai. It is not. Capital is localized even when regulations are regional. If Dubai is the place where entities can securely manage and transfer digital assets, then Bahrain, Saudi Arabia, Qatar, and Egypt will experience the attraction regardless of whether their systems develop at the same pace. Treasury desks will redirect liquidity via the route with minimal regulatory hurdles; product teams will create wrappers that transcend borders while the underlying execution remains in the UAE. Skill adheres to the same slope. Every additional approval intensifies the clustering effect: attorneys, risk analysts, market-structure experts, and product designers gravitate towards locations where transactions finalize and mandates exist. In this regard, BitGo’s move represents not only a victory for a single firm; it also strengthens the GCC’s effort to establish itself as the crypto finance center of the Global South.

Doubt remains relevant in the discussion. Regulation throughout MENA is inconsistent, and flawless custody still does not eliminate protocol risk. Bugs in smart contracts, failures of validators, and governance disruptions stay external to the balance sheet of any custodian. Macro policy can similarly disrupt local strategies; a sudden change in U.S. interest rates or an unexpected move in European regulations can alter cross-border transactions instantly. With the entry of additional global providers into the Gulf, pricing pressures will challenge unit economics. The issue isn’t that risks disappear; rather, the market is now capable of assessing them using tools that meet institutional standards.

Volatility, frequently portrayed as the critical weakness of crypto, appears distinctly when viewed this way. Through actual custody and monitored execution, it turns into a quantifiable spread, a manageable exposure, and occasionally a source of additional return. Market quality enhances when reliable participants adhere to trustworthy regulations. In the near term, the most noticeable sign is narrower spreads.

What follows is a transformation of identity. For years, the narrative of the region’s crypto space has revolved around retail expansion and the emergence of exchanges; the upcoming phase will focus on mandates, benchmarks, and risk budgets. Should VARA persist in enhancing its oversight as companies like BitGo expand their offerings from custody to execution to prime-style services, Dubai will not just be “friendly” to crypto; it will become bankable. That’s the point that converts headlines into distributions. Liquidity draws in more liquidity, and trustworthy platforms attract reliable issuers: tokenized money-market funds for managing cash, verified staking products for yield segments, and derivatives that correspond to actual hedging requirements instead of speculative activity. Every new tool brings a distinct type of balance sheet to the mix, increasing the depth of the water and smoothing the surface.

Any individual approval can be over-analyzed. However, the trend is difficult to overlook. Dubai is intentionally weaving together the unexciting, regulation-intensive infrastructure that organizations need. BitGo’s progress within that framework serves as the link between vault and venue. If the 2021 period focused on stories, the 2025–2027 period in MENA centers on infrastructure. This is how volatility shifts from a cause for waiting into a motive for action, as returns arise not just from price but from the capacity to access, secure, hedge, and report exposures in defensible ways for fiduciaries.

In that context, BitGo’s narrative in Dubai appears more as a regional model than a press release. Establish reliable custody. Incorporate supervised execution. Allow liquidity and productization to proceed accordingly. Maintain regulations strict enough to build confidence yet adaptable enough to encourage creativity. Accomplish that, and you not only embrace crypto in the Gulf but also transform how the Gulf interacts with global capital.