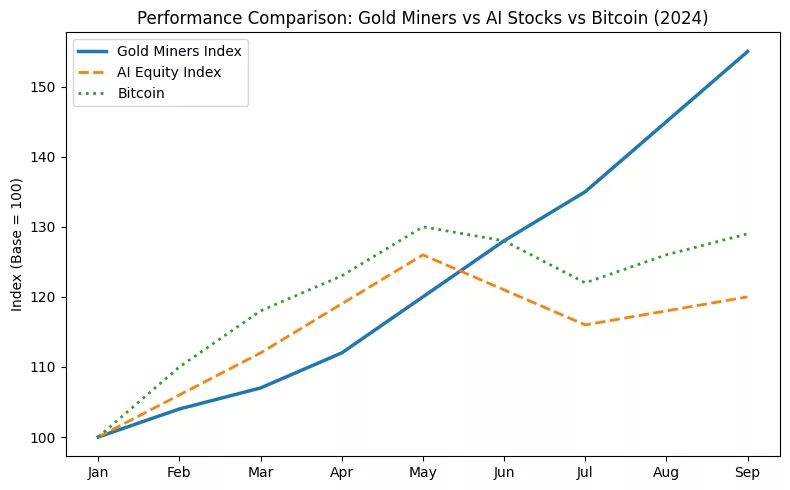

- Gold mining stocks have risen 55% year-to-date, surpassing AI equities and Bitcoin as investors shift towards physical assets.

- The increase is fueled by central bank purchases, macroeconomic uncertainty, and declining real yields.

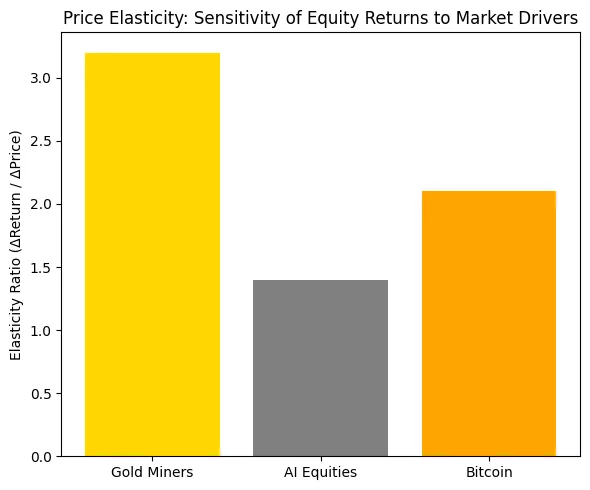

- Mining stocks provide three times the responsiveness to gold prices in comparison to AI or Bitcoin, enhancing upside possibilities.

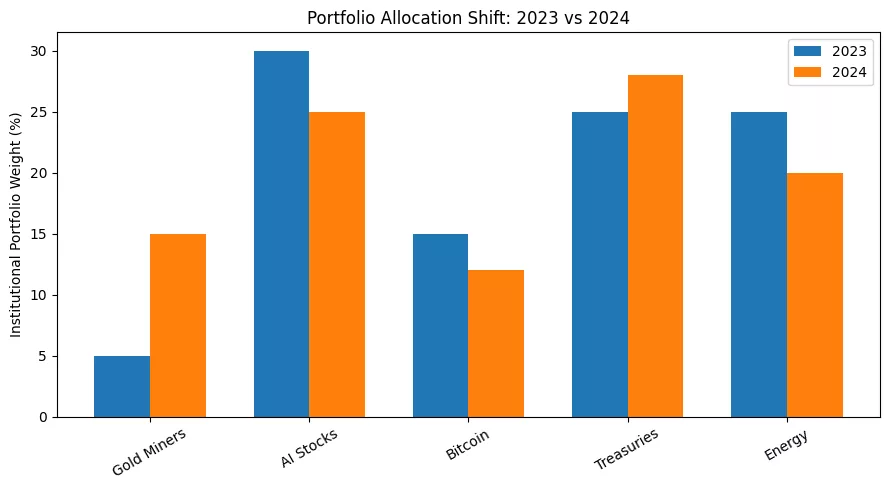

- Institutional portfolios are transitioning from speculative technology to resource-focused sectors for more stable returns.

- Analysts caution about cyclical risks, yet the overarching trend indicates a shift back to physical value amidst digital fatigue.

In a time characterized by AI adoption and Bitcoin’s digital gold hype story, traditional miners have subtly taken centrestage. With tech valuations stabilizing and crypto’s pace slowing, gold mining companies, previously regarded as remnants of the past, are now at the forefront of worldwide returns.

From hype to haven

The most recent report from the Financial Times emphasizes that the S&P Global Gold Mining Index has surpassed both the Nasdaq AI Index and Bitcoin in performance during the last quarter. The rally is not based on speculation. It stems from financial fatigue; the markets indicate a shift from excitement about innovation to real value.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Gold’s enduring allure has intertwined with contemporary macro concerns: geopolitical instability, expectations of interest rate cuts, and dissatisfaction with fiat currency. When risk assets falter, gold shines, and this time, the miners are gaining even more than the metal itself.

Gold’s relentless comeback

In early 2024, Bitcoin and AI stocks captured attention, but gold subtly reached unprecedented highs beyond $2,500/oz in late September. The surge in the precious metal, usually seen as a defensive asset, was instead fueled by aggressive demand, especially from central banks and sovereign wealth funds diversifying away from the dollar.

Gold mining stocks, which had been trailing spot gold prices for a long time, suddenly caught up. S&P data shows that leading companies such as Newmont, Barrick, and Agnico Eagle increased by 30–45% in the past three months, surpassing Nvidia, Tesla, and even Bitcoin.

Here is a performance comparison chart featuring gold mining stocks, AI-related equities, and Bitcoin from January 2024 onwards.

The anatomy of the rotation

This turnaround is not coincidental; it’s systematic. Investors are moving from growth to value, from narrative-driven stocks to financial statements

AI stocks, although still holding premium valuations, are experiencing earnings fatigue particularly as Nvidia’s data center margins level off and Big Tech pulls back. At the same time, Bitcoin’s surge, fueled by ETF inflows earlier this year, has slowed as liquidity decreases and macroeconomic uncertainty increases.

Conversely, gold miners gain from increasing metal prices and reduced production expenses due to falling energy inputs. Their ability to detect gold prices transforms every 5% increase in metal into a 15–20% rise in equity.

The ensuing visualization contrasts the price elasticity of gold mining stocks with AI equities and Bitcoin, illustrating how minor changes in commodities lead to significant returns for miners.

Fundamental drivers: Geopolitics, liquidity, and fear

The revived affection for “neglected” assets such as gold mining stocks is also a macro narrative. Central banks in China, Russia, and the Middle East are persistently gathering gold at unprecedented speed, altering global reserves away from the dollar. In the meantime, actual yields are weakening a longstanding advantage for gold.

However, the underlying cause might be the loss of trust. From AI illusions to cryptocurrency scams, investors seek physical, limited, and geopolitically stable assets.

In a realm of algorithmic uncertainty and digital obscurity, gold’s straightforwardness is its advantage. Mining firms, previously regarded as outdated, now embody access to something invigoratingly tangible: the material basis of worth.

The heatmap below depicts the change in 2024 portfolio distributions, with gold miners increasing institutional prominence as speculative tech investments diminish.

Analysis: Is this the new “AI” trade?

Gold’s superior performance prompts an unsettling question: are we observing a hidden bubble cycle.

Although the fundamentals are more robust this time, mining shares traditionally exhibit cyclical behavior. The current risk is in excessive rotation: if inflation decreases or rate cuts fall short, gold’s momentum might diminish rapidly. Additionally, AI and Bitcoin could recover when liquidity comes back, turning this trade into more of a macro hedge rather than a fundamental change.

However, the more significant insight is psychological. Following years of intangible assessments in the digital and algorithmic marketplace, investors are re-embracing the security of physical assets. The identical investors who previously purchased AI stories are now acquiring minerals and land.Gold mining, previously representative of stagnation, has transformed into a symbol for a fatigued market seeking something substantial.