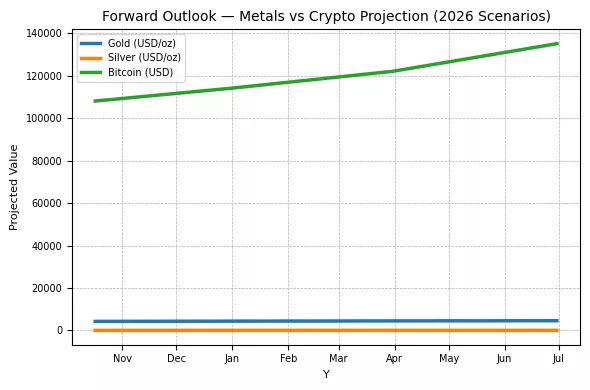

- Gold could stabilize over $4,200 and might reach $4,500 if real yields decrease further.

- Silver’s industrial need sustains its upward potential, bringing the gold-silver ratio closer to 75.

- Bitcoin may bounce back in 2026 as liquidity improves and institutional investments resurge.

- The divergence between metals and crypto might evolve into a complementary relationship rather than one of competition.

- “Scarcity premium” whether from mining or coding shapes the upcoming investment story.

Gold’s ascent: Structural drivers behind a record surge

On October 16, 2025, gold soared above USD 4,300 per ounce, surpassing earlier all-time records due to heightened safe-haven interest. This rally is fueled not merely by volatility or speculative excitement.

The core of gold’s surge lies in the relationship between real interest rates and inflation. With nominal yields on government bonds staying high, inflation has reduced real returns, resulting in a decrease in real yields (nominal yield minus inflation), which in some instances has turned negative. Gold, which yields no return on its own, becomes relatively more appealing when bonds offer inadequate real rewards. Historically, gold and real yields have shown a strong opposite relationship when real yields decrease, gold usually increases.

Adding to this is the increasing belief among investors that the U.S. Federal Reserve is approaching a pivotal moment. Markets are anticipating forthcoming rate cuts to boost growth in light of weakening labor data and inflationary pressures. This change in anticipated monetary policy lowers the opportunity cost of maintaining non-yielding assets such as gold.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

A significant driver is geopolitical risk and uncertainty in policies. Rising tensions between the U.S. and China, unpredictable trade policies, and ongoing fiscal deficits in key economies are increasing the risk premium on secure assets. Gold is gaining from its traditional function as a safeguard against risks when trust in paper assets falters.

The dynamics of currency also have an impact. In 2025, the U.S. dollar will depreciate, resulting in lower gold prices for purchasers using other currencies and increasing international demand. At the same time, numerous central banks persist in building gold reserves, bolstering structural demand that is not as affected by short-term movements.

In summary, gold’s swift rise is supported by factors beyond mere momentum or excitement. It relies on the decline of actual yields, the evolving position of central banks, increased risk premiums, and ongoing institutional support. In this context, gold is not merely responding; it is reaffirming its supremacy in the asset hierarchy.

Silver’s explosion: Industrial demand meets safe-haven flow

Although gold’s rise is based on macro and monetary factors, silver’s surge indicates a more intense mix of influences. Silver, utilized in electronics, solar panels, and batteries as an industrial metal, is gaining from increasing demand in green technology industries. That demand is increasing even while global supply is having difficulty keeping pace.

Reports indicate unusual pressure in silver markets: backwardation in futures markets (spot trading exceeds future prices), increases in borrowing/loan rates for silver contracts (some reaching 30–40 % in pressured markets), and very low warehouse stocks. These indicators suggest a physical shortage or constraint. In other terms, the market is displaying signs of pressure rarely observed in precious metals.

Silver’s dual nature (both industrial and precious) results in a higher beta: it can excel during bullish periods in speculation but can also decline when trends turn around. Currently, there is a convergence occurring: safe-haven investments are directing funds into metals, and silver, being less expensive and more volatile, draws greater speculative interest compared to gold.

Crypto’s pause top coins losing momentum

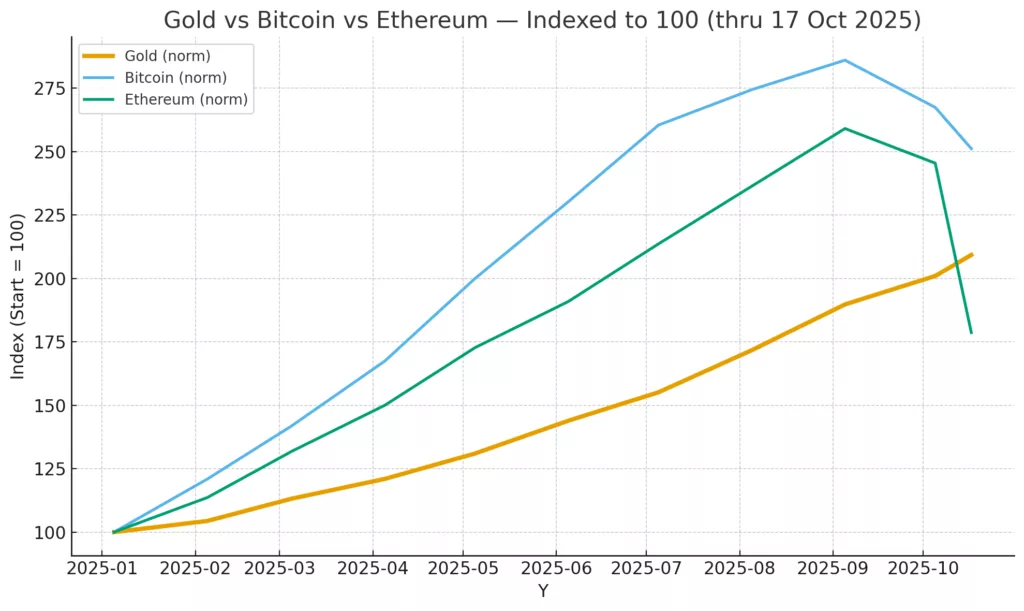

As gold and silver reach new peaks, the cryptocurrency market is experiencing a slowdown. Bitcoin is priced around USD 108,000, decreased from its summer high exceeding USD 123,000, indicating a waning risk appetite and a shift of capital into physical assets. Ethereum has taken a comparable route, lingering around USD 5,100, whereas Solana has dropped to approximately USD 190, indicating that altcoins are significantly more reactive to liquidity trends.

The slowdown in cryptocurrency performance doesn’t indicate failure; instead, it represents a realignment. As yields decline and institutional investors shift to metals for hedging, liquidity in digital assets briefly contracts. Bitcoin’s earlier association with gold as “digital gold” has diminished, leading to a negative short-term correlation with gold at -0.45, based on recent metrics from CME and Glassnode, in contrast to a positive correlation of 0.6 earlier this year.

A portion of the difference arises from placement. Hedge funds and major institutions view crypto mostly as a high-beta asset instead of a defensive investment. When markets transition to a risk-off environment such as the current situation those same funds reduce their involvement in crypto while increasing investments in gold ETFs and tangible assets. Essentially, Bitcoin functions as a safe haven primarily in long-term inflation hedging scenarios, rather than during periods of immediate macroeconomic tightening or uncertainty.

At the same time, Ethereum and Solana are showcasing the decline in DeFi and NFT engagement, with daily active addresses decreasing more than 20% month-over-month, indicating that speculative involvement has diminished. Nonetheless, on-chain indicators like exchange reserves and accumulation by long-term holders display strength Bitcoin supply retained for over a year stands at 69%, close to all-time highs, indicating that committed investors are holding onto their assets.

In general, the pause in crypto is more of a reset than a failure. Following a stronger performance than stocks and bonds through much of 2024–2025, the market is absorbing gains as it awaits more definitive monetary indications. Numerous analysts think that after the Fed officially reduces rates, Bitcoin might mimic gold’s path with a delay, reflecting previous cycles where crypto trailed metals by two to three months.

Interrelation rotation, correlation, and capital shifts

The present phase of the market indicates a notable separation between gold, silver, and crypto, viewed not as a fleeting divergence, but as a fundamental reconfiguration of capital movements. Investors are shifting from speculative, high-risk assets to solid stores of value, indicating a favor for reliability over possibility. This shift is most evident in the concurrent rise of metals and the decline of digital assets.

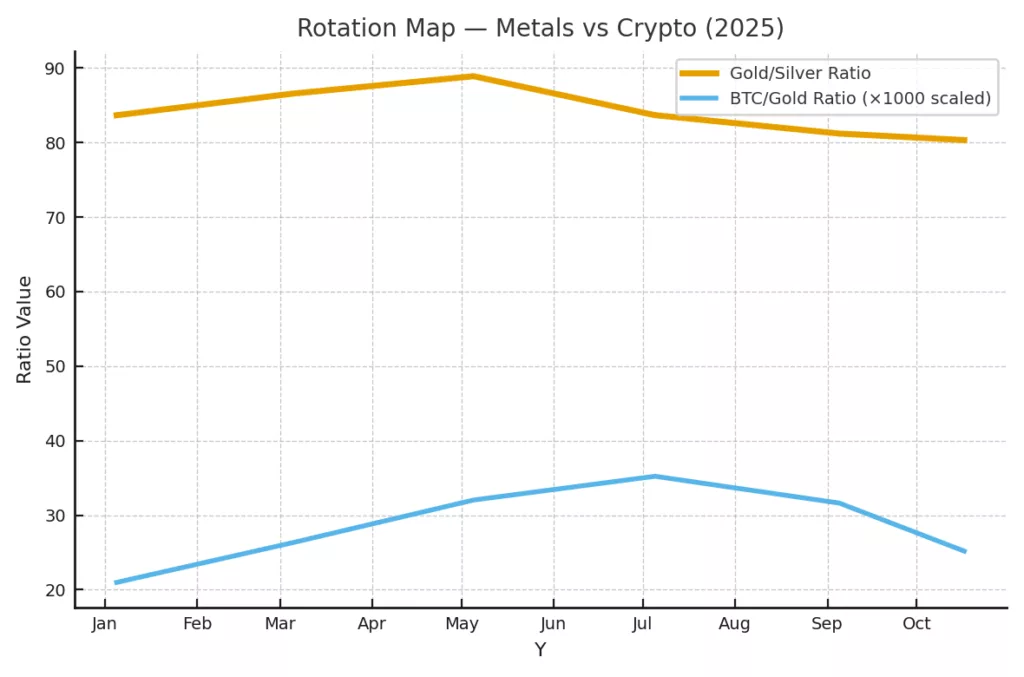

For years, Bitcoin and gold frequently moved in somewhat alignment: both gained from liquidity injections and risk-averse sentiment. By 2025, the relationship has broken down. Gold and silver are currently influenced mainly by real yield compression, increasing fiscal deficits, and greater demand from central banks, whereas Bitcoin’s path is more tied to market liquidity, risk sentiment, and leverage factors. The short-term relationship between gold and Bitcoin, previously around +0.55 last year, has shifted to neutral or negative, with rolling 30-day figures varying between –0.3 and –0.5. This change underscores a disparity between safe-haven interest and speculative bets.

Streams validate this adjustment. Data from exchange-traded funds (ETFs) indicate significant inflows into precious-metal funds, marking the highest levels since 2020, whereas inflows into crypto funds have stabilized since the middle of the year. Institutional desks indicate consistent gold purchases from central banks and sovereign wealth funds, along with constricting physical supplies in the markets for both gold and silver. Conversely, crypto capital has stalled, caught between a decreased risk appetite and diminishing short-term stories. The market clearly indicates that physical scarcity is once more surpassing digital potential.

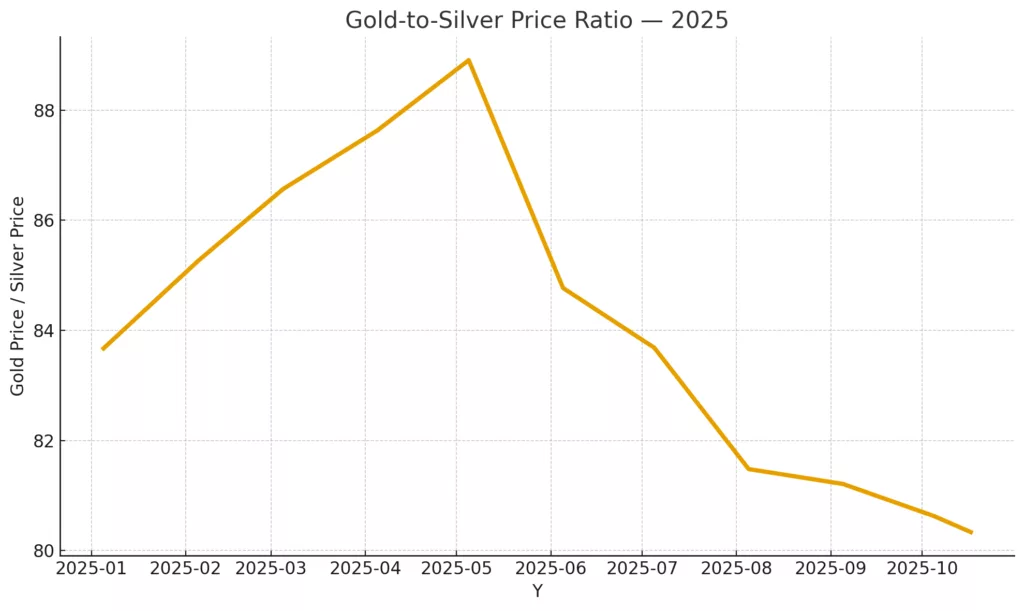

This change is also evident in cross-asset ratios. The gold-to-silver ratio, beginning 2025 close to 100, has decreased to around 80 as silver surpasses the increases in gold. Simultaneously, the BTC-to-gold ratio has contracted from around 30× to about 25×, suggesting that investors currently value digital risk less compared to physical scarcity. These actions indicate not a decline in trust in crypto, but a reassessment of perceived safety and longevity.

Liquidity is essential in this new balance. Both metals and cryptocurrencies flourish in conditions of increasing liquidity, yet their reactions vary. When the dollar declines or central banks indicate easing, gold responds almost immediately, whereas Bitcoin’s surge now demands further validation like fresh ETF inflows or stabilization in the equity market. The transmission mechanism has evolved: liquidity first enhances tangible assets, and speculative digital assets only afterward, if it happens at all.

Apart from economics, psychology adds to the overall understanding. Metals symbolize apprehension regarding policy shortcomings, whereas crypto reflects optimism for financial transformation. In 2025, anxiety prevails. Investors encountering financial unpredictability, political tensions, and systemic threats favor the reliability of what they can measure and keep. The shift from code to commodity isn’t a withdrawal from innovation it’s a readjustment to what seems authentic in unpredictable times.

What comes next for metals and digital assets

As 2025 approaches its last quarter, the overarching conditions shaping this shift between physical and digital assets continue to evolve. The main factor is the Federal Reserve’s forthcoming decision and the timing of global liquidity stabilization. Both metals and cryptocurrencies are situated at critical junctures where changes in policy, inflation outlooks, or dollar strength might redefine correlations .

Gold’s supremacy appears to be maintainable in the short term. The macro environment of negative real yields, ongoing fiscal strain, and geopolitical division still supports increased gold allocations for institutional investors. With central banks increasingly diversifying their reserves away from the dollar, gold may stay structurally supported above the $4,200–$4,300 level, facing new resistance only around $4,500. Analysts perceive this as more than a temporary upswing; it represents a reassessment of gold’s international significance within a multipolar financial framework.

Silver’s path could be even more volatile. Demand from industries linked to renewable energy, electric vehicles, and battery technologies persists in supporting physical tightness. Its fluctuations will continue, yet the metal’s dual nature as both industrial and precious positions it as the main beneficiary of economic stabilization. Should the green-tech cycle pick up speed in early 2026, silver may surpass gold once more, leading the gold-to-silver ratio to decrease toward 75.

For cryptocurrency, the consolidation in 2025 might turn out to be a tactical break rather than a drop. The narrative of Bitcoin as digital gold hasn’t vanished; it has transformed. Institutional investors are increasingly viewing it as a long-term volatility hedge instead of a liquidity play. As interest rate reductions occur and global liquidity increases, Bitcoin might enter a postponed catch-up period, particularly if stock market volatility levels off. Ethereum’s relative strength is dependent on network demand and the recovery of the fee market, as the wider altcoin market continues to face challenges in attracting new capital inflows.

The upcoming convergence of metals and crypto will rely on trust and returns. Should fiat real yields decline further and policy trust diminishes, metals will remain dominant. If the growth of liquidity outpaces inflation expectations, digital assets may experience a comeback. The two markets are no longer identical but rather complementary representations of investor sentiment: gold provides a hedge against failure, while Bitcoin embodies speculation on reinvention.

The story as we approach 2026 isn’t about metals against crypto; it’s about diversifying stores of value. Investors are no longer deciding between digital and physical assets; they’re distributing across both, adjusting to a financial landscape where scarcity, whether derived from mining or coding, establishes the new value.