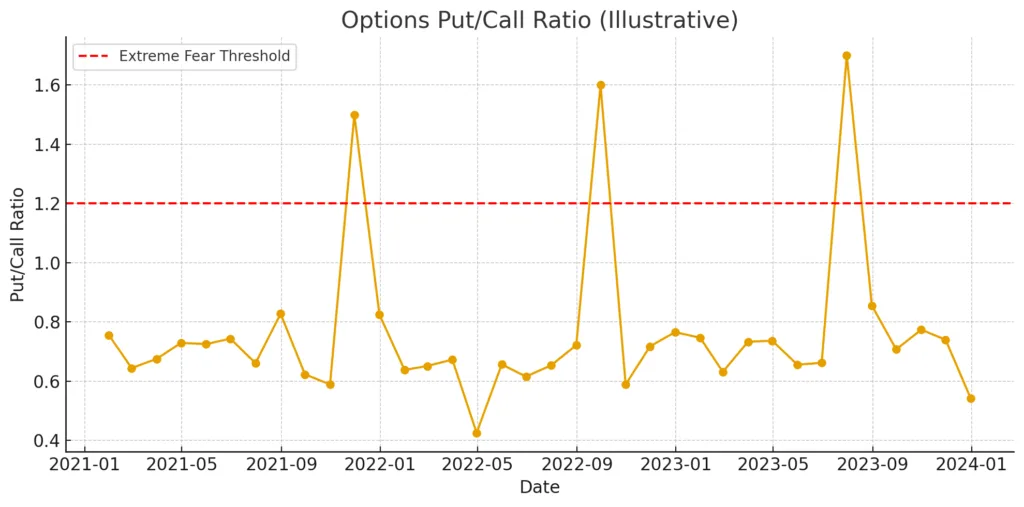

- Options markets indicate apprehension via heightened put-to-call ratios, skew, and spikes in implied volatility, frequently signaling impending market lows.

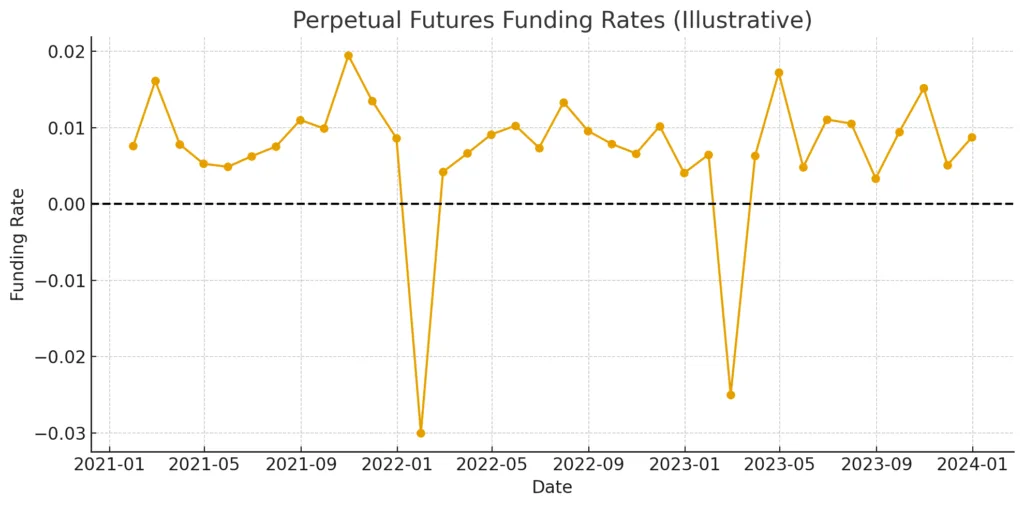

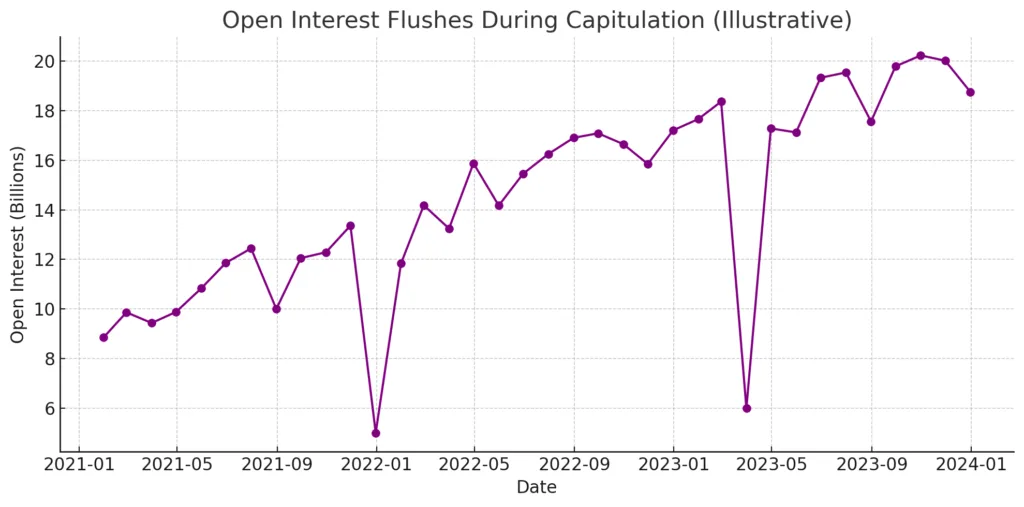

- Perpetual futures funding rates and open interest fluctuations reveal leverage fatigue, indicating the moments when capitulation transforms into recovery.

- Present data indicates stress, yet not complete surrender, implying we are near a bottom but not at the extremes characteristic of historical turnarounds.

Market bottoms are not moments of quiet or serene contemplation. They represent intense peaks in the narrative of financial cycles, shaped by surrender, where anxiety overtakes certainty, funding becomes scarce, and investors rush to safeguard what is left of their holdings. Conventional technical indicators and macroeconomic signals offer valuable reference points; however, in recent years, the most telling insights have come not from spot price charts or central bank policy announcements, but from the derivatives markets. In particular, options and perpetual futures have developed into some of the most dependable predictors of exhaustion and reversal.

Options markets enable us to see the equilibrium between greed and fear by examining hedging costs, the comparative demand for puts and calls, and how volatility is incorporated into contract pricing. In the meantime, perpetual futures markets, featuring their distinct funding methods, indicate where leverage is being applied most intensely and if traders are incurring additional costs to hold long or short positions. Combined, these two areas form a lens for the market’s psychological aspects. When spot prices seem to decline indefinitely, it is frequently the options and perpetual data that indicate when exhaustion has maxed out and when last-resort buyers are subtly gearing up for the recovery.

The structure of a bottom, thus, is more than just a chart pattern; it represents a change in positioning, a collective instant when fear reaches its peak and leverage diminishes. Through the analysis of options skew, put-to-call ratios, funding rates, and open interest movements, analysts frequently identify those hidden inflection points where difficulty shifts into potential.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Options as a sentiment thermometer

The options market acts as one of the most evident indicators of investor sentiment. In contrast to spot or futures markets, where trades have a specific direction, options provide both security and speculation, rendering them extremely responsive to high levels of fear and optimism. Traditionally, market lows have seen a significant increase in the need for downside protection. When investors hurriedly purchase puts, the put-to-call ratio surges, occasionally doubling or tripling relative to typical levels. These spikes signify not calculated caution but sheer panic, a belief that losses will persist and that safeguarding at any price is better than the danger of being unprotected.

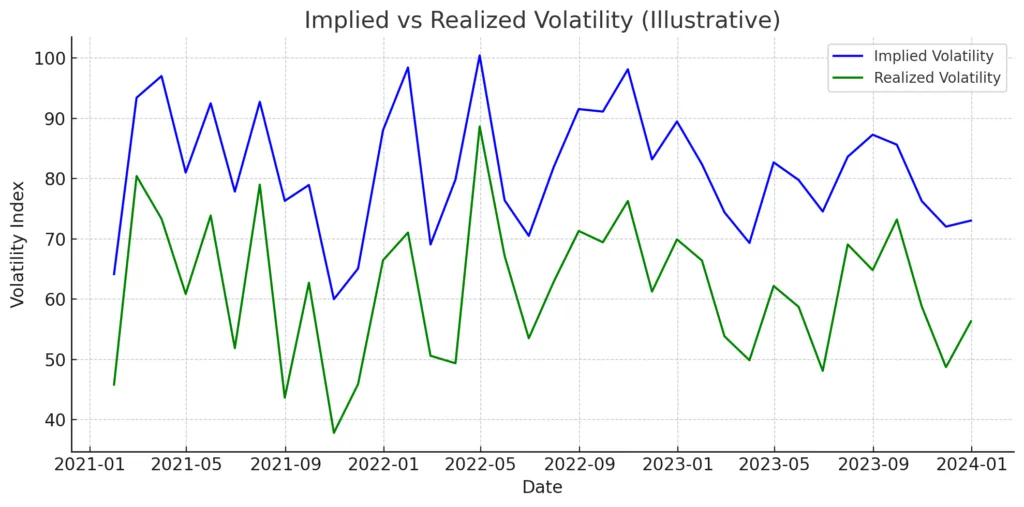

An additional dimension arises from implied volatility. As fear escalates, the price of options rises significantly. In the midst of steep selloffs, implied volatility frequently spikes to two or three times the level of realized volatility, indicating that the premium is driven not by actual movements but by the anticipation of heightened future turbulence. The disparity between puts and calls also increases, with downside puts being traded at several times the rate of their upside equivalents. This skew indicates a lopsided market, where hedging demand is so intense that it disrupts typical pricing patterns. Historically, such distortions have frequently coincided with the instances when selling pressure was nearing its end.

Open interest provides yet another dimension. Around bottoms, we frequently see heavy concentrations of open put contracts sitting just below market price. When the market holds or bounces, these puts lose value rapidly, triggering short covering and a cascade of buying. What was once fear-driven positioning becomes the spark for a rebound.

The options market thus conveys a narrative not only of safety but also of fatigue. When hedging costs soar to excessive levels and the need for downside prevails, it typically does not indicate the start of a lengthy downturn but rather a sign that sellers are close to exhausting their power.

Source: Generated with Python, Implied volatility regularly operates at a higher level than realized volatility, with surges during stressful situations indicating fear-based pricing that frequently aligns with market lows.

Perpetual futures: the pulse of leverage

In the realm of cryptocurrency, perpetual futures introduce a unique aspect to market evaluation. In contrast to standard futures, these contracts lack an expiration date, meaning their balance is sustained via a funding mechanism. The funding rate likely provides the most straightforward insight into trader confidence, as it indicates the expense of maintaining long or short positions. At market peaks, funding rates become excessively positive as buyers are eager to pay any premium to maintain their positions. At market lows, funding rates drop significantly into negative levels, indicating a substantial surge in short positions.

This occurrence has recurred in every significant decline. In the March 2020 Covid crash, Bitcoin perpetual funding rates hit unprecedented negative levels as traders rushed to take short positions. Comparable extremes took place in the summer of 2022 amidst the Luna and Three Arrows Capital downfall, and once more in November 2022 during the FTX crisis. In every instance, when funding became substantially negative and remained so for multiple days, the market had already anticipated the most unfavorable results. The shorts became congested, and when the selling pressure eased even a bit, forced liquidations triggered the initial stages of recovery.

Open interest is an essential factor. A sharp decline in open interest often genuinely indicates capitulation. When vast sums of money in positions are liquidated quickly, the market is purged of leverage. This flush resets the market, resulting in traders who are unleveraged or have a long-term structural outlook.

The futures basis plays a role in this narrative as well. During periods of panic, futures contracts may be sold below spot prices, a situation referred to as backwardation. This reversal indicates significant pressure, as participants are prepared to sell futures at reduced prices merely to avoid risk. When such circumstances arise, historical evidence indicates that the likelihood of a bottom rises considerably.

Historical precedents of derivatives predicting bottoms

History presents numerous instances in which derivatives markets, including options and perpetual futures, have predicted the conclusion of severe downturns long before stable spot prices emerged. The 2008 worldwide financial crisis, while focused on stocks and credit, offers a preliminary case study. In late 2008, the option-implied volatility indicated by the VIX soared past 80, significantly surpassing the realized volatility. The immense need for puts exposed a market overwhelmed by fear, but it simultaneously indicated the exact area where stocks reached their lowest point. Investors who identified the fatigue within options pricing benefited as stocks started their extended rebound in early 2009.

In cryptocurrency markets, the proof is even more compelling. The Covid crash in March 2020 caused Bitcoin to drop by almost 50% within two days. During this surrender, perpetual futures funding rates plummeted to significantly negative levels on prominent exchanges, while open interest vanished as billions of dollars were liquidated. Simultaneously, options skew indicated unprecedented demand for protective measures against downside risk. This remarkable alignment of indicators came before one of the most significant recoveries in Bitcoin’s history, resulting in the asset doubling within a few months.

A further educational moment occurred following the Terra-Luna collapse in mid-2022. The collapse of a major stablecoin and the resulting bankruptcy of leading hedge funds produced unmatched pressure. Options markets showed significant put skew and implied volatilities that far exceeded realized levels, whereas perpetual markets noted unprecedented negative funding rates. Despite the dire sentiment, these extremes once more indicated a bottoming process. By the time FTX imploded later that year, markets had already shed significant leverage, and although prices dropped further, the comparative derivatives indicators implied that the capitulation phase was already in progress.

The 2020 pandemic panic demonstrated the same lesson even in stocks. SPX options skew shifted significantly negative, indicating strong apprehension about additional drops. Perpetual leveraged ETFs and futures faced significant outflows and backwardation. With policymakers implementing emergency measures, these derivative signals had already indicated the waning of fear, forecasting the eventual recovery.

What remains constant throughout these episodes is not the particular event but the psychology uncovered in derivatives markets. When hedging becomes excessively costly and leverage leads to involuntary selling, the conditions are primed for a rebound. Consequently, options and perps do not simply reflect spot price; they anticipate turning points by magnifying human actions.

Where we are today

The primary concern on trading desks at present is if the prevailing circumstances correspond with historical market lows. To respond, we need to analyze today’s derivatives environment through the same perspective that uncovered previous pivotal moments.

In the options market, the skew has consistently favored put options, although not to the disastrous levels observed during occurrences such as Covid or FTX. The put-to-call ratio has increased consistently in recent weeks, indicating caution, yet implied volatility has not surged compared to realized volatility. This indicates that investors are hedging more than normal yet are not factoring in catastrophic risk. This pattern frequently aligns with mid-cycle adjustments instead of final lows.

Perpetual futures information delivers clearer signals. Funding rates on leading exchanges have decreased into negative territory amid recent downturns, albeit only slightly compared to historical lows. Crucially, open interest stays high, suggesting that leverage has not been removed from the system yet. Historically, genuine market bottoms have aligned with drastic declines in open interest, eliminating billions in speculative holdings. The lack of this purging event indicates that although stress is increasing, complete surrender has not transpired yet.

The futures basis warrants consideration as well. In conventional futures and CME Bitcoin contracts, spreads have narrowed considerably, sometimes edging into backwardation. This indicates constricting liquidity and increasing apprehension, yet the situation has not endured long enough to resemble historical bottoming indicators. Instead, it illustrates a scenario of careful doubt rather than complete hysteria.

Macro conditions add more complexity to the situation. In contrast to 2020, when central banks inundated the system with liquidity, the present situation is characterized by tight policies and persistent inflationary pressures. This environment establishes a stronger tether for risk assets, implying that derivative indicators might have to attain more extreme levels to create a lasting low.

What is our current situation? The current state of derivatives suggests vulnerability but not an end. Options pricing indicates apprehension but not hysteria. Perpetual markets exhibit strain but not fatigue. Leverage remains, anticipating a trigger for purification. In summary, we are nearer to a late-cycle adjustment than a conclusive market low. The indicators that have traditionally indicated a lasting recovery a decline in open interest, significant skew, and highly negative funding are not completely established yet.

The road ahead

Anticipating the future, the interaction between options and perpetual markets will further influence the trajectory toward the next genuine bottom. If history serves as a reference, the ultimate stage of surrender will necessitate a catalyst, be it a macroeconomic jolt, an unexpected regulation, or the collapse of a significant entity. These occurrences shift careful hedging into full-blown panic, causing option premiums to spike and pushing ongoing funding rates sharply into negative zones.

When this trigger occurs, the elimination of leverage becomes unavoidable. Billions of dollars in both long and short positions are wiped out, open interest contracts decline significantly, and the market is now under the control of traders with reduced leverage and extended timeframes. Simultaneously, option prices rise to unaffordable levels, and the skew expands to unsustainable extremes. Ironically, these extremes in derivatives pricing indicate not additional collapse but the onset of recovery.

For traders and investors, the journey forward demands self-control. Relying solely on spot prices can be misleading; true bottoms are seldom evident in the moment. Concentrating on derivatives metrics such as put-to-call ratios, implied volatility skew, funding rates, and open interest allows participants to navigate through misleading noise. These instruments serve as seismographs for market sentiment, capturing vibrations of fear and fatigue long before the surface levels out.