- The cryptocurrency market saw a decline of more than $180 billion in just a week due to reduced liquidity and profit-taking activities.

- Macro challenges from the Fed and a robust dollar exerted pressure on digital assets overall.

- AI and gaming tokens suffered losses as investors shifted focus to infrastructure-driven initiatives.

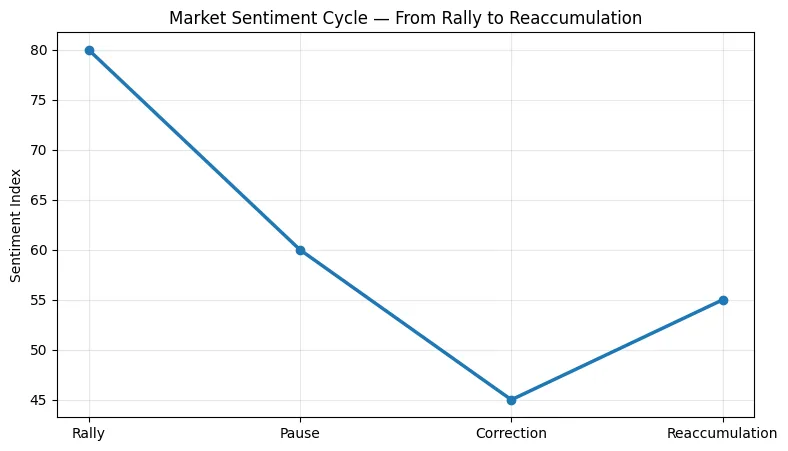

- Technicals suggest a robust correction, rather than a market collapse.

- Institutional sentiment continues to be cautiously positive, with Bitcoin ETFs consistently drawing in steady inflows.

The break in momentum

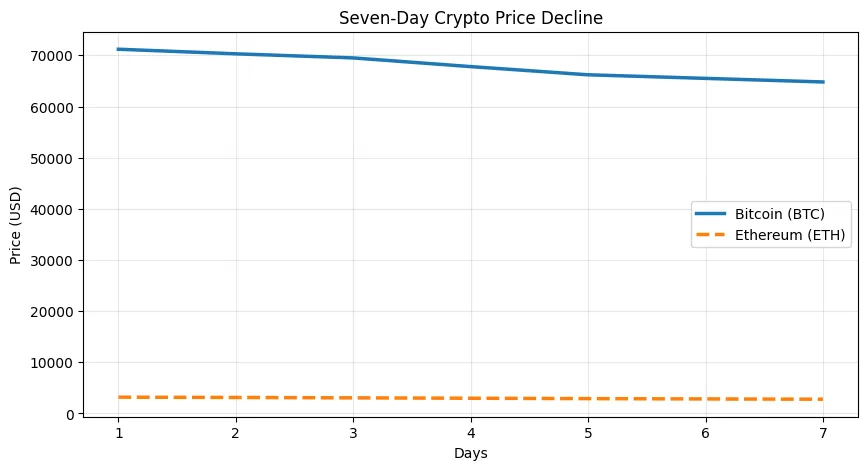

For almost two months, the cryptocurrency market rallied with constant optimism, Bitcoin returning to $70,000, Ethereum surpassing $3,000, and altcoins resonating with the same bullish trend. Suddenly, there was a complete silence. In the past week, total cryptocurrency market capitalization shrank by more than $180 billion, representing the largest weekly drop since the beginning of 2024.

The rally’s fatigue wasn’t abrupt, it was systemic. Liquidity in spot markets started to decrease while derivative positions grew. Signs of exhaustion were evident in ongoing funding rates that turned negative on prominent exchanges such as Binance and OKX, indicating that traders were starting to bet against the rally.

Institutional flows, which had been a support since Q2, also diminished. The most recent CoinShares report indicated that digital asset investment products experienced outflows of $48 million, primarily driven by Bitcoin and Solana. A break, not fear yet one considerable enough to disturb sentiment throughout all crypto levels.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Macro winds and the fed shadow

Beyond graphs and market sentiment, macro factors have taken center stage once more. The most recent minutes from the Federal Reserve have weakened expectations for a December rate reduction, solidifying a “higher for longer” outlook. Treasury yields surged, risk assets declined, and the dollar rallied, creating a typical scenario that constrains Bitcoin’s liquidity-sensitive framework.

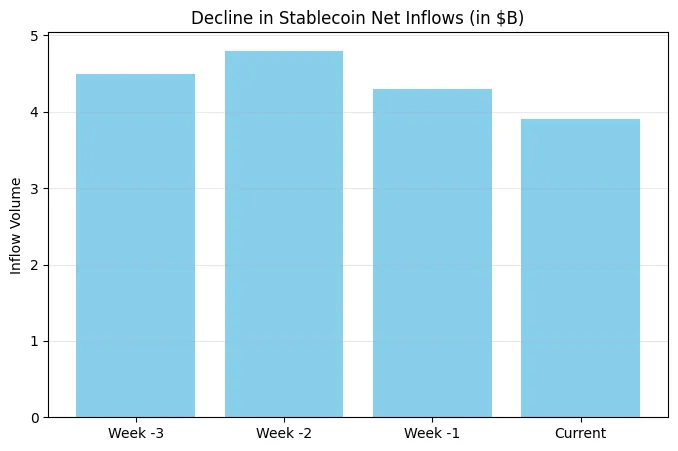

As the expense of managing risk increases, capital frequently departs from crypto initially. This has been especially apparent in the movement of stablecoins. DeFiLlama data indicates that stablecoin net inflows decreased by 8% week-over-week, while exchange reserves increased, implying that investors are staying inactive as they await macroeconomic clarity.

The link between Ethereum and tech stocks, especially the Nasdaq, reappeared after several months of divergence. With a 3.2% decline in the Nasdaq, Ether followed suit. The story is no longer simply “crypto risk-on,” it’s now “crypto tied to macro factors.”

Altcoins, AI tokens, and the evolving storyline

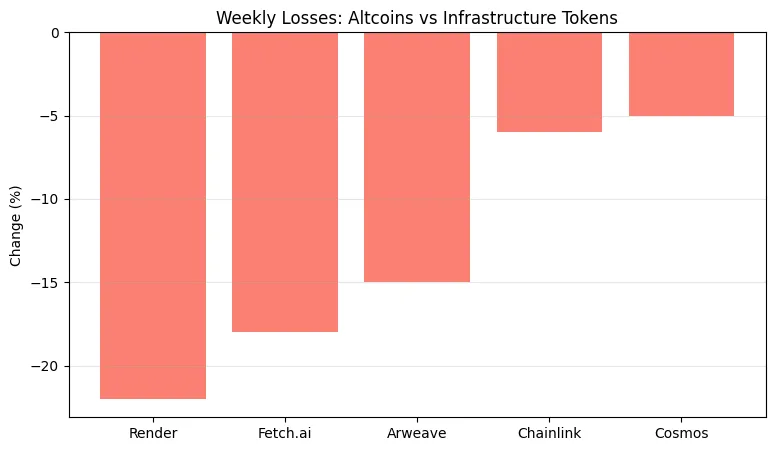

Altcoins, particularly those associated with AI and gaming themes, suffered significantly during the market pullback. Tokens such as Render, Fetch.ai, and Arweave experienced double-digit weekly declines, wiping out a significant portion of their summer profits.

This adjustment isn’t merely conjectural deflation; it also involves narrative realignment. Investors are reevaluating what constitutes hype and what qualifies as infrastructure. Initiatives featuring enduring revenue sources or practical integrations like Chainlink or Cosmos have maintained their position more effectively.

The retreat also shows that retail positioning is still unstable. LunarCrush’s social media sentiment data indicates a 42% decrease in positive mentions of crypto within just one week. The community energy that typically boosts rallies has diminished a digital mirror of shared doubt.

The technical landscape a controlled correction

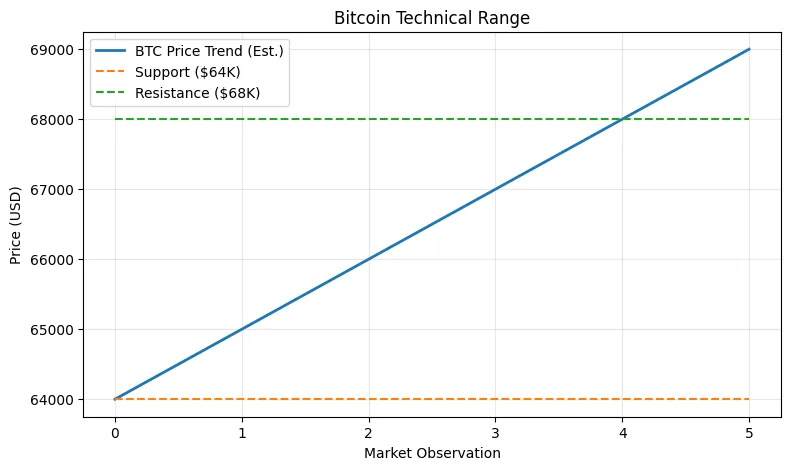

From a technical viewpoint, Bitcoin’s decline over the past seven days remains part of a broader consolidation trend.The support near $64,000 stays unchanged, aligning with the 50-day moving average. Ableitende Daten zeigen, dass gehebelte Positionen abgebaut werden, was das Risiko einer Marktüberhitzung verringert.

Funding rates have stabilized, and open interest decreased by almost 20%, indicating a return to a healthier market structure.This isn’t the sort of breakdown that comes before a fall; it resembles more of a breath release after a run.

Analysts are already watching crucial resistance at $68,000 to confirm renewed momentum. The timing of that test will rely on macro catalysts, particularly inflation reports and any dovish signals from the Fed in early November.

The outlook serenity, before what follows

The decline over seven days has ignited fresh discussions: is this a short-term cooling or the beginning of a wider rollback? Historically, such breaks have come before new upward trends assuming macro conditions stabilize. Institutional investors remain attentive, especially since Bitcoin ETFs have been seeing consistent inflows amid market volatility.

Should yields decline and liquidity improve, Bitcoin’s fundamental story digital gold amidst fiat instability may strengthen again. Currently, traders are shifting from excitement to patience, a change that typically characterizes lasting bull markets.

Crypto isn’t fueled solely by excitement; it thrives on determination. The previous week wasn’t a conclusion; it served as a reminder that each rally requires some space to recover.