-

Blockchain microfinance is enabling undercollateralized lending, giving global borrowers access to credit without heavy collateral demands.

-

DeFi protocols are using decentralized identity, on-chain credit scores, and tokenized insurance to reduce default risks.

-

Digital micro-lending empowers small businesses, migrant workers, and students, driving financial inclusion and economic growth worldwide.

Microfinance has been regarded for a long time as an essential instrument for promoting financial inclusion. Since the late twentieth century, it has provided millions in developing nations with small loans that conventional banks would never authorize. Loans, sometimes as small as $100 or $200, have assisted farmers in purchasing seeds, shopkeepers in replenishing inventory, and students in paying for tuition. However, in spite of its achievements, microfinance has consistently faced limitations due to geographical factors, restricted funding, and dependence on intermediaries. Currently, blockchain technology has the potential to elevate microfinance by facilitating a global, digital variant of micro-lending that minimizes collateral requirements and links borrowers directly to international capital sources.

Central to this movement is decentralized finance, commonly referred to as DeFi. Constructed on open blockchain networks, DeFi platforms allow anyone with an internet connection and a digital wallet to lend, borrow, or invest. Traditionally, DeFi lending protocols necessitate that borrowers overcollateralize their loans, frequently securing over 150 percent of the loaned sum in cryptocurrencies like Bitcoin or Ether. Although this guarantees repayment, it also restricts loans to individuals who possess significant digital assets. This model is poorly designed for the global unbanked and underbanked groups, the very individuals that microfinance intends to uplift. To tackle this shortcoming, innovators are currently testing undercollateralized lending on the blockchain, a framework that might ultimately deliver the potential of microfinance in the digital era.

Undercollateralized cryptocurrency lending enables borrowers to obtain funds without needing to provide substantial collateral. Instead, protocols utilize different indicators of creditworthiness, including reputation scores, blockchain-based identity systems, and transaction records stored on the blockchain. Through the examination of on-chain activity, lenders can assess the probability of repayment in manners similar to how conventional banks utilize credit scores; however, these digital reputations are global, movable, and open. Certain platforms are also incorporating artificial intelligence to enhance risk models and identify fraudulent activities prior to loan disbursement.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Opportunities and risks in blockchain microfinance

The consequences for financial inclusion are significant. In developing regions, where traditional banking is often inaccessible, a $200 loan provided through blockchain can have a transformative impact. Small business proprietors might utilize these funds to grow their enterprises, whereas migrant employees can pay for remittance charges or urgent needs without depending on predatory lenders. Learners in emerging areas can take loans to cover tuition, laptops, or exam costs, obtaining educational chances that may enhance their future income potential. Since the loans are financed by international liquidity pools, borrowers are not constrained by the resources present in their local areas. Simultaneously, lenders gain from risk diversification by distributing minor loans across various regions and types of borrowers.

However, obstacles persist. Lenders encounter increased risks of default, especially in unstable crypto markets, when there is no collateral as a safeguard. To address this, certain protocols are incorporating protective measures like staking pools, where community members help cover possible losses, or tokenized insurance that automatically reimburses lenders in the event of loan defaults. Some are creating systems that link borrowing eligibility to decentralized identity credentials, allowing borrowers to establish verifiable digital credit histories that travel with them across platforms. These innovations aim to create a balance between ease of access for borrowers and sustainability for lenders.

Skeptics caution that undercollateralized lending might bring back the same dangers that disrupted conventional finance in previous crises. They contend that excitement for financial inclusion must not eclipse the necessity for strict risk management. Additionally, the volatility of cryptocurrencies continues to be a major issue. A borrower taking a loan in Bitcoin or stablecoins might see their ability to repay impacted if exchange rates fluctuate significantly. Regulatory ambiguity adds to the complexity, with governments globally still discussing how to categorize and manage digital lending platforms.

The future of blockchain microfinance

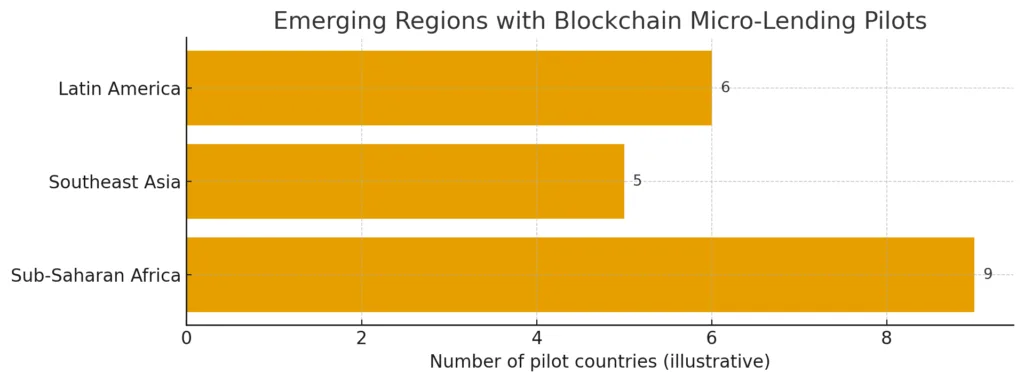

In spite of these obstacles, progress is gaining traction. Numerous pilot initiatives are currently in progress in areas like sub-Saharan Africa, Southeast Asia, and Latin America, where there is a strong demand for credit and the use of mobile wallets is increasing swiftly. Collaborations between DeFi protocols and NGOs are arising, merging blockchain advancements with practical microfinance knowledge. These partnerships might offer the hybrid framework necessary for responsibly scaling digital micro-lending.

Considering the broader perspective, microfinance driven by blockchain could emerge as one of the most significant uses of decentralized technology. Similar to how traditional microfinance transformed credit access in the late twentieth century, undercollateralized crypto lending may redefine it for the twenty-first. Utilizing worldwide liquidity, clear ledgers, and decentralized management, digital micro-lending could establish a borderless safety net that directs funds to individuals and regions that have never received it before. For millions around the globe, this could represent more than just obtaining loans; it signifies a true route to economic empowerment.

As the industry develops, the crucial inquiry will be if innovators can maintain a balance between inclusion and caution. Should they succeed, blockchain microfinance could rank with mobile payments and digital banking as a pivotal financial innovation of our era. Otherwise, it risks turning into another sincere endeavor that stumbled due to inadequate risk management and regulatory ambiguity. Regardless, the upcoming years will be crucial. Microfinance has consistently focused on releasing human potential via small yet significant actions. Within the blockchain, such interventions could expand beyond what was previously thought possible.