- Quantitative models are changing cryptocurrency from sentiment-based guessing to data-supported accuracy.

- The integration of AI enables prediction systems to adjust dynamically to fresh market information.

- Deep learning and NLP methods convert social sentiment into implementable trading signals.

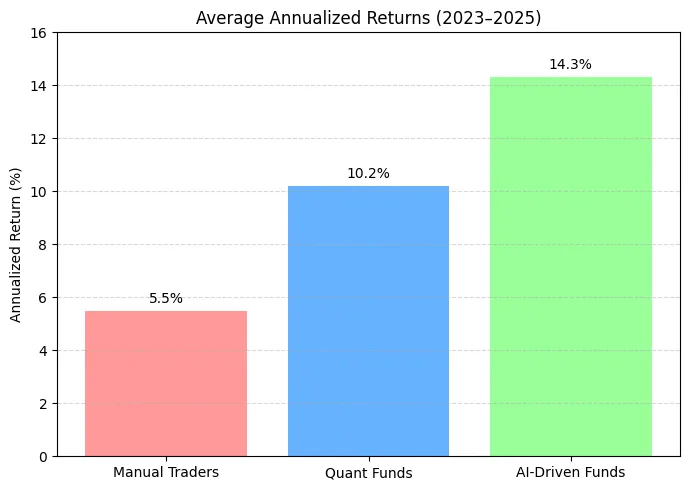

- Funds driven by AI are consistently surpassing conventional crypto strategies.

- The future is in predictive infrastructure where algorithms independently dictate market actions.

The age of prediction

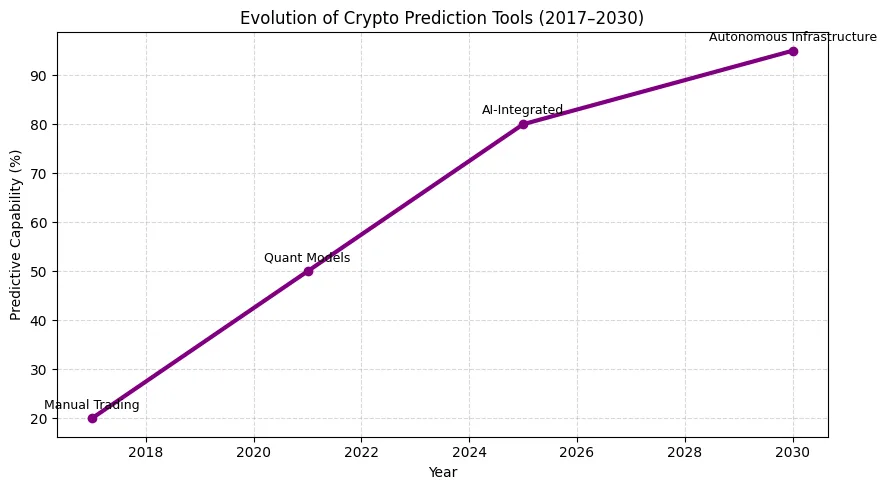

In the initial stages of cryptocurrency, decisions were frequently driven by instinct and feelings. Traders depended on Twitter’s sentiment, gossip, and market excitement to seize the upcoming surge. As digital assets evolved, the techniques employed to predict them also advanced. Quantitative models previously exclusive to Wall Street hedge funds are now present in the crypto space, introducing mathematical accuracy to a once-turbulent market.

Currently, artificial intelligence and quantitative modeling are converging to create a novel category of predictive systems that strive not only to analyze data but also to foresee market changes before they happen. The period of conjecture is yielding to a data-oriented age, where algorithms may soon emerge as the most dependable traders present.

From chaos to code: The rise of quantitative crypto models

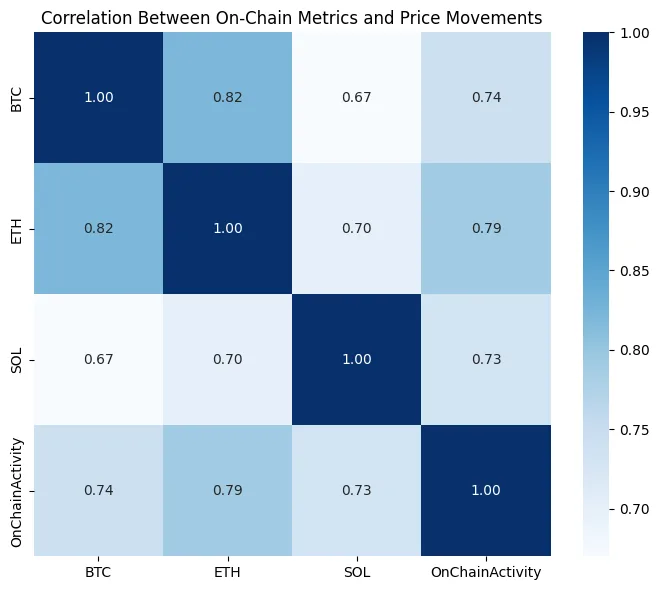

To address this, developers created new frameworks. Models like ARIMA (Auto-Regressive Integrated Moving Average), Monte Carlo simulations, and LSTM neural networks have been trained using terabytes of blockchain data, market depth, and on-chain activities. The objective is no longer merely to predict Bitcoin’s upcoming candle but to chart the entire behavioral landscape of digital assets, encompassing whale activities and DeFi liquidity streams.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

These quantitative systems don’t eradicate uncertainty; they handle it. By analyzing numerous variables in real time, they convert noise into signal, a change that’s reshaping how contemporary traders perceive crypto markets.

AI enters the equation

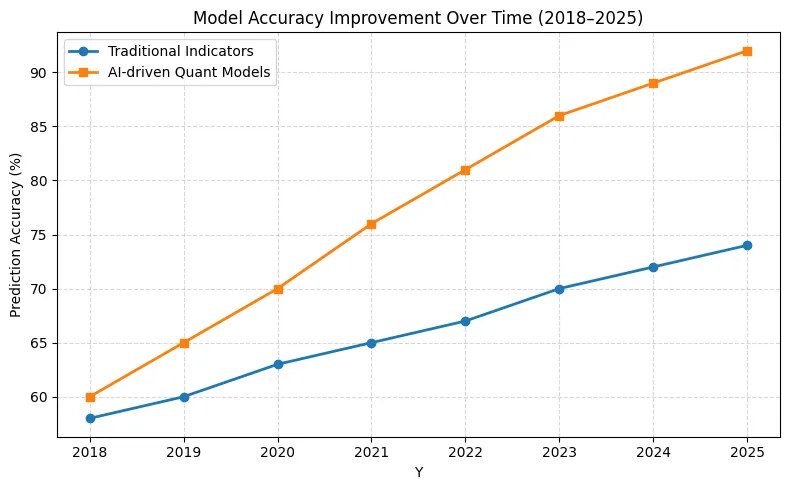

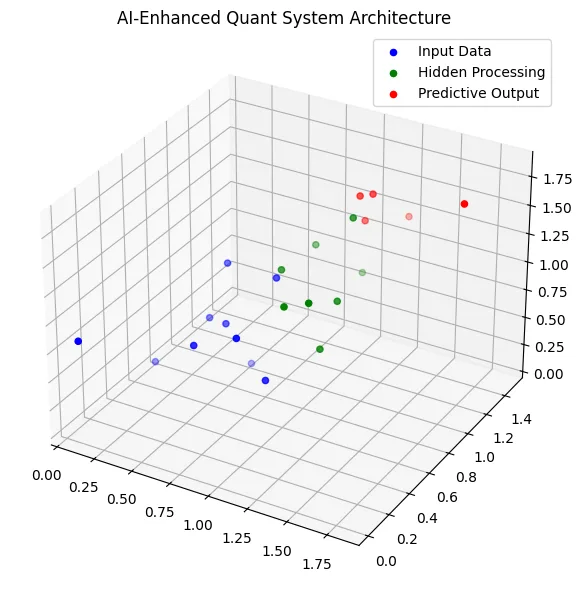

Artificial intelligence enhances quantitative models significantly. Conventional quants rely on established parameters and mathematical principles created by humans. AI, in contrast, learns those parameters in a dynamic manner. Machine learning models are capable of handling intricate, nonlinear data connections, uncovering patterns that classical regression or moving averages might miss.

In 2025, AI trading platforms are transforming from simple helpers into independent systems. Deep learning models, such as transformers and reinforcement learning agents, emulate numerous market scenarios every second, adjusting strategies as fresh data comes in. Certain systems even incorporate natural language processing (NLP) to analyze the sentiment of crypto news and Twitter/X activity, transforming emotions into numerical weights for predictive models.

The integration of AI into quantitative models results in hybrid systems that possess both logical reasoning and emotional understanding. It’s not the end of human traders; instead, it’s the emergence of “augmented trading,” in which humans create the structure and machines enhance the execution.

Beyond hype: Testing AI’s real predictive power

Amid all the excitement, one question persists: does AI truly forecast crypto prices more accurately? Empirical findings indicate moderate achievement. AI systems excel over manual traders in handling short-term volatility and recognizing patterns, particularly in range-bound markets. They encounter difficulties when macro events such as interest rate changes or regulatory measures result in gaps that historical data cannot accurately represent.

The difficulty is in understanding the interpretation. Quantitative models are testable and interpretable, while deep AI networks frequently function as black boxes. Traders can receive correct signals without knowing the reasons they function. This lack of transparency leads to trust problems and regulatory worries, particularly as institutional investors more frequently embrace algorithmic approaches for cryptocurrency investments.

Nonetheless, the outcomes are persuasive. AI-enhanced quant funds have delivered steady annual returns of 8%–15% since 2023, surpassing conventional crypto index approaches. What previously seemed like excitement is swiftly evolving into a bona fide investment approach grounded in quantifiable results, not promotion.

The road ahead: Prediction as infrastructure

The upcoming frontier focuses not on forecasting prices but on forecasting systems. Sophisticated AI models are being developed to replicate complete market frameworks: liquidity movements, regulatory responses, and even network congestion trends. These tools will not only predict; they will also evaluate and enhance ecosystems prior to their existence.

In decentralized finance (DeFi), AI-powered quantitative models are currently being incorporated into smart contracts that automatically rebalance portfolios and modify collateral ratios. Prediction is integrated into the infrastructure, rather than being considered an afterthought.

At the same time, regulators are monitoring attentively. With the rising impact of predictive algorithms on crypto markets, concerns regarding manipulation, transparency, and accountability are emerging. In the upcoming years, we might witness the emergence of “regulatory AI auditors” that oversee other systems to guarantee fairness and adherence.

In the end, the combination of quantitative modeling and AI will not eradicate risk. However, it will change how markets view it. For investors, developers, and regulators, this transformation signifies a critical moment: crypto’s tumultuous teenage years are evolving into a data-driven industry rooted in science, rather than mere hype.