- The Paxos $300 trillion glitch exposed how a single decimal error can destabilize trust in the entire stablecoin ecosystem.

- Blockchain transparency reveals mistakes instantly, turning technical oversights into global financial events.

- Even fully regulated issuers like Paxos prove that compliance cannot prevent operational or coding risks.

- Stablecoins have become critical financial infrastructure efficient, but dangerously centralized and fragile.

- True stability in digital finance demands constant precision, not promises; vigilance must replace blind trust.

The illusion of stability

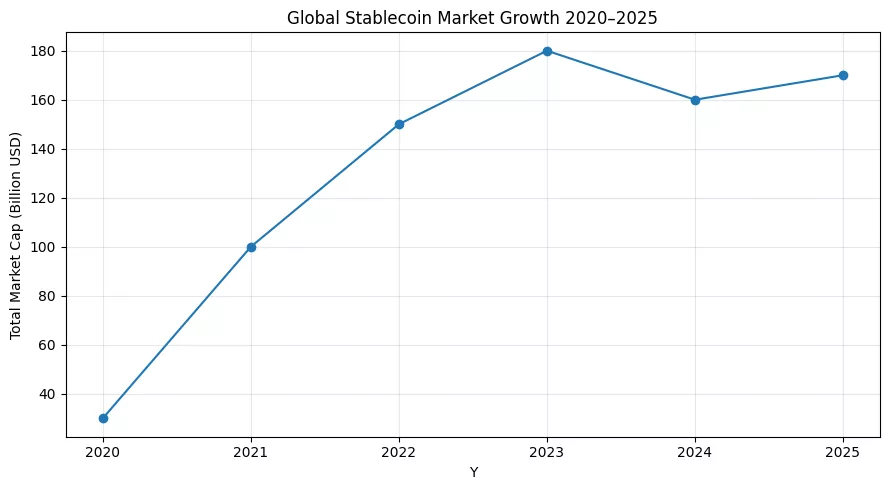

Stablecoins have long represented stability amidst the tumult of cryptocurrency digital currencies that assure blockchain efficiency while avoiding Bitcoin’s volatility. Their purpose was to connect the disorderly nature of DeFi with the organized realm of traditional finance. However, one occurrence highlighted that stability can still waver under the burden of code. When Paxos, a highly regarded and regulated issuer of stablecoins, briefly logged $300 trillion in mistaken transactions, the market was in shock.

The error wasn’t a breach, nor a loss of money. It was a decimal overflow, a minor error that expanded into an astonishing amount apparent throughout the blockchain. In just hours, Paxos made it clear that no funds had actually transferred, and the error had been fixed. However, the harm to perception had already occurred. The episode demonstrated that stability in cryptocurrency is not an innate characteristic; rather, it is a continuous process involving technical, operational, and human accuracy.

Behind the glitch

This $300 trillion mistake wasn’t related to deceit; it concerned vulnerability. It highlighted that even systems based on trust, adherence, and mathematical precision can fail when faced with scale and complexity. In a system that values transparency, even the slightest error, no matter how harmless, is immediately evident to everyone.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

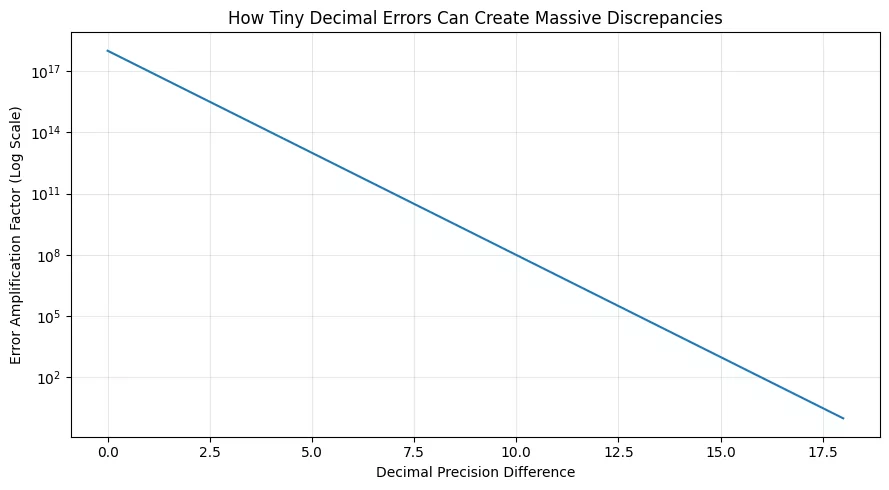

The core of the problem was surprisingly straightforward. Similar to many blockchain issues of this kind, the Paxos error arose from a discrepancy in decimal accuracy between on-chain and off-chain systems. Stablecoins, usually divisible to 18 decimal points, depend on complete precision. A minor variation in unit conversion or rounding between internal databases and smart contracts can lead to massive discrepancies when multiplied over billions in nominal value.

Source:Generated with Python, a one-decimal discrepancy in accuracy can exponentially amplify recorded figures, transforming billions into trillions.

The architecture of fragility

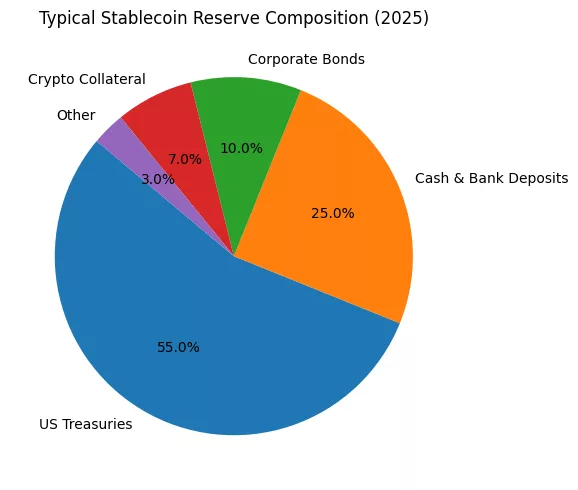

Stablecoins were created to remove volatility, but they have brought about a different kind of risk: reliance on code, custody, and communication systems. Fiat-collateralized stablecoins such as USDC, USDT, and Paxos USD depend on the stability of the conventional banking system. They are “digital” merely on the surface; their core is still closely connected to fiat backing, regulatory supervision, and centralized record-keeping. When an issue arises in that chain, the blockchain’s immutability reveals it immediately, even if the actual impact is slight.

Models such as DAI and FRAX, which are algorithmic and decentralized, aimed to eliminate those dependencies by securing value with cryptocurrency collateral and utilizing smart contracts. However, they too have demonstrated weakness. The fall of TerraUSD in 2022 erased over $60 billion in worth, and USDC’s brief depegging in 2023, triggered by $3.3 billion in reserves trapped in a collapsed bank, showed that even “secure” stablecoins can fail. Regardless of being centralized or decentralized, the outcome is obvious: the stability of cryptocurrency relies on the reliability of the system’s most vulnerable component.

The scale problem and regulatory pressure

The Paxos flaw revealed a harsh reality about scalability. In a system handling billions of dollars each day, a simple rounding mistake can amount to trillions. A decimal point fraction that would have been overlooked in conventional finance can turn into a major story in a clear, unchangeable record. Blockchain removes the capability to hide errors but does not remove the chance of committing them. In this new framework, mistakes don’t vanish; they resonate.

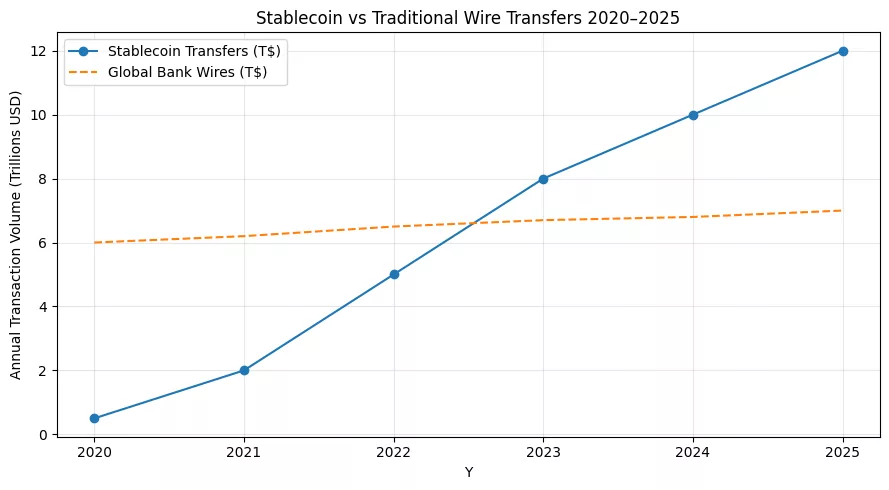

This vulnerability has garnered fresh regulatory focus. Stablecoins have subtly emerged as the foundation of the digital economy, enabling trillions in transactions, payments, and remittances monthly. They essentially represent the shadow currency of international finance. Agencies such as the SEC and the New York Department of Financial Services have clarified that stablecoin issuers must adhere to the same regulations as banks. However, the Paxos incident showed that adherence does not ensure flawlessness. Regulation can impose accountability, but it cannot eliminate human oversight.

The trust paradox

Transparency, which was once hailed as the greatest strength of crypto, has turned into its double-edged weapon. It guarantees instant responsibility but amplifies every mistake. In the case of Paxos, this transparency served as both a lifeline and a hindrance; users noticed the irregularity, sought explanations, and got them, but not until a surge of doubt spread through social media and financial markets. In digital finance, trust can vanish in moments and can only be restored through consistent behavior over time.

Stablecoins were not designed to substitute conventional currency; they were intended to reinvent its role. However, with their increasing scale, they now bear the same systemic significance as financial institutions. They are no longer in the experimental phase; they have become infrastructural. Infrastructure requires not only innovation but also resilience and reliability.

Lessons for the future

The Paxos error wasn’t disastrous, but it was indicative. It served as a reminder to the industry that while blockchain can streamline verification, it cannot replace vigilance. Every additional layer of abstraction in smart contracts, oracles, and custody integrations adds another possible failure point. The message is unmistakable: to achieve the designation of “stable,” these digital currencies need to be constructed with bank-level accuracy and blockchain-level openness.

In the end, the Paxos $300 trillion mistake will be recalled not for its financial impact, which was nonexistent, but for what it disclosed about the essence of contemporary finance. Stability in cryptocurrencies is a constantly shifting goal, an equilibrium between human frameworks and digital systems. It is not a fixed assurance but a continuous adjustment of trust, technology, and reality.

In a reality where one misjudged decimal can generate worldwide news, the task for future stablecoin creators is easy to outline yet difficult to accomplish: ensure genuine stability.