Stablecoins have been praised for years as the innovation that would transform worldwide payments. Linked to the worth of fiat currencies and easily exchanged on blockchain platforms, they offered a quicker, less expensive, and more accessible method for conducting transactions internationally. However, in spite of the excitement, their drawbacks are becoming more evident. They carry no interest, subject holders to issuer and credit risks, and have mostly not been evaluated in extensive international settlement systems. A more believable option is starting to surface as tokenized money market fund shares, which merge the security of conventional government debt with the effectiveness of blockchain.

The promise and pitfalls of stablecoins

Stablecoins were first welcomed by the crypto community as a link between digital currencies and traditional money. Their capacity to offer a reliable unit of account rendered them crucial for merchants and decentralized finance systems. Recently, proponents have claimed that they could significantly impact international finance, especially in sectors like cross-border transactions and foreign exchange settlement.

Nonetheless, the limitations of stablecoins are now clearer. They cannot allocate yield to investors, which renders them less appealing to institutional treasurers and portfolio managers who need to enhance liquidity. Their structure usually includes a claim against the issuer instead of the actual sovereign assets, resulting in the persistence of credit and counterparty risks. Additionally, their history in international settlements is restricted, and the regulatory approval of stablecoins as wholesale payment tools remains unclear. Although they may fulfill specific roles, it is increasingly difficult to claim that stablecoins will support the next evolution of global payment systems.

A familiar instrument with a new form

In contrast, money market funds have been established mainstays of worldwide finance. Since the 1970s, they have offered investors a secure, cash-like asset supported by short-term governmental bonds. During uncertain times, they are considered among the most reliable private-sector assets, sustaining a steady net asset value while providing interest to holders. Corporate treasurers and asset managers have historically used them as instruments for managing liquidity.

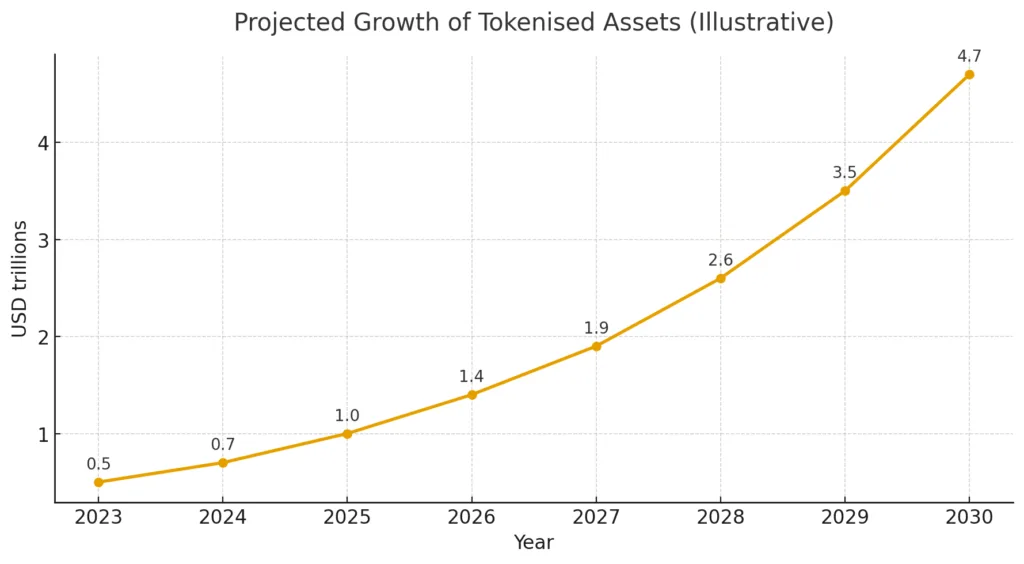

Tokenization provides these funds with a completely new perspective. Through the issuance of money market fund shares on blockchain, asset managers can enhance the “money-like” characteristics of these instruments beyond conventional markets. Tokenized shares can be moved immediately, settled outside of standard trading hours, and incorporated into decentralized financial systems. They maintain the regulatory understanding and inherent safety of conventional MMFs while incorporating the extra benefits of programmability and composability that are distinctive to blockchain.

Tokenised MMFs as a settlement tool

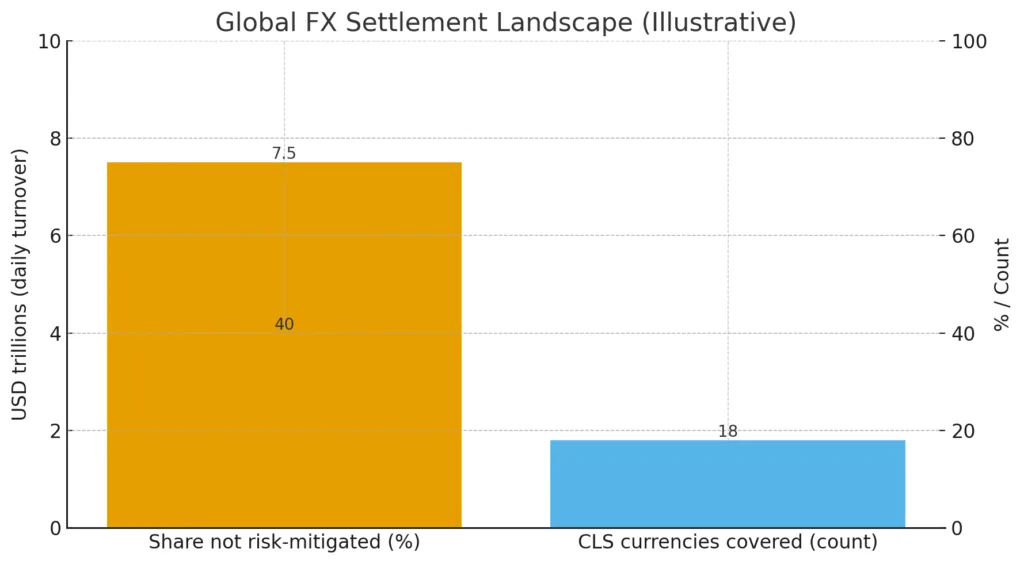

The main promise of tokenised money market funds is their role as settlement tools, especially in currency exchange. Currently, FX ranks as the largest financial market globally, with daily transactions surpassing $7.5 trillion. However, settlement continues to be among its most vulnerable aspects. Approximately 40 percent of transactions lack risk-mitigation strategies, settlement systems like CLS only accommodate a restricted number of currencies, and settlement durations for lesser-known currencies can often reach two days or more. The dollar plays a role in nine out of ten transactions, resulting in significant reliance and systemic weaknesses.

Source: Author, daily trading volume exceeds $7.5 trillion, with about 40 percent of transactions without risk protection and CLS coverage limited to 18 currencies.

Tokenised MMFs might overcome these limitations by enabling the atomic trade of tokenised shares expressed in various currencies. For example, a dollar-based MMF share might be swapped instantly for a renminbi-based share, facilitating payment-versus-payment settlement without the need for correspondent banks. The outcome would include immediate gross settlement, streamlined positions at execution, lower intraday liquidity needs, and the capacity to immediately reuse received shares. This would result in considerable gains in capital, liquidity, and funding efficiency, along with regulatory savings for banks by removing exposures to correspondents and outstanding receivables.

Advantages over stablecoins and deposits

When compared directly, tokenised MMFs seem to outperform both stablecoins and tokenised deposits. Stablecoins do not yield interest and subject investors to issuer risk, while tokenised deposits usually earn interest at rates lower than the current money market rate and necessitate new clearing systems for international transactions. In contrast, tokenised MMFs provide yield directly, involve low credit risk when supported by government bonds, and are already governed by established regulatory and supervisory frameworks. Their interest-earning characteristics render them especially appealing in comparison to stablecoins, which essentially keep cash unused.

Adoption challenges and path forward

Certainly, challenges persist. Legal and contractual structures might require adjustments to acknowledge that the delivery of tokenized MMF shares fulfills payment responsibilities. Banks must adjust their systems to manage and transfer tokenized securities internationally. Accounting, taxation, and regulatory measures must also develop to accommodate this new type of settlement. However, these challenges are not impossible to overcome. Since money market funds are already well incorporated into the financial system, transitioning to tokenized MMF settlement may be easier than trying to create a new system based on stablecoins.

A safer, more efficient future

The debate over the future of international payments has often placed stablecoins at the centre. But when measured against the criteria that matter most to global finance safety, yield, regulatory acceptance, and systemic efficiency tokenised money market funds appear better suited for the role. They build on familiar, high-grade instruments while adding the benefits of blockchain technology. In doing so, they offer a path to improved cross-border payments and foreign exchange settlement without the risks and limitations that continue to burden stablecoins.

Stablecoins may remain useful in crypto markets and as retail payment tools, but their role in wholesale international settlement is likely to be limited. Tokenised MMFs, with their combination of safety, efficiency, and yield, may prove to be the true future of cross-border payments.