- The rise of inflation and banking failures in emerging markets is steering Gen Z toward decentralized finance.

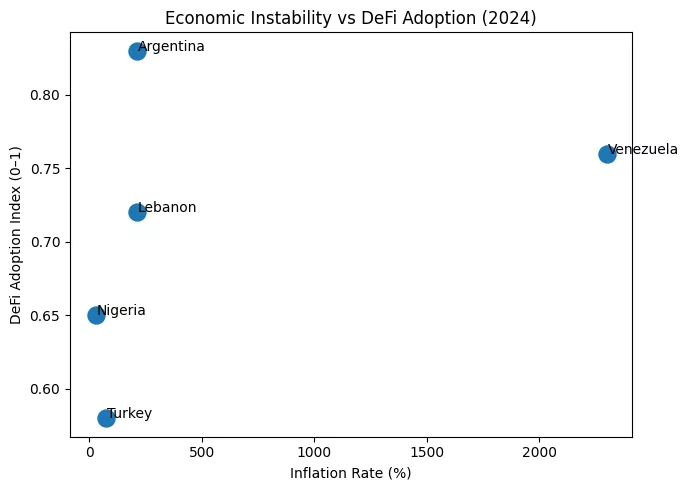

- Lebanon, Argentina, Nigeria, Turkey, and Venezuela are listed in the top 20 worldwide for DeFi adoption.

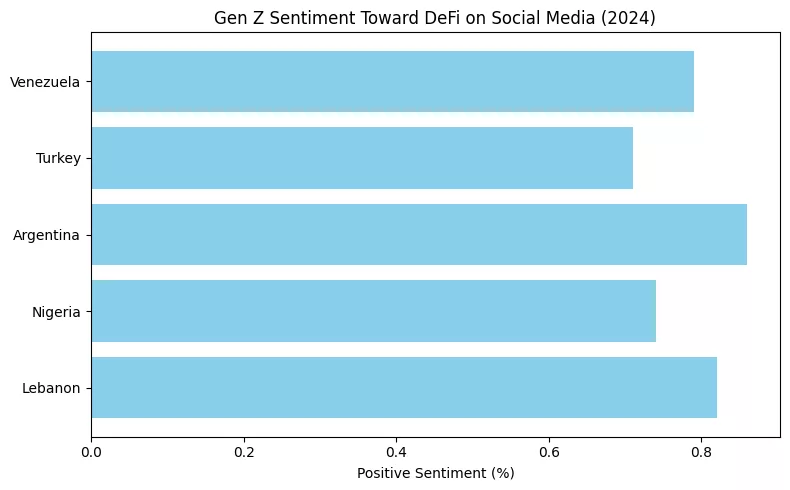

- DeFi is combining financial independence with digital culture within Gen Z groups.

- Even with increasing exploit risks, users consider DeFi to be safer than traditional systems that have failed.

- Smart contracts signify a transformative shift in the concepts of trust and ownership

From collapse to code

In a Beirut café, a young developer browses his MetaMask wallet rather than reviewing his local bank account. A student in Buenos Aires exchanges pesos for stablecoins prior to the weekend. A Lagos-based designer invests her savings on Aave, generating more earnings in a week than her parents earned from bank interest in a year.

These are the DeFi exiles, a generation whose monetary existence no longer relies on institutions or politicians but rather on code. For Gen Z in struggling economies, decentralized finance is not just speculation. It’s protection against oneself.

As banks halted withdrawals, created more currency, and neglected their people, the youngest depositors sought a completely transparent solution: smart contracts. What was formerly a trial in cryptocurrency trading has evolved into a new type of financial refuge.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

The collapse of trust

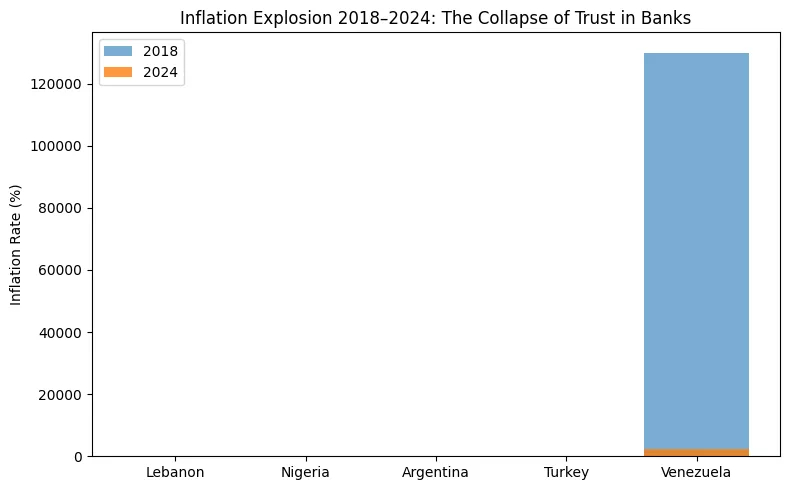

Trust in traditional banking systems is eroding across multiple continents. In Lebanon, decades of political mismanagement led to one of the worst economic collapses in modern history. In Argentina, inflation soared above 200% in 2024. Nigeria and Turkey faced currency devaluations that wiped out savings overnight. Venezuela’s bolívar became a symbol of hyperinflation and despair.

Data from the IMF and local central banks indicate that there has been a significant rise in deposit withdrawals, black-market exchange rates, and parallel currency systems. Gen Z experienced this directly as their initial paychecks, savings, or freelance income frequently disappeared in unreliable local banks.

Presented here is a graphic illustrating the inflation rates of these five countries from 2018 to 2024, highlighting the correlation between the decline in purchasing power and the increase in cryptocurrency adoption.

Smart contracts as safe havens

In these economies, smart contracts emerged as a substitute not only for banks but also for complete monetary systems. Stablecoins such as USDT and USDC have become the primary currency in certain regions of Lebanon and Nigeria. Argentinians utilize DeFi staking protocols to protect against inflation. Turkish freelancers accept cryptocurrency payments to avoid lira fluctuations.

In contrast to banks, DeFi protocols are unbiased and immediate. A Uniswap transaction completes in seconds; a transfer from a Lebanese bank may take weeks if it clears at all. This clarity and independence transformed the meaning of “savings” for Gen Z.

Information from Chainalysis’ Global Crypto Adoption Index indicates that these five countries are positioned within the top 20 globally for on-chain value received. The following graph links inflation rates to DeFi adoption index scores in 2024, illustrating how instability directly influences adoption.

Gen Z’s social layer: Code, culture, and rebellion

For this generation, DeFi represents more than just yield; it symbolizes identity. On TikTok, Telegram, and X, “DeFi threads” gain popularity alongside music, fashion, and activism. Hashtags such as #BankTheUnbanked, #SmartContractSafety, and #InflationEscape draw millions of younger audiences.

The style represents a digital uprising: vibrant graphs, anime profiles, and phrases such as “Verify, don’t trust.” What was once Wall Street’s domain has now become Gen Z’s form of protest.

In crisis economies, DeFi emerged as a cultural expression, a financial rebuttal to the systems that let them down. The sentiment map below displays the positive and negative social media mentions of DeFi in 2024 across these identical countries, derived from aggregated social media data samples.

Risk and reality check

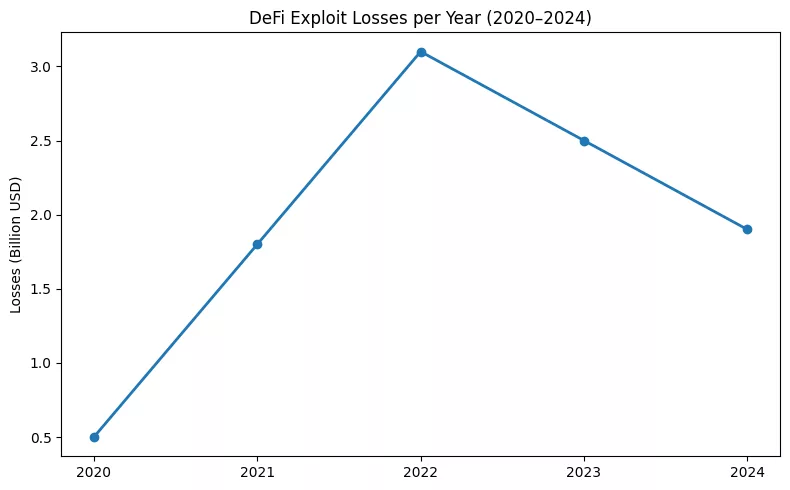

DeFi has its flaws. Smart contract exploits, rug pulls, and yield fraud continue. According to DeFiLlama, in 2023, more than $2.5 billion was taken through DeFi exploits. However, for numerous individuals in volatile economies, that danger still seems less significant than relying on a failing banking system.

When the “secure” option continually fails, risk becomes comparative. Gen Z users frequently refer to DeFi as “preferring volatility to confinement.” The irony is striking: they prefer to confront code risk over corruption risk.

Presented here is a depiction of yearly losses from DeFi exploits, highlighting that although confidence in banks has deteriorated, DeFi’s strength continues to face challenges annually.

A Generation that builds its own bank

In areas where banks represented deception, DeFi emerged as the model for trust. This generation isn’t relying on institutions to change; they are reconstructing finance from scratch, one smart contract at a time.

“Where our parents concealed cash beneath mattresses, we store it in MetaMask.”

That saying, frequently found in crypto discussions in Arabic, Spanish, and English, encapsulates a reality that characterizes the contemporary refugee economy: ownership has become digital, and trust can be coded

The DeFi refugees aren’t running away from systems. They’re building their own.