- The engineer’s perspective transforms excitement into sustainable, thoughtfully crafted DeFi frameworks.

- A defined structure: formulate with mathematics, verify with programming, support via funding.

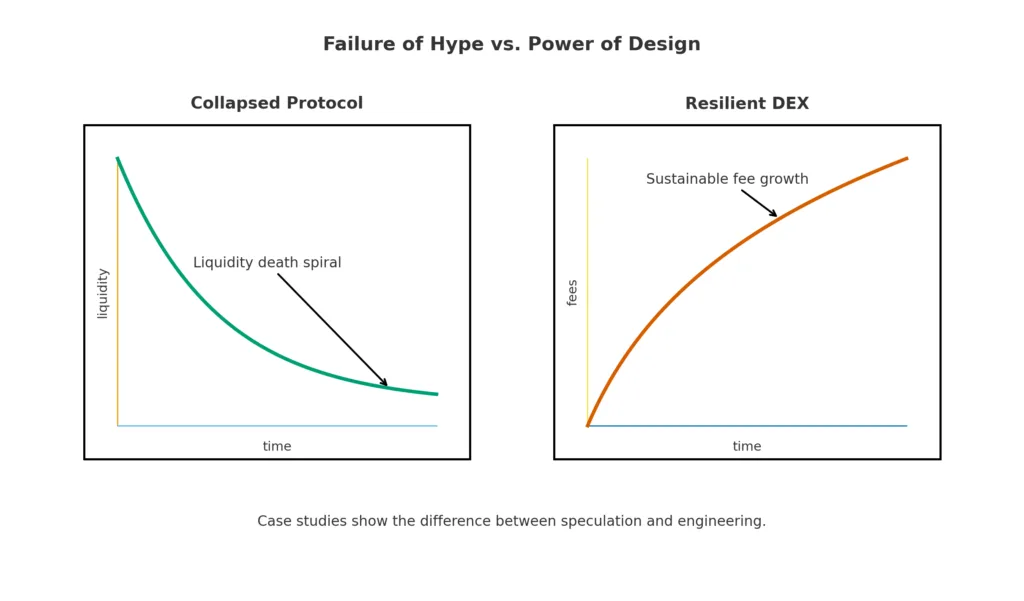

- Research indicates that death spirals diminish as fee-driven DEXs persist.

The decentralized finance (DeFi) movement flourishes through innovation and rapidity. New protocols arise every week, stories change every day, and wealth is gained or lost in an instant. However, underneath the surface exists a stark reality: numerous projects are constructed on unstable bases. Failures resulting from inadequate tokenomics, vulnerable code, or misguided incentives have undermined confidence throughout the ecosystem. For DeFi to progress beyond phases of excitement and disappointment, it requires more than just passion. It requires the perspective of an engineer.

An engineer tackles challenges with method, organization, and precision. Through the combination of mathematics, programming, and finance, this perspective converts disorder into structure and conjecture into enduring strategy. It is a perspective that uncovers trends where others perceive chaos, and resilience where others pursue immediate rewards.

Mathematics: the language of stability

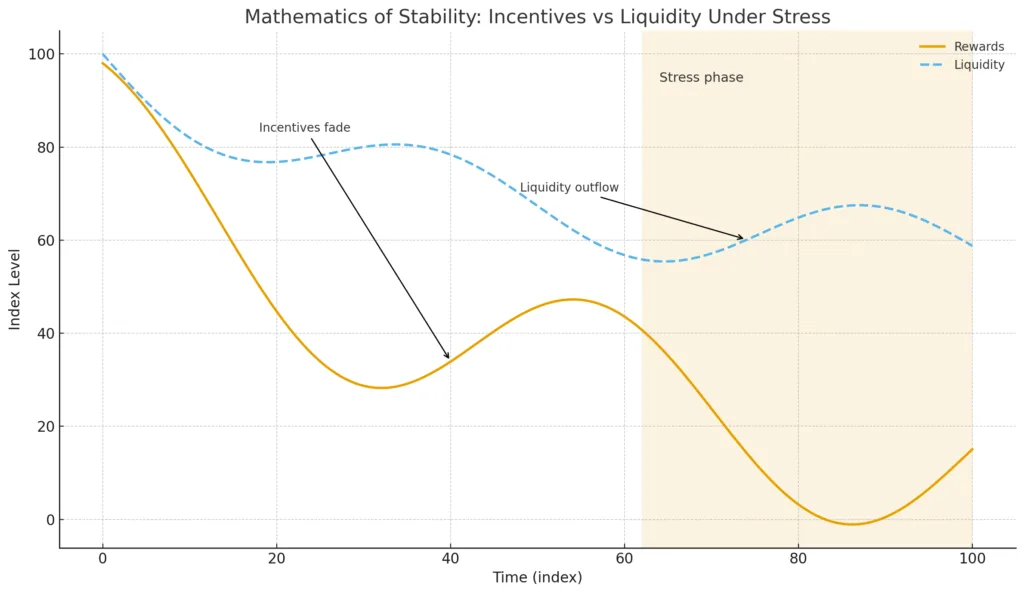

At its essence, every financial system is a collection of equations that need resolution. DeFi is similar. The mathematics of probability and optimization can reveal the behavior of liquidity pools during extreme volatility. Stochastic modeling brings attention to weaknesses that polished whitepapers frequently overlook. Game theory clarifies why liquidity providers hurry to seize high returns but disengage as soon as rewards diminish. Numbers unveil reality and reveal the underlying mechanics of systems that may otherwise appear appealing on the outside.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Coding: the laboratory of innovation

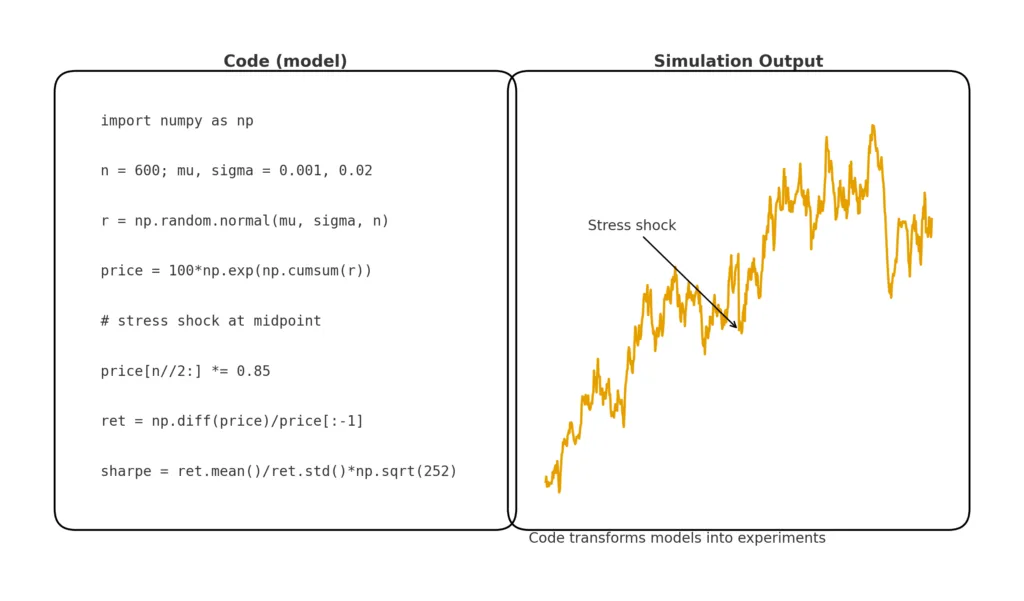

If mathematics offers the framework, coding servesas the lab where these models undergoexperimentation. Smart contracts gobeyondbeingmere digital agreements; they constitute the foundationthatsupports DeFi. Without solid code, even the most sophisticated mathematical design fallsapart. With coding, theory turnsinto practice.

Python-built simulations can evaluate strategies understress before capital is risked. Models of machine learning usedon on-chain data can detect anomalies or forecastshifts that human traders miss. Automated trading systems can carryout strategies accurately,eliminating the distractions of human feelings. In this regard, coding serves not merelyas a means for efficiency but as the actualmethod of experimentation and verification that sets engineering apart from conjecture.

Finance: bridging theory and reality

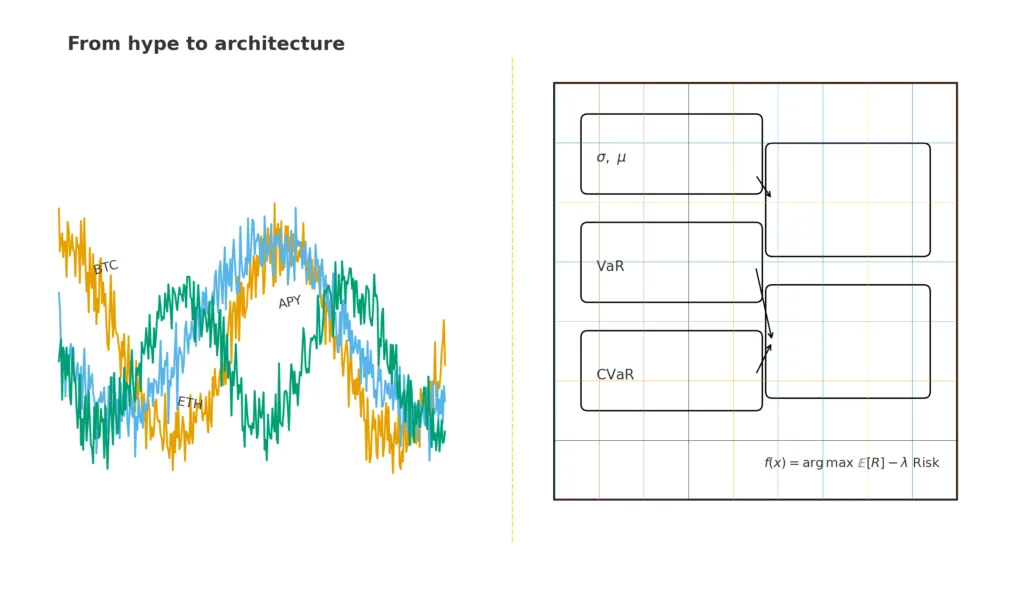

However, DeFi is not just a technical endeavor. It exists in the domain of finance, commerce, and human actions. This is where finance finalizes the triad, anchoring theoretical models and programmed systems in economic truth. Risk management frameworks such as Value-at-Risk and Sharpe ratios can be modified to assess the stability of DeFi portfolios. For tokenomics to be sustainable, it must consider inflation, dilution, and the generation of enduring revenue. Protocols that distribute more in rewards than they generate in fees are structures built on unstable foundations.

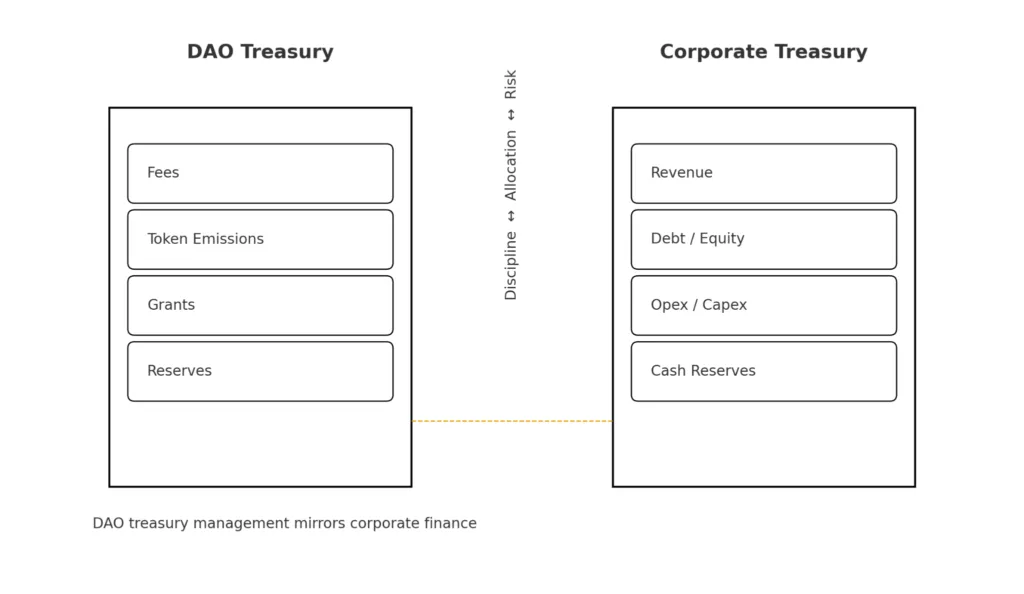

In numerous aspects, DAO treasury management reflects the financial choices of companies. Disciplines are necessary for revenues, expenses, and capital allocations. Finance guarantees that strategies transcend mere clever experiments, evolving into dynamic systems resilient enough to withstand cycles of prosperity and recession.

From chaos to architecture

When seen from an engineer’s perspective, DeFi can be comprehended and assessed in three dimensions. Mathematical rigor is prioritized, guaranteeing that systems remain stable under pressure. Next is code validation, in which simulations and audits determine if models reflect reality. Ultimately, financial sustainability underpins the whole framework, harmonizing incentives with eco-friendliness. As these three forces intersect, DeFi strategies evolve from spontaneity to systematic design.

Past examples highlight this difference clearly. Yield farms that guaranteed unsustainable returns fell apart as they overlooked mathematical and financial principles. In contrast, decentralized exchanges featuring well-crafted fee models have weathered numerous bear markets. The distinction is not in chance but in discipline in whether systems were designed for durability or hastily assembled for speculation.

Toward a sustainable future

DeFi is still in its experimental phase, where daring concepts frequently outpace regulation. However, to transform into the financial framework of the future, it needs to progress from experimentation to something resembling engineering. Mathematics offers precision, coding supplies dependability, and finance guarantees existence. Collectively, they form a perspective that transforms DeFi from merely a speculative arena into a framework for enduring innovation.

The upcoming generation of protocols won’t be noted for hype bubbles or quick wealth. They will be known for their resilience, sustainability, and the trust they build. To accomplish this, we need to cease constructing castles on sand and begin creating structures intended to endure.