- Information and awareness are becoming the new productive resources of the digital economy.

- AI models and cryptocurrency networks are merging into a cohesive data liquidity framework.

- Investors are adjusting their value on intelligence rather than hardware, moving from computation to understanding.

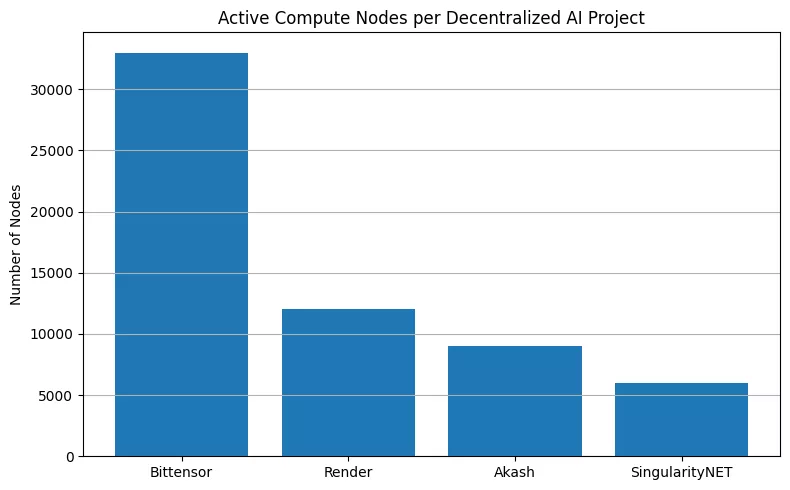

- Bittensor and Render are prominent decentralized AI networks in terms of engagement and functionality.

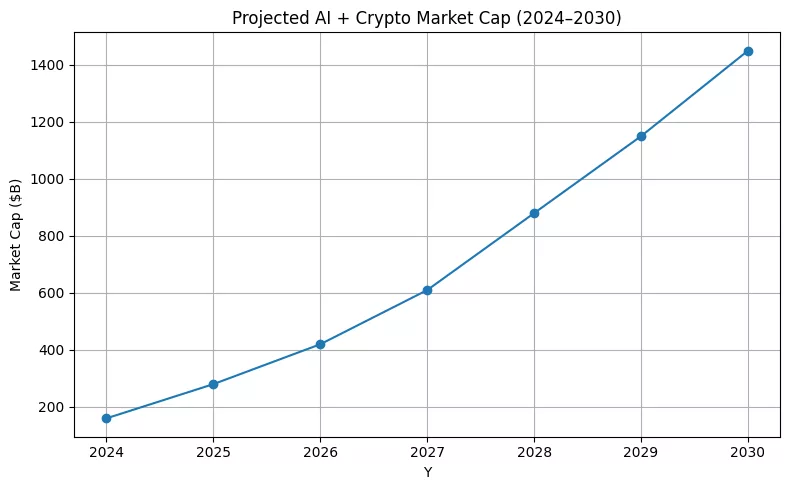

- The AI–Crypto economy might surpass $1.4 trillion by 2030 as information transforms into the new asset.

When information becomes capital

A quiet adjustment of prices is occurring throughout the markets. What was once freely available from search engines, sensors, and social media the data of human and machine existence is now being categorized as an asset. Artificial intelligence has transformed that raw output into an essential component for understanding, while cryptocurrency has provided the infrastructure to tokenize, secure, and exchange it. Collectively, they create the inaugural genuinely worldwide data asset economy, in which information ownership transforms into a new type of capital, and the entitlement to train on it becomes a privilege that generates returns.

AI models such as GPT-5 or Claude-Next process enormous amounts of both structured and unstructured information. Each prompt, transaction, satellite image, and genome input adds to an increasingly valuable resource: confirmed, varied, and high-entropy data. However, information by itself is inactive without incentive alignment, and that’s where cryptocurrency steps in to create trustless marketplaces, incentivizing curation, and facilitating fractional ownership of knowledge. The convergence of these two sectors turns thinking into trade, leading to an economy where the primary unit of worth is knowledge itself.

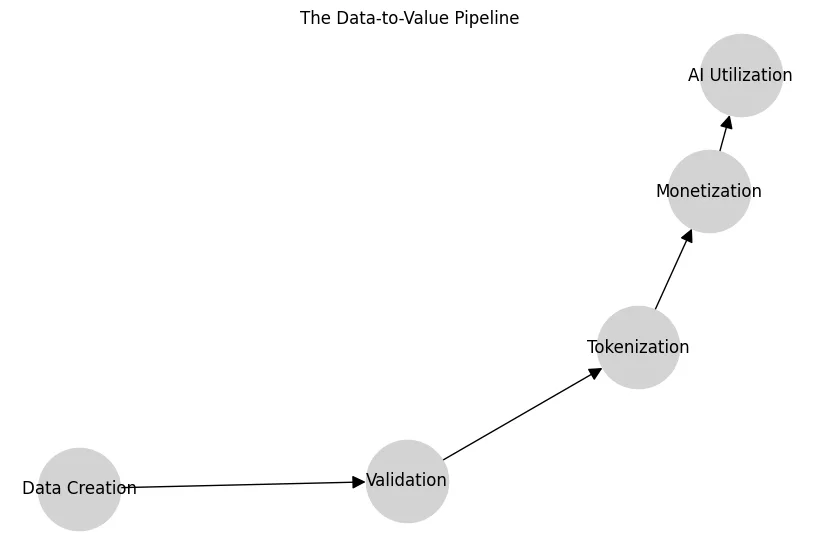

The data-to-value pipeline

The data economy establishes an innovative chain of custody. It begins with content generated by users, IoT devices, and synthetic creators, then moves to validation, where decentralized networks verify provenance. By means of tokenization, validated information turns into liquid assets; through monetization, it generates returns for both machines and their human participants.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Protocols like Ocean Protocol, Fetch.AI, SingularityNET, and Bittensor (TAO) are designing this framework. Ocean creates clear data exchange frameworks regulated by smart contracts. Fetch streamlines data management between autonomous agents. SingularityNET facilitates cooperative efforts among AI services. Bittensor transforms intelligence into tokens, compensating neural models for contributing knowledge to a worldwide AI network.

The common factor linking them is the alignment of incentives. Data contributors are finally rewarded, models only incur costs for high-quality inputs, and markets can evaluate knowledge with unmatched accuracy. The outcome is liquidity generated from understanding instead of speculation, a change as impactful as the creation of capital markets.

The great repricing: From compute to cognition

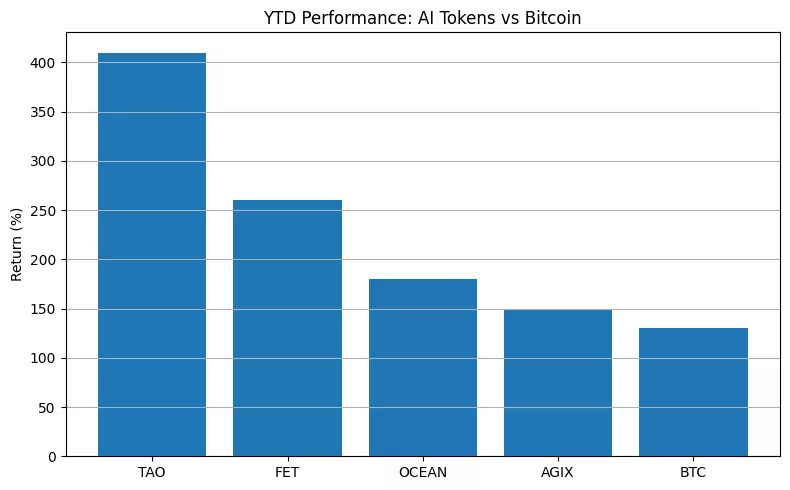

During the industrial period, markets valued steel and oil; in the digital era, computing emerged as the new gold. At present, intelligence has become the limited resource. Investors are starting to appreciate not only hardware capability but also the informational edge that data provides.

Tokens such as TAO, FET, OCEAN, and AGIX have surpassed Bitcoin in performance this year, indicating that markets are already adjusting their perceptions. The paradigm change substitutes proof-of-work with proof-of-intelligence frameworks, allowing contributors to earn rewards based on the informational value they produce. This establishes a completely new asset category: AI yield, a return generated from the effective utilization of data and computation instead of just basic liquidity supply.

As this repricing develops, networks abundant in contextual and high-entropy data will turn into the premium assets of Web3. The new standard for economic strength might not be hashrate or TVL, but rather the combined IQ of the network.

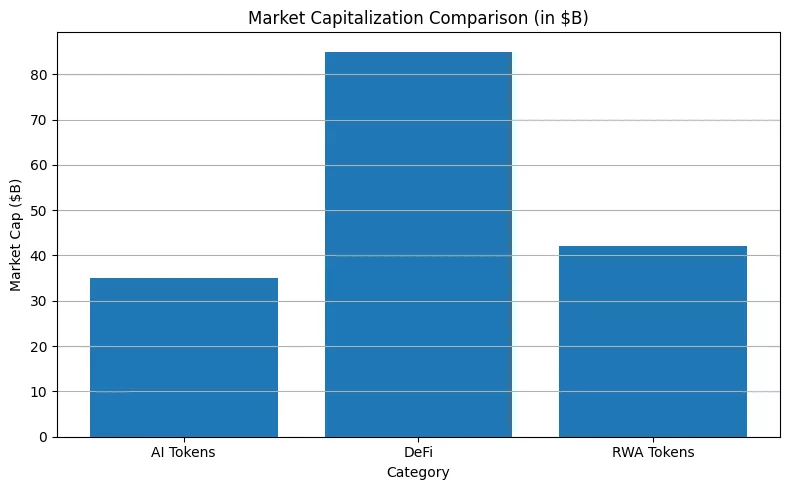

Convergence of AI and crypto infrastructure

The boundary distinguishing AI from blockchain is blurring. Crypto networks provide what AI is missing: traceable origins, clear incentive systems, and decentralized storage, while AI supplies what blockchains need: flexible automation, solid governance, and anticipatory insights.

Projects like Render (RNDR) and Akash (AKT) transform GPU capabilities into a tokenized asset, turning computing resources into an on-chain commodity. Bittensor promotes collective neural contributions, while Worldcoin’s identity system authenticates data origins on a human level. They jointly establish an economy in which computation, comprehension, and identity are interconnected.

This unity is not trivial; it’s essential. AI generates insights that drive crypto markets, whereas crypto provides the infrastructure that safeguards AI’s integrity. Each reinforcement cycle bolsters the link between data quality and monetary value. The result is a marketplace where thought processes become collateral, tradable, and capable of generating returns just like any other digital asset.

Outlook: The data asset economy

By 2030, this integration might transform international finance. Countries could convert national datasets into sovereign wealth assets through tokenization. Companies could use internal knowledge graphs as collateral to generate liquidity. People could rent out anonymized digital identities to AI training systems for passive earnings. The economic landscape will shift towards data fluidity, with clarity substituting trust and possession taking the place of access.

This transformation requires new regulatory frameworks that view data rights as property rights and acknowledge algorithmic agents as economic actors. However, the momentum cannot be reversed. In the era of artificial intelligence, each interaction is a micro-transaction, and every dataset represents a possible connection.

The Great Repricing focuses not on speculative multiples but on reassessing what society values. In the past, capital fueled machines; today, machines create capital via cognition. The line separating intelligence and earnings has disappeared, and the markets are starting to reflect that insight.