- The role of Bitcoin as an inflation hedge is moving from safeguarding prices to safeguarding policies.

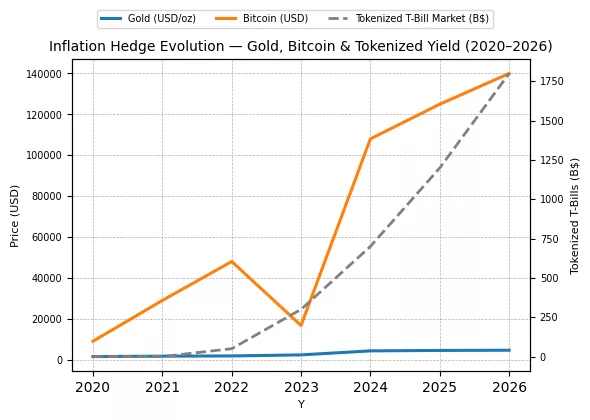

- Gold will continue to serve as a reliable inflation hedge as real yields decrease and fiscal pressures intensify.

- Tokenized Treasuries and yield-generating digital assets are emerging as the new wave of inflation protection.

- The years 2026–2027 could usher in a hybrid phase where physical and digital safeguards exist together in varied portfolios.

- The modern hedge is now focused on trust, yield, and credibility rather than scarcity.

In August 2025, U.S. headline inflation increased by 2.9% compared to the previous year, while core inflation (excluding food and energy) remained steady around 3.1%. These figures convey a clear message: price pressures are still quite significant. However, in spite of this high inflation, Bitcoin and several other cryptocurrencies are not consistently behaving as inflation hedges.

The discrepancy between rising inflation and occasional dips in crypto creates a paradox. Bitcoin was often promoted as “digital gold,” a safeguard against currency devaluation and financial breakdown. In reality, it’s acting more like a risk asset, influenced by central bank actions, actual yields, and overall market sentiment. If inflation acts as the spark, then the policy response serves as the flame, with crypto’s value being the heat,

This article examines how Bitcoin’s connection to inflation is indirect, influenced by liquidity, real yields, and the psychology of investors. We will analyze the behavior of gold, cryptocurrency, and real yields during inflation cycles, and explore how this dynamic varies between developed and emerging markets.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Inflation & liquidity: The real drivers of crypto reaction

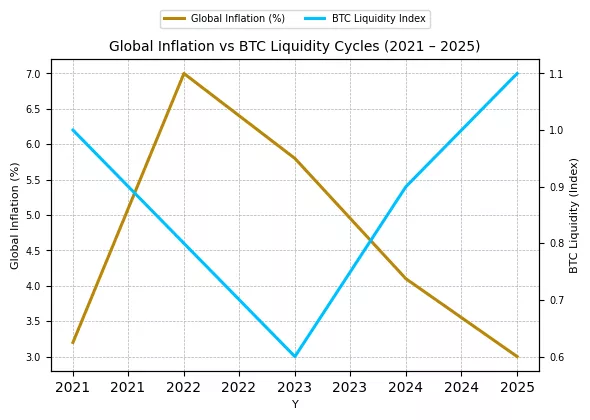

Bitcoin is not influenced by inflation directly; rather, it responds to the changes in policy that inflation compels central banks to make. When inflation speeds up, the typical reaction is for central banks to increase interest rates or decrease balance-sheet support. That contraction of liquidity frequently leads to a decline in risky assets, and cryptocurrency is not an exception. On the other hand, when inflation indicates it’s calming down, central banks might loosen policies, replenishing liquidity and establishing a supportive atmosphere for crypto surges.

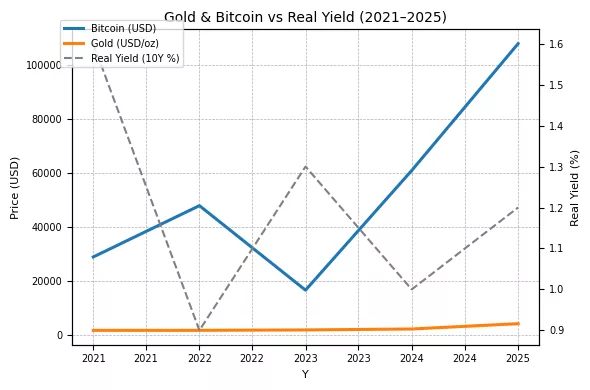

A crucial measure in this context is the real yield: the nominal yield on Treasury securities reduced by anticipated inflation. Cryptocurrency generally excels when actual yields are low or negative, as the opportunity cost associated with holding a non-yielding asset decreases. During times of increasing real yields (i.e., policy tightening), cryptocurrency frequently lags behind. In that regard, Bitcoin serves more as a liquidity safeguard than a direct protection against inflation.

M2 growth, central bank balance-sheet growth, and credit flows also show a strong correlation with cryptocurrency cycles. When the growth of fiat supply outpaces inflation, cryptocurrencies tend to gain. However, when central banks tighten, liquidity decreases and cryptocurrency declines.

In summary, inflation is significant as it necessitates policy adjustments, and those adjustments influence cryptocurrency. The connection exists not between Bitcoin and CPI, but rather between Bitcoin and monetary reaction.

The new inflation correlation Gold, real yields, and bitcoin

Throughout much of financial history, gold has served as the global inflation indicator the singular asset that appreciates as currencies diminish in purchasing power. However, market data from 2025 shows a shifting environment: gold and Bitcoin no longer move in tandem, and their relationship with inflation is now determined by real yields rather than just raw CPI figures.

At the beginning of 2025, gold was priced around $2,200 per ounce, rising to more than $4,250 by the middle of October. This doubling occurred not due to inflation, as CPI barely changed, but rather because real yields plummeted with concerns over slowing growth and increasing fiscal deficits. Investors shifted to gold as a safeguard against policy uncertainty, in addition to inflation. The identical liquidity surge that supported gold at first also propelled Bitcoin past $108,000, until policy tightening reduced speculative enthusiasm.

The power of gold is rooted in its consistent perception. Central banks consider it a reserve anchor, a perpetual hedge when real yields fall beneath 1%. Bitcoin, on the other hand, continues to reflect market demand. It acts as a high-beta variant of gold, surging when liquidity increases but plummeting when credit constricts. To put it another way, gold protects against inflation expectations, whereas Bitcoin safeguards monetary trustworthiness.

This difference accounts for the compression of the BTC/Gold ratio, which measures Bitcoin’s price against an ounce of gold, through 2025. In early January, one Bitcoin could purchase about 30 ounces of gold; by October, that figure decreased to around 25×, indicating a market shift towards physical assets. At the same time, the U.S. 10-year real yield dropped under 1.2%, a point that has historically aligned with robust gains in gold and crypto; however, Bitcoin’s underperformance indicates how capital is currently distinguishing between store-of-value and a speculative liquidity proxy.

The result is a new inflation correlation:

- Gold rises on falling real yields (direct hedge).

- Bitcoin rises on expanding liquidity (indirect hedge).

- Both decline when real yields rise and liquidity tightens.

Inflation is still the catalyst, but the transmission mechanism now flows through policy, not prices.

Emerging markets — Where crypto still hedges inflation

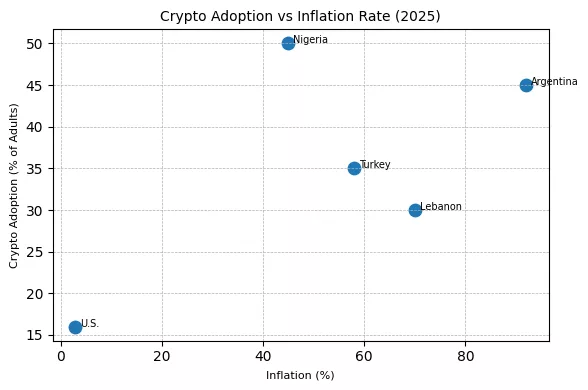

Although the narrative of Bitcoin as an inflation hedge has diminished in developed countries, it continues to thrive in emerging markets, where inflation is not merely a theoretical figure but an everyday experience.

In nations such as Argentina, Turkey, Nigeria, and Lebanon, where yearly inflation rates range from 45% to 100%, people utilize crypto not for investment purposes but as a means of survival. When traditional currency fails, digital assets emerge as usable money.

Argentina provides the most vivid example. With inflation approaching 92% in 2025 and a peso that weekly diminishes in purchasing power, stablecoins like USDT and USDC lead local exchanges and payment methods. Individuals receive income in pesos, but they protect their wealth in digital dollars, converting immediately after payday to maintain their savings. In Turkey, where inflation has eased to roughly 58%, cryptocurrency plays a comparable protective role, shielding families from the fluctuations of the lira.

In Nigeria, cryptocurrency adoption increased to over 50% of the adult population, fueled by the devaluation of the naira and limitations on international remittances. Bitcoin functions more like an informal currency for cross-border transactions than a traditional investment, facilitating trade and migration even amid capital restrictions. In Lebanon, where hyperinflation depleted bank deposits, stablecoins became an alternative for locked accounts, facilitating rent payments and remittances.

In these economies, the adoption of cryptocurrency correlates positively with inflation and skepticism toward institutions. In the advanced economies, Bitcoin is exchanged as a macro asset; in developing markets, it functions as currency. This distinction highlights the dual role of crypto as speculative in Wall Street investments, yet essential in volatile monetary systems.

The global feedback loop inflation, policy, and crypto markets

Inflation is no longer solitary; it has become the primary component in a self-perpetuating worldwide feedback mechanism. Increasing prices compel policymakers to decide between trustworthiness and expansion, and whichever path they take triggers tremors across cryptocurrencies, metals, and stocks.

When inflation speeds up, central banks increase interest rates or reverse quantitative-easing measures to reestablish control. That move bolsters the U.S. dollar, reduces liquidity, and puts pressure on Bitcoin and other high-risk assets. It further increases actual yields, rendering non-yielding assets such as gold and cryptocurrencies less appealing. However, this defensive restriction cannot last forever: increased borrowing expenses slow down economies, debt repayment pressures increase, and political patience for a recession diminishes. The subsequent reaction of renewed liquidity injections often triggers significant recoveries in both Bitcoin and gold at the same time.

In 2025, this cycle occurred again on a smaller scale. Inflation surges at the start of the year instigated aggressive policy discussions; liquidity tightened; Bitcoin dropped from $123,000 to $108,000. As growth data weakened and Treasury issuance surged, markets started to anticipate a rate cut in 2026, real yields fell beneath 1.2%, and both gold and cryptocurrencies recovered. The pattern uncovered a more profound reality: Bitcoin is not a safeguard against inflation, but rather a safeguard against monetary policy.

The loop stretches out more. Inflation expectations influence the Fed’s direction; the Fed’s direction impacts global liquidity; liquidity governs capital distribution; and capital distribution affects asset prices that sway consumer and investor confidence, closing the loop. In that cycle, cryptocurrency serves as an immediate indicator of policy trustworthiness, increasing when confidence in fiat policies diminishes and declines when the system seems secure.

At the same time, inflows from emerging markets into stablecoins and Bitcoin are now impacting Western markets, passing local inflationary pressures into the global demand for digital currencies. The outcome is a dual-layer crypto economy: one influenced by macro liquidity (Wall Street), and another motivated by inflation resilience (Main Street). United, they create a coordinated ecosystem where the effects of inflation can shift trillions in digital assets in just hours.

The repricing of the inflation hedge

As 2025 approaches its conclusion, the inquiry shifts from whether Bitcoin protects against inflation to what specific type of inflation it actually safeguards against. The solution depends on how the upcoming monetary cycle develops. Should 2026 see a deceleration in growth, diminishing inflation, and an increase in quantitative easing, cryptocurrency might once more act as “digital gold.” However, if inflation becomes persistent and real yields stay positive, Bitcoin is likely to keep trading as a volatile, reactive, and cyclical high-beta liquidity asset.

The next phase of the inflation–crypto relationship will depend on two structural forces:

- Monetary credibility, and

- Tokenized yield alternatives.

Should central banks persist in expanding their balance sheets to cover fiscal shortfalls, confidence in fiat currencies might decline, directing investment towards limited digital assets. In that reality, Bitcoin and gold might exist together as dual hedges, one tangible, one digital both indicating the market’s unease with fiat currency devaluation. Nonetheless, should real yields remain above 1%, stablecoins and tokenized U.S. Treasuries will prevail, attracting capital from volatile assets towards on-chain yield.

By 2026, the emergence of tokenized T-bills, corporate bonds, and money-market funds may provide investors a unique advantage that crypto hasn’t offered programmable returns with inflation safeguards. This change reinterprets the concept of “inflation hedge”: it is now not just about scarcity, but also about yield modified for trust. From that perspective, the upcoming hedge might not be Bitcoin against gold it could be crypto yield protocols compared to fiat debt markets.

Nonetheless, Bitcoin’s long-term significance is far from concluded. Every inflation cycle strengthens its role as the measure of policy risk. When authorities create currency, Bitcoin increases. When liquidity vanishes, Bitcoin suffers. It serves as protection not against the symptom of inflation (price increase) but rather against its cause, which is excessive monetary expansion. And that, paradoxically, renders it the clearest inflation indicator the contemporary system has ever generated.

With investors gearing up for a possibly tumultuous cycle in 2026–2027, gold is expected to remain stable around the $4,500 level, while Bitcoin’s fair-value estimates range from $100,000 to $140,000, presuming moderate interest rate reductions and ongoing suppression of real yields. Silver might also continue to be the industrial variable that fluctuates but is becoming more connected to the liquidity curve instead of consumer prices.

The conclusion is simple:

Inflation initiated the narrative, but the credibility of policies will conclude it.

The hedge has transformed from fixed scarcity to active assurance.