- Investor scrutiny = SaaS + infrastructure: monitor gross margins, cohort payback, NRR; stress-test for demand surges, MEV, DAO failures, L1 fee volatility; mandate governance with effective levers and regulatory resilience.

- Ecosystem success = plentiful affordable blockspace, instant finality, wallets functioning as accounts, seamless bridges, quicker shipping cycles; value concentrates on reliability layers sequencers, DA, security infrastructures, and access points.

- The pivot is beneficial: strong frameworks make applications engaging, facilitate compliant institutional usage, unlock payments for creators and machines, and generate sustainable returns

The focal point of gravity in crypto is shifting. Following periods ruled by token speculation, points, and transient liquidity, investment is shifting towards the infrastructures that enable actual utilization to be affordable, quick, and dependable. This “infrastructure shift” supports teams delivering throughput, low latency, data accessibility, security features, and fiat on/off-ramps instead of temporary app incentives. The argument is simple: when blockspace is plentiful, consistent, and easily utilized, lasting demand arises, and the financial benefits go to the layers that supply it.

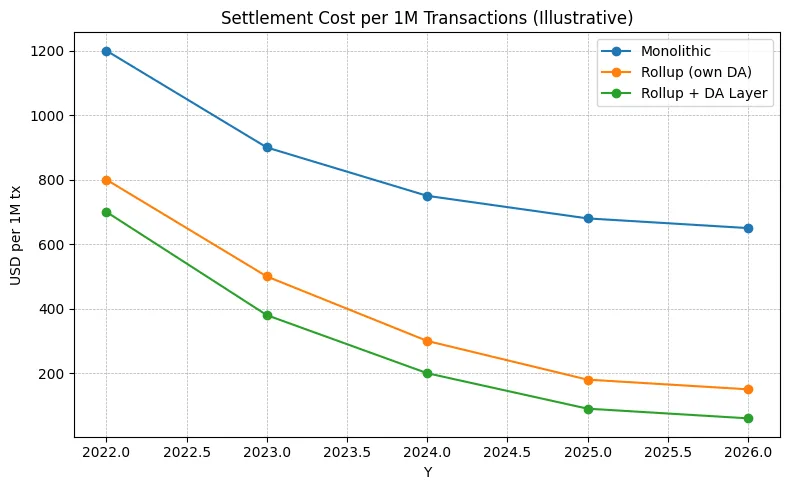

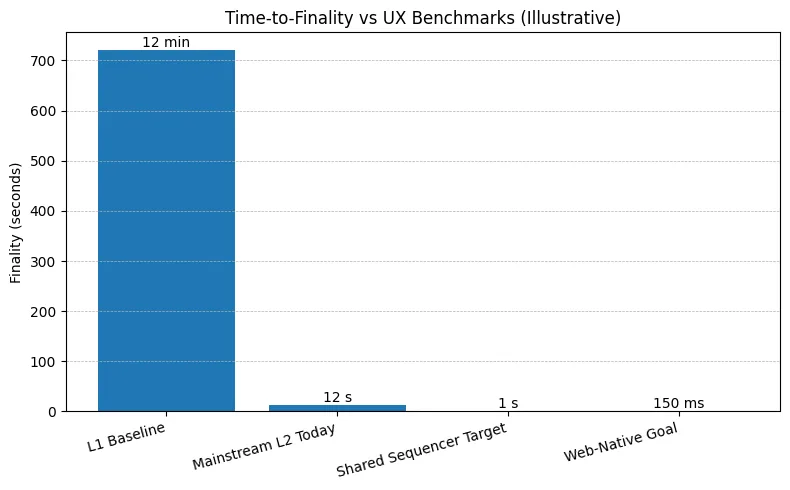

Payments and settlements offer the most transparent indication. Stablecoins represent a significant portion of on-chain activity; however, their expansion has been limited by elevated fees, lengthy or unpredictable finality, and dispersed liquidity between chains. Investors are supporting rollups and shared sequencers to reduce time to inclusion; data-availability networks to lower the expense of submitting proofs; and intent- or account-abstraction wallets that conceal multi-chain intricacies from users. As the stack reduces transaction costs and enhances reliability, entire categories that previously seemed unfeasible micro-commerce, casual gaming, creator payments, machine-to-machine transactions begin to be feasible.

The experience of developers is the second factor. Teams select platforms that reduce the gap from concept to execution: managed RPC and indexing, live event streams, secure key management, observability, and testing tools. When integrated, these services demonstrate minimal churn and pricing based on usage that grows with successful clients. For investors, that profile is simpler to assess than token programs that suffer a decline in activity once incentives are removed. Strong gross margins along with net revenue retention and multi-year agreements create infrastructure-like predictability, even during unpredictable market conditions.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

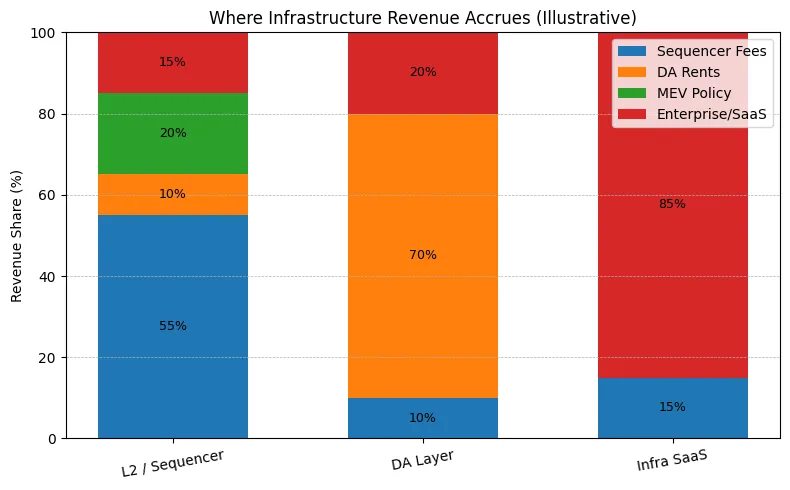

Monetization is much more transparent at the foundational levels. Rollup operators receive sequencer fees for arranging transactions. Data-availability providers charge fees for reliable storage and retrieval assurances. Restaking markets generate revenue from validator capacity by providing security to supplementary networks. On- and off-ramp vendors apply a spread and market enterprise integrations. Through reliable governance, tokens can be associated with these cash flows through fee burns, a share of protocol revenue, or staking rights that fortify the system, minimizing dependence on narrative alone and enhancing value retention.

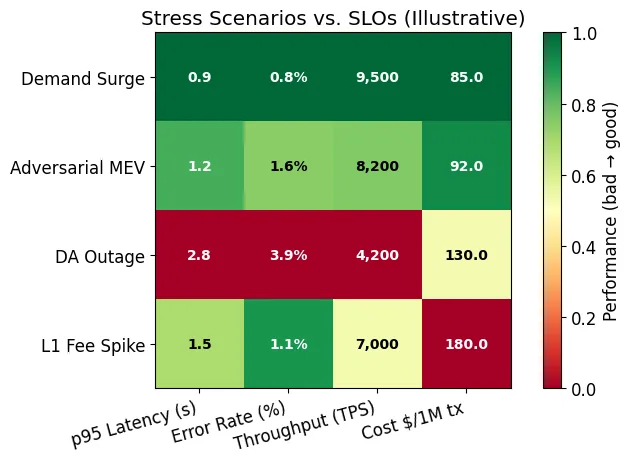

All of this carries some risk. Commoditization can shrink margins when services appear similar and customers inherently multi-home. Fragmentation among multiple rollups increases bridging and liquidity expenses, and inconsistent standards create challenges for developers in terms of portability. Regulations can alter custody and escalate economics instantly. Value capture can shift up or down the hierarchy as competition grows: what is a unique capability today might turn into a public good tomorrow. Successful teams combat these challenges with barriers rooted in dependability and speed, accessibility via developer platforms, multi-chain impartiality, and clear token economics linked to actual use and system security

The structure of the stack is evolving in manners that strengthen the pivot. Shared sequencing and cross-rollup block creation distinguish ordering from proof generation; modular data-availability layers separate storage from execution. That breakdown encourages specialization and genuine price discovery: which element is limited, and where do users truly experience discomfort? Simultaneously, ethical MEV regulations and order-flow auctions are transforming what previously appeared as a concealed tax into a regulated income source that can be distributed among applications and, in certain models, with end consumers. The outcome is a more transparent market for blockspace and a better understanding of who profits, who spends, and for what reasons.

A useful strategy guide is taking shape for founders. Demonstrate reliability initially: share uptime, latency percentiles, and incident reviews. Cost clearly stated per million transactions, bytes, or validated proofs, ensuring customers grasp unit economics. Deliver SDKs that streamline integration to a single day instead of a lengthy process, and focus on creating documentation and examples that empower junior engineers to thrive. Assess adoption through concrete metrics such as SDK installations, weekly active projects, and deployment speed, instead of superficial figures like TVL alone. Provide migration options: support for multiple chains, one-click redeployments, and compatibility with widely-used wallets and signers. Dependability, lucidity, and quickness to incorporate performance plans consistently.

Investor diligence, ecosystem outcomes, and why infrastructure wins

For investors, diligence ought to resemble SaaS combined with essential infrastructure. Monitor gross margins, cohort payback, and net revenue retention, while also simulating system performance under stress: a demand increase, hostile MEV, a data-availability failure, or a spike in L1 fees. Assess governance: do tokenholders and customers possess genuine influence over budgets and parameters, and are the incentives designed to promote performance instead of extraction? Lastly, think about the longevity of regulations: is the company capable of adjusting if regulations become stricter regarding fiat transactions, staking returns, or consumer information.

What does achievement appear like on an ecosystem level? More affordable blockspace consistently accessible across devices and locations. Finality reduced from seconds to sub-second for most consumer interactions. Wallets that resemble accounts instead of mere addresses. Bridges that vanish behind purposes and coded assurances. Developers deliver production features in weeks, rather than quarters. And an economy where value accumulates to the layers that possess reliability and distribution sequencers, data-availability suppliers, security networks, and ramps instead of to the most vociferous tokens of the time.

The shift in infrastructure does not signify the demise of tokens or applications; rather, it serves as the foundation for their long-term success. When the rails are quick, affordable, and secure, all other narratives improve: consumer applications keep users engaged, organizations can adhere smoothly, creators can profit from minor actions, and machines can transact autonomously without human oversight. The shift we are observing is not protective; it is positive. It supports the unexciting excellence that transforms blockchains from speculative markets into reliable networks, and those networks into unseen, everyday infrastructure. That is the source where enduring profits will progressively originate.